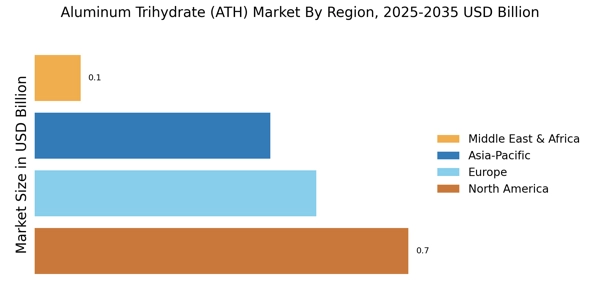

By Region, the study segments the market into North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific aluminum trihydrate (ATH) market accounted for USD 0.48 billion in 2021 and is expected to exhibit an 6.40% CAGR during the study period. This is attributed to use of alumina trihydrate is the plastic industry, it is most economical and widely used as a flame retardant and smoke suppressant. Plastic is used in every sector, including packaging, building and construction, textiles, consumer goods, transportation, electrical and electronics, and industrial machinery.

Growing middle-class population, rising disposable income, changing lifestyles, and others are factors expected to drive demand, supporting the market growth in this region. Moreover, factors such as the ready availability of raw materials and labor, advanced technology and innovation drive economic growth in the Asia Pacific region.

Further, the major countries studied are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe aluminum trihydrate (ATH) market accounts for the second-largest market share due to the ATH is a natural mineral used as a key ingredient in composite materials for solid surfacing. Many households and companies have composite materials for solid surfacing in kitchens, bathrooms, and laboratory countertops. This is a factor expected to drive the growth of the target market. Strong economic growth associated with industrial production is expected to increase the demand for plastics, thereby propelling the demand for engineering plastics.

Furthermore, an increasing number of residential and commercial infrastructures in the region is a factor expected to increase the demand for plastics in the region. Further, the Germany aluminum trihydrate (ATH) market held the largest market share, and the Rest of Europe aluminum trihydrate (ATH) market was the fastest growing market in the European region

The North America aluminum trihydrate (ATH) Market is expected to grow at a CAGR of 4.8% from 2022 to 2030. North America is projected to hold a significant share of the target market owing to growth in end-use applications and wider acceptance of ATH flame retardants in various end-use industries. Moreover, US aluminum trihydrate (ATH) market held the largest market share, and it was the fastest growing market in the North America region

For instance, US aluminum trihydrate (ATH) market is the favored by technological advancements and cost-effective solutions have positively impacted the alumina trihydrate market. Expanding industrial vehicles' applicability and utility in alum production will present an impressive growth curve through the forecast year. Stringent emissions standards are forcing OEMs to reduce overall weight and improve fuel economy, thereby reducing transportation operating costs. Additionally, strict regulations in many regions have imposed strict emission standards due to rising vehicle emissions levels.

Vendors collaborate with regional and local players to develop new end-use products to enhance product portfolio and strengthen their footprint, which in turn are factors driving the alumina trihydrate market growth in the U.S.