Expansion of Livestock Production

The expansion of livestock production in the United States serves as a significant driver for the US Probiotics Animal Feed Market. With the increasing demand for meat, dairy, and eggs, producers are seeking ways to enhance the efficiency and productivity of their operations. Probiotics have emerged as a viable solution, as they can improve feed conversion rates and overall animal performance. According to recent data, the US livestock sector is projected to grow by 3% annually, leading to a heightened need for effective feed solutions. This growth in livestock production not only supports the demand for probiotics but also encourages innovation in feed formulations, thereby fostering a robust market environment for the US Probiotics Animal Feed Market.

Regulatory Support and Guidelines

Regulatory support and guidelines play a crucial role in shaping the US Probiotics Animal Feed Market. Government agencies, such as the FDA and USDA, have established regulations that promote the safe use of probiotics in animal feed. These regulations not only ensure the safety and efficacy of probiotic products but also encourage research and development in this field. The establishment of clear guidelines has fostered confidence among producers, leading to increased adoption of probiotics in livestock diets. As regulatory frameworks continue to evolve, they are likely to further support the growth of the US Probiotics Animal Feed Market, facilitating innovation and ensuring that high-quality products are available to meet market demands.

Increasing Awareness of Animal Health

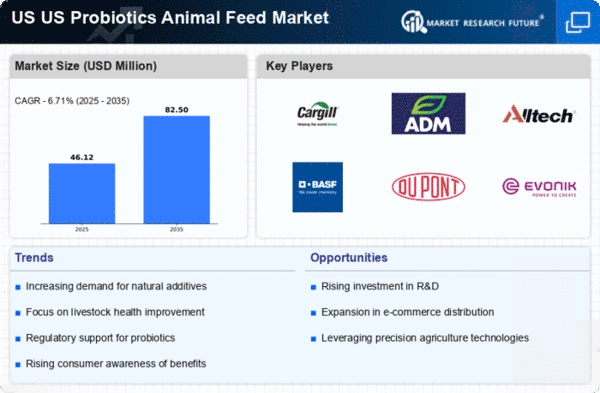

The growing awareness regarding animal health and nutrition is a pivotal driver for the US Probiotics Animal Feed Market. Livestock producers are increasingly recognizing the benefits of probiotics in enhancing gut health, improving digestion, and boosting immunity in animals. This trend is reflected in the rising sales of probiotic animal feed products, which have seen a compound annual growth rate (CAGR) of approximately 7% over the past few years. As consumers demand higher quality meat and dairy products, producers are compelled to adopt probiotics as a means to ensure the health and productivity of their livestock. This shift towards prioritizing animal welfare and health is likely to continue, further propelling the growth of the US Probiotics Animal Feed Market.

Consumer Preference for Organic and Natural Products

The rising consumer preference for organic and natural products is significantly influencing the US Probiotics Animal Feed Market. As consumers become more health-conscious, they are increasingly demanding meat and dairy products that are free from synthetic additives and antibiotics. This trend has prompted livestock producers to seek out natural feed additives, including probiotics, to meet consumer expectations. The organic livestock feed market has been growing steadily, with projections indicating a potential increase of 10% annually. This shift towards organic practices not only supports animal health but also aligns with broader sustainability goals, thereby driving the demand for probiotics in the US Probiotics Animal Feed Market.

Technological Advancements in Probiotic Formulations

Technological advancements in probiotic formulations are driving innovation within the US Probiotics Animal Feed Market. The development of more effective strains of probiotics, along with improved delivery systems, has enhanced the efficacy of these products. For instance, encapsulation technologies allow for better survival rates of probiotics during processing and storage, ensuring that animals receive the full benefits. This innovation is crucial as it aligns with the increasing demand for high-quality animal feed solutions. As producers seek to optimize animal health and productivity, the adoption of advanced probiotic formulations is likely to rise, thereby contributing to the growth of the US Probiotics Animal Feed Market.