Growing Focus on Sustainability

Sustainability initiatives are becoming a cornerstone of the Rail Composites Market, as stakeholders seek to minimize environmental impact. The adoption of eco-friendly composite materials, which are often recyclable and produced with lower carbon footprints, aligns with global efforts to reduce greenhouse gas emissions. Rail operators are increasingly prioritizing sustainable practices, leading to a rise in the use of bio-based composites. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers. The market for sustainable rail composites is expected to expand significantly, with projections indicating a potential increase in market share by 15% within the next decade.

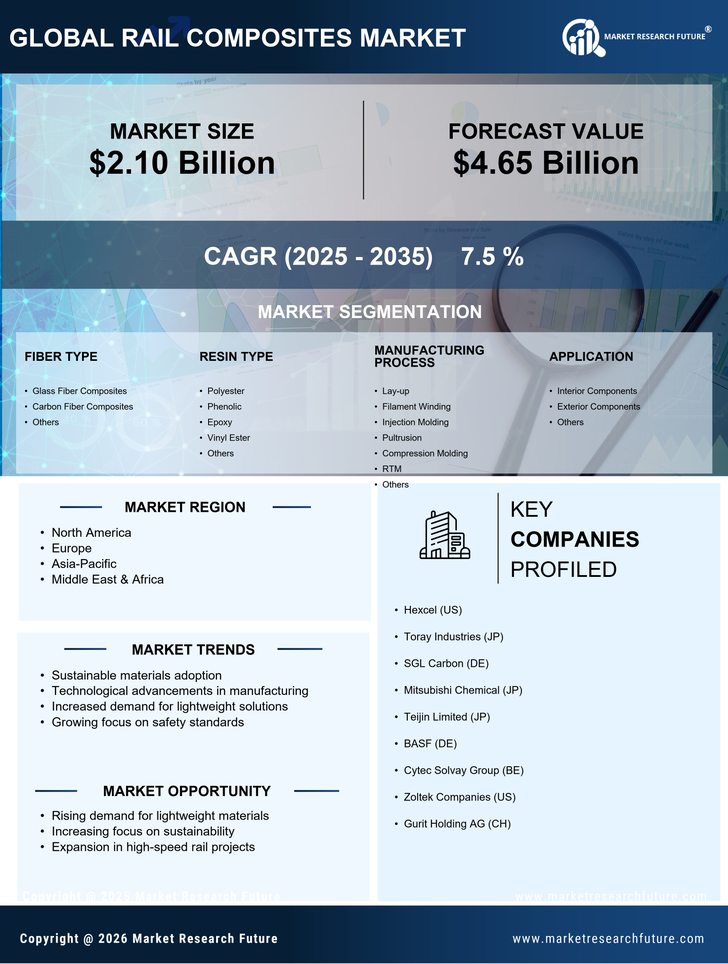

Increased Demand for Lightweight Materials

The Rail Composites Market is experiencing a notable surge in demand for lightweight materials, driven by the need for enhanced fuel efficiency and reduced operational costs. Composites, known for their high strength-to-weight ratio, are increasingly being adopted in rail applications. This shift is particularly evident in the manufacturing of train components such as carriages and bogies, where weight reduction can lead to significant energy savings. According to recent data, the use of composite materials in rail applications is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend indicates a robust market potential for manufacturers specializing in lightweight composite solutions.

Enhanced Safety Standards in Rail Operations

Safety enhancements are a critical driver in the Rail Composites Market, as the sector increasingly prioritizes the use of materials that improve safety performance. Composites are being recognized for their ability to withstand harsh conditions and provide better impact resistance compared to traditional materials. This is particularly relevant in the context of rail accidents, where the use of advanced composites can mitigate damage and enhance passenger safety. Regulatory bodies are also establishing stricter safety standards, which further propels the demand for high-performance composite materials. The market is likely to see a continued emphasis on safety, with projections indicating a 12% increase in the adoption of safety-oriented composite solutions over the next few years.

Technological Innovations in Composite Manufacturing

Technological advancements are playing a pivotal role in the Rail Composites Market, particularly in the development of advanced composite manufacturing techniques. Innovations such as 3D printing and automated fiber placement are enhancing production efficiency and reducing costs. These technologies enable manufacturers to create complex geometries and tailor composite properties to meet specific performance requirements. As a result, the market is witnessing an influx of new products that offer improved durability and performance. The integration of smart materials, which can respond to environmental changes, is also gaining traction, potentially revolutionizing rail applications and expanding the scope of composite usage in the industry.

Regulatory Support for Rail Infrastructure Development

The Rail Composites Market is benefiting from increased regulatory support aimed at enhancing rail infrastructure. Governments are investing in modernizing rail networks, which includes the integration of advanced materials like composites. This investment is often accompanied by policies that encourage the use of innovative materials to improve safety and efficiency. For instance, initiatives aimed at upgrading aging rail systems are likely to drive demand for composite materials that offer superior performance and longevity. As infrastructure projects are rolled out, the market for rail composites is expected to see a substantial boost, with estimates suggesting a growth rate of 10% in the coming years.