Culinary Trends and Gourmet Cooking

The Edible Animal Fat Market is significantly influenced by the resurgence of culinary trends that emphasize traditional cooking methods and gourmet experiences. Chefs and home cooks alike are rediscovering the rich flavors and textures that animal fats can impart to dishes. This trend is evident in the rising popularity of cooking with lard, duck fat, and beef tallow, which are being used to enhance the taste of various cuisines. Market data indicates that the gourmet cooking segment is expanding, with a projected increase in sales of specialty animal fats by 6% annually. This culinary renaissance is likely to sustain interest in edible animal fats, as consumers seek authentic and flavorful cooking experiences.

Sustainability and Ethical Sourcing

The Edible Animal Fat Market is increasingly shaped by consumer demand for sustainability and ethical sourcing practices. As awareness of environmental issues grows, consumers are gravitating towards products that are sourced from animals raised in humane and sustainable conditions. This shift is prompting manufacturers to adopt transparent supply chains and promote their commitment to ethical practices. Market Research Future suggests that products labeled as organic or grass-fed are witnessing a surge in popularity, with sales expected to rise by 5% annually. This focus on sustainability not only appeals to environmentally conscious consumers but also enhances brand loyalty, thereby driving growth in the edible animal fat sector.

Cultural Heritage and Traditional Practices

The Edible Animal Fat Market is deeply intertwined with cultural heritage and traditional culinary practices. Many cultures have long utilized animal fats in their cooking, and this trend is experiencing a revival as consumers seek authentic flavors and traditional recipes. The resurgence of interest in heritage cooking is driving demand for traditional animal fats, such as lard and schmaltz, which are integral to various regional cuisines. Market analysts project that this cultural appreciation will contribute to a steady growth rate of approximately 3% in the edible animal fat sector over the next few years. As consumers increasingly value culinary authenticity, the market for edible animal fats is likely to flourish.

Regulatory Support and Food Safety Standards

The Edible Animal Fat Market is benefiting from enhanced regulatory support and stringent food safety standards. Governments are increasingly recognizing the importance of animal fats in food production and are implementing regulations that ensure quality and safety. This regulatory framework is fostering consumer confidence in edible animal fats, which is crucial for market growth. Recent data indicates that compliance with food safety standards has led to a 10% increase in consumer trust in products containing animal fats. As regulations continue to evolve, they are likely to create a more favorable environment for the edible animal fat market, encouraging innovation and expansion.

Health Consciousness and Nutritional Benefits

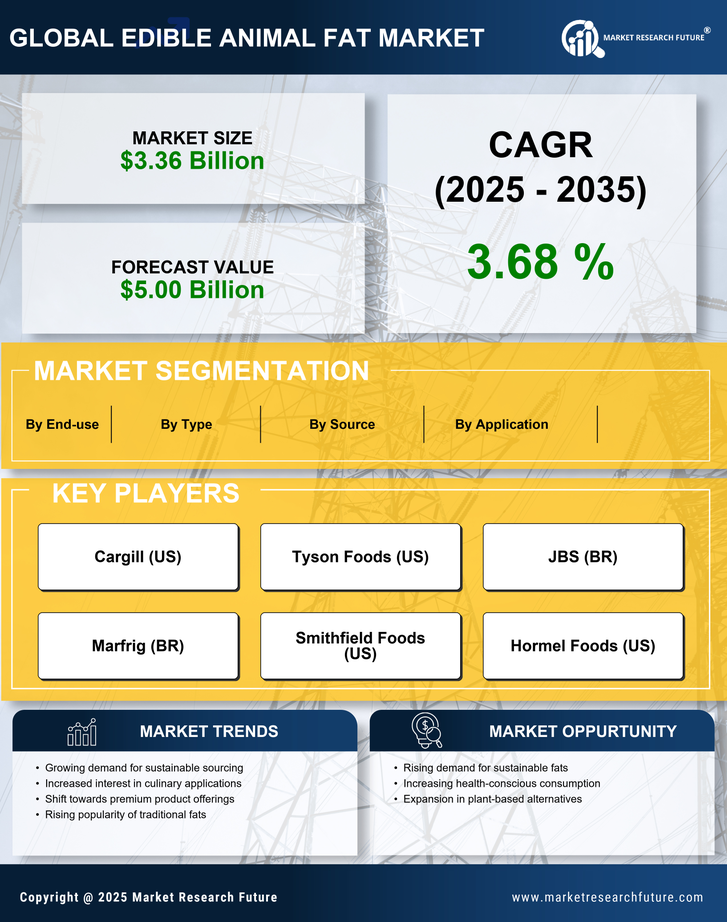

The Edible Animal Fat Market is experiencing a notable shift as consumers increasingly prioritize health and nutrition. Animal fats, such as lard and tallow, are being recognized for their potential health benefits, including high levels of vitamins A, D, E, and K. This trend is further supported by a growing body of research suggesting that certain animal fats may be beneficial for heart health when consumed in moderation. As a result, the demand for these fats is likely to rise, with market analysts projecting a compound annual growth rate of approximately 4% over the next five years. This increasing health consciousness among consumers is driving manufacturers to innovate and promote products that highlight the nutritional advantages of edible animal fats.