Social Media Influence

The RTD Alcoholic Beverages Market is significantly impacted by the influence of social media. Platforms such as Instagram and TikTok have become vital marketing tools for brands, allowing them to reach younger audiences effectively. The visual nature of these platforms encourages the sharing of aesthetically pleasing drinks, which can drive consumer interest and engagement. Data indicates that products featured in social media campaigns often see a spike in sales, as consumers are influenced by peer recommendations and trending content. This trend highlights the importance of digital marketing strategies in the RTD sector, as brands leverage social media to create buzz around new product launches and seasonal offerings. The ability to connect with consumers through engaging content is likely to remain a key driver in shaping purchasing behaviors within the market.

Diverse Flavor Profiles

The RTD Alcoholic Beverages Market is characterized by an increasing demand for diverse flavor profiles. Consumers are no longer satisfied with traditional flavors; they seek unique and innovative combinations that enhance their drinking experience. This trend is evident in the rise of craft cocktails and exotic flavor infusions, which have gained popularity among consumers looking for something distinct. Market data indicates that flavored RTD beverages account for a substantial portion of sales, with fruit and herbal infusions leading the charge. As brands continue to experiment with new flavors, the market is likely to see an expansion in product lines that cater to adventurous palates. This emphasis on flavor innovation not only attracts new consumers but also encourages brand loyalty, as customers are drawn to products that offer a memorable taste experience.

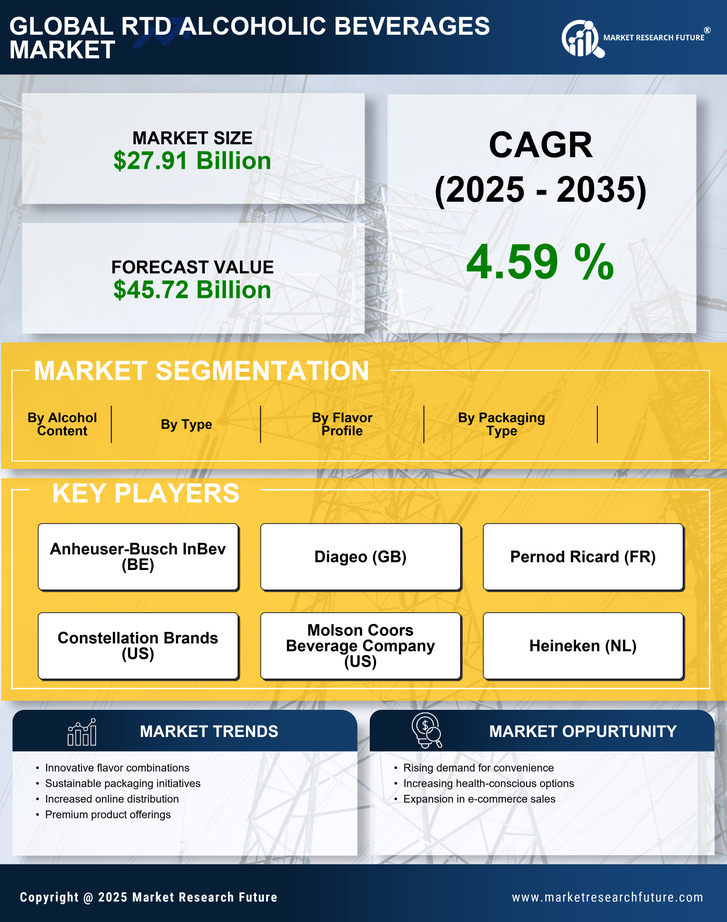

Health and Wellness Trends

The RTD Alcoholic Beverages Market is increasingly influenced by health and wellness trends. As consumers become more health-conscious, there is a growing demand for beverages that align with their lifestyle choices. This has led to the introduction of low-calorie, low-sugar, and organic options within the RTD segment. Market Research Future suggests that products marketed as healthier alternatives are gaining traction, with sales of low-calorie RTD beverages rising significantly. Brands are responding to this shift by reformulating existing products and launching new lines that emphasize natural ingredients and nutritional benefits. This focus on health not only attracts a broader consumer base but also positions brands favorably in a competitive market, as they cater to the evolving preferences of health-oriented consumers.

Sustainability Initiatives

The RTD Alcoholic Beverages Market is increasingly shaped by sustainability initiatives. As environmental concerns gain prominence, consumers are gravitating towards brands that demonstrate a commitment to sustainable practices. This includes the use of eco-friendly packaging, responsible sourcing of ingredients, and transparent production processes. Market data suggests that products marketed as sustainable are experiencing higher demand, with consumers willing to pay a premium for environmentally friendly options. Brands are responding by adopting sustainable practices, which not only appeal to eco-conscious consumers but also enhance brand reputation. This trend towards sustainability is likely to continue influencing purchasing decisions, as consumers increasingly prioritize environmental responsibility in their choices, thereby driving growth within the RTD segment.

Convenience and Portability

The RTD Alcoholic Beverages Market is experiencing a surge in demand for products that offer convenience and portability. Consumers increasingly favor ready-to-drink options that can be easily consumed on-the-go, whether at social gatherings, picnics, or outdoor events. This trend is particularly pronounced among younger demographics, who prioritize convenience in their purchasing decisions. According to recent data, the RTD segment has seen a growth rate of approximately 15% annually, driven by the desire for hassle-free consumption. As lifestyles become busier, the appeal of ready-to-drink beverages that require no preparation is likely to continue influencing market dynamics. This shift towards convenience is reshaping product offerings, with brands innovating to create portable packaging solutions that cater to the needs of modern consumers.