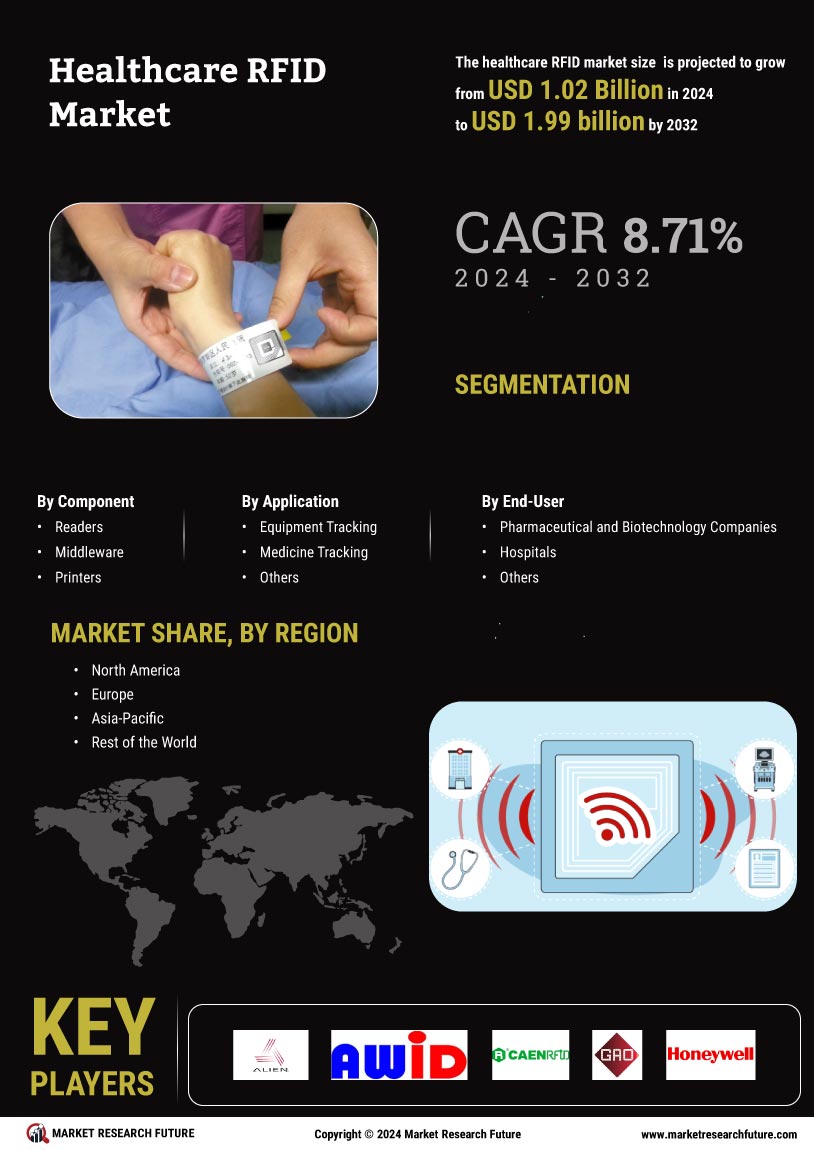

Enhanced Inventory Management

The Healthcare RFID Market is experiencing a notable shift towards enhanced inventory management solutions. RFID technology facilitates real-time tracking of medical supplies and equipment, thereby reducing instances of stockouts and overstock situations. This capability is particularly crucial in hospitals where the availability of essential items can directly impact patient care. According to recent data, hospitals utilizing RFID systems have reported a reduction in inventory costs by up to 30%. This efficiency not only streamlines operations but also contributes to better financial management within healthcare facilities. As the demand for efficient inventory management continues to rise, the Healthcare RFID Market is likely to see increased investments in RFID solutions that promise to optimize supply chain processes.

Improved Patient Care and Safety

The Healthcare RFID Market is increasingly focused on improving patient care and safety through the implementation of RFID technology. By enabling precise tracking of patients, medications, and medical devices, RFID systems help to minimize errors associated with patient identification and medication administration. Studies indicate that hospitals employing RFID solutions have experienced a significant decrease in medication errors, enhancing overall patient safety. Furthermore, the ability to monitor the location and status of critical medical equipment ensures that healthcare providers can deliver timely and effective care. As patient safety remains a top priority for healthcare organizations, the Healthcare RFID Market is poised for growth as more facilities adopt these technologies to safeguard patient welfare.

Regulatory Compliance and Standards

The Healthcare RFID Market is influenced by the increasing emphasis on regulatory compliance and adherence to industry standards. Healthcare organizations are mandated to maintain accurate records of medical devices and pharmaceuticals, which can be efficiently managed through RFID technology. Compliance with regulations such as the FDA's Unique Device Identification (UDI) system necessitates robust tracking mechanisms that RFID provides. This technology not only aids in meeting regulatory requirements but also enhances traceability and accountability within healthcare systems. As regulatory pressures mount, the Healthcare RFID Market is likely to expand as organizations seek to implement RFID solutions that facilitate compliance and improve operational transparency.

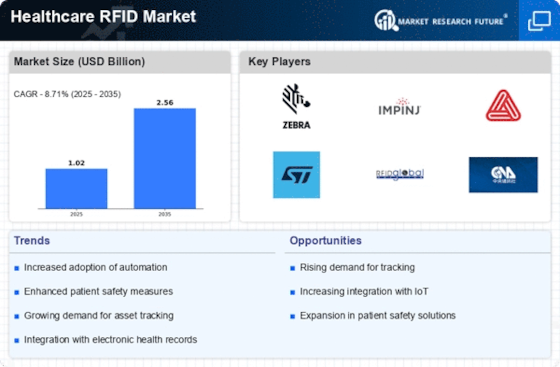

Integration with Advanced Technologies

The Healthcare RFID Market is increasingly integrating with advanced technologies such as the Internet of Things (IoT) and artificial intelligence (AI). This convergence allows for more sophisticated data analytics and real-time monitoring capabilities, enhancing the overall effectiveness of RFID systems. For instance, IoT-enabled RFID solutions can provide insights into equipment usage patterns, enabling healthcare facilities to optimize asset utilization. Additionally, AI algorithms can analyze data collected from RFID systems to predict trends and improve decision-making processes. As healthcare organizations strive for innovation and efficiency, the integration of RFID with these advanced technologies is likely to propel the Healthcare RFID Market forward, fostering a more connected and intelligent healthcare ecosystem.

Cost Reduction and Operational Efficiency

The Healthcare RFID Market is driven by the need for cost reduction and operational efficiency within healthcare facilities. RFID technology enables organizations to automate various processes, thereby reducing labor costs associated with manual tracking and inventory management. By streamlining operations, healthcare providers can allocate resources more effectively, leading to improved service delivery. Reports suggest that hospitals implementing RFID systems have achieved operational cost savings of approximately 20%. This financial incentive, coupled with the potential for enhanced patient outcomes, positions RFID as a compelling solution for healthcare organizations. As the pressure to reduce costs intensifies, the Healthcare RFID Market is expected to witness a surge in adoption rates.