Regulatory Changes and Standards

Regulatory changes and evolving standards are shaping the Animal Feed Ingredients Market. Governments and regulatory bodies are increasingly implementing stringent guidelines regarding feed safety and quality. These regulations are aimed at ensuring the health and safety of livestock and, by extension, consumers. Compliance with these standards often necessitates the use of higher-quality feed ingredients, which can drive up demand in the market. Recent data suggests that the market for feed additives, which are subject to these regulations, is expected to grow by approximately 8% annually. This regulatory landscape is likely to influence the sourcing and formulation of feed ingredients, thereby impacting the Animal Feed Ingredients Market.

Rising Demand for Animal Protein

The increasing global population and changing dietary preferences are driving the demand for animal protein. As consumers become more health-conscious, the consumption of meat, dairy, and eggs is on the rise. This trend is likely to propel the Animal Feed Ingredients Market, as livestock producers seek to enhance productivity and meet consumer needs. According to recent data, the demand for animal protein is projected to grow by approximately 20% over the next decade. Consequently, this surge in demand for animal protein necessitates a corresponding increase in high-quality feed ingredients, thereby stimulating growth in the Animal Feed Ingredients Market.

Focus on Animal Health and Nutrition

There is a growing emphasis on animal health and nutrition, which is influencing the Animal Feed Ingredients Market. Livestock producers are increasingly aware of the importance of providing balanced diets to enhance growth, reproduction, and overall health. This focus is leading to a rise in the incorporation of functional ingredients, such as probiotics and prebiotics, into animal feed. The market for such ingredients is expected to expand significantly, with estimates suggesting a growth rate of around 10% annually. This trend indicates a shift towards more specialized feed formulations that cater to the specific nutritional needs of animals, thereby driving the Animal Feed Ingredients Market.

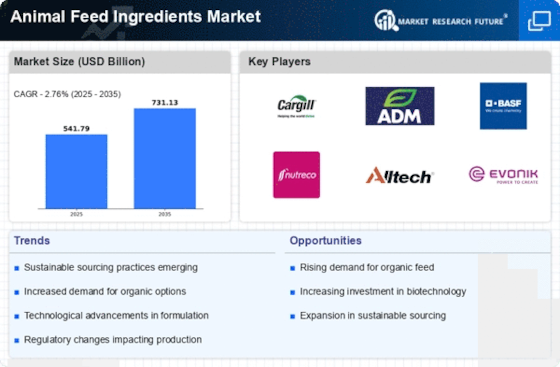

Sustainability Initiatives in Agriculture

Sustainability initiatives are becoming a central theme in agriculture, impacting the Animal Feed Ingredients Market. Producers are increasingly adopting sustainable practices to reduce their environmental footprint. This includes sourcing feed ingredients that are produced with minimal environmental impact. The demand for organic and non-GMO feed ingredients is on the rise, as consumers seek products that align with their values. Reports indicate that the market for organic animal feed is expected to grow at a compound annual growth rate of 12%. This shift towards sustainability is likely to reshape the Animal Feed Ingredients Market, as stakeholders prioritize eco-friendly practices.

Technological Innovations in Feed Production

Technological advancements are revolutionizing the Animal Feed Ingredients Market. Innovations in feed formulation and processing technologies are enabling producers to create more efficient and effective feed products. For instance, the use of precision nutrition and data analytics allows for tailored feed solutions that optimize animal performance. The integration of these technologies is projected to enhance feed efficiency by up to 15%, thereby reducing costs for producers. As these technologies become more accessible, they are expected to drive growth in the Animal Feed Ingredients Market, as producers seek to improve productivity and profitability.