North America : Market Leader in Animal Transport

North America is poised to maintain its leadership in the animal transportation market, holding a significant market share of 2044.91 million. The growth is driven by increasing pet ownership, stringent regulations on animal welfare, and advancements in logistics technology. The demand for safe and efficient transportation solutions is further fueled by the rise in e-commerce and global trade of live animals, which necessitates compliance with various regulatory frameworks.

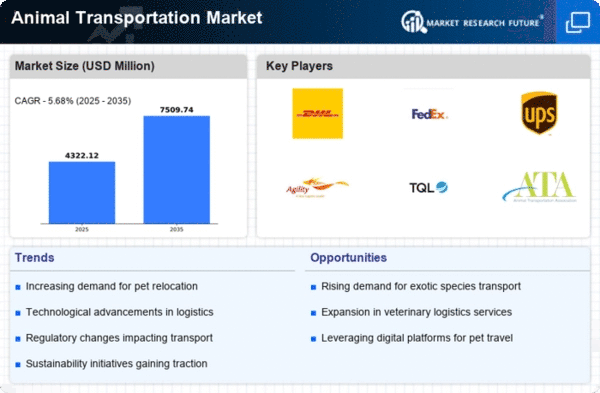

The United States stands out as the leading country in this region, with major players like FedEx, UPS, and TQL dominating the competitive landscape. These companies are investing in specialized services to cater to the unique needs of animal transport, including temperature-controlled environments and real-time tracking. The presence of organizations like the Animal Transportation Association also underscores the commitment to best practices in animal welfare during transit.

Europe : Growing Market with Regulations

Europe's animal transportation market is expanding, with a market size of 1226.0 million. The growth is driven by increasing awareness of animal welfare and the implementation of stringent regulations across member states. The European Union has established comprehensive guidelines to ensure the humane treatment of animals during transport, which has catalyzed demand for compliant logistics solutions. Additionally, the rise in pet ownership and international trade of livestock contributes to market growth.

Leading countries in this region include Germany, France, and the UK, where companies like Kuehne + Nagel and Agility Logistics are key players. These firms are adapting to regulatory changes and investing in innovative solutions to enhance service quality. The competitive landscape is characterized by a mix of established logistics providers and specialized animal transport companies, ensuring a robust market environment.

Asia-Pacific : Emerging Market with Potential

The Asia-Pacific region is witnessing significant growth in the animal transportation market, valued at 680.0 million. This growth is driven by increasing disposable incomes, rising pet ownership, and a growing demand for livestock trade. Regulatory frameworks are gradually evolving to address animal welfare concerns, which is further propelling the market. The region's diverse geography also necessitates specialized transportation solutions to cater to various animal types and conditions.

Countries like China, Japan, and Australia are leading the market, with a mix of local and international players. Companies such as DHL and PetRelocation are expanding their services to meet the rising demand. The competitive landscape is becoming increasingly dynamic, with new entrants focusing on innovative logistics solutions tailored for animal transport, enhancing overall service quality and efficiency.

Middle East and Africa : Developing Market with Challenges

The Middle East and Africa region is developing its animal transportation market, currently valued at 138.91 million. The growth is driven by increasing awareness of animal welfare and the need for efficient logistics solutions in the livestock trade. However, regulatory challenges and infrastructure limitations pose significant hurdles. Governments are beginning to implement regulations to ensure humane treatment during transport, which is essential for market growth and sustainability.

Leading countries in this region include South Africa and the UAE, where companies are beginning to invest in specialized animal transport services. The competitive landscape is still emerging, with a mix of local logistics providers and international firms looking to establish a foothold. As regulations evolve, the market is expected to attract more investment and innovation, paving the way for future growth.