Airport Surveillance Radar Size

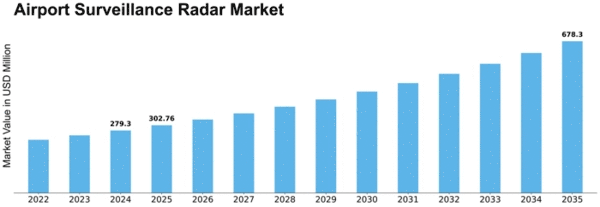

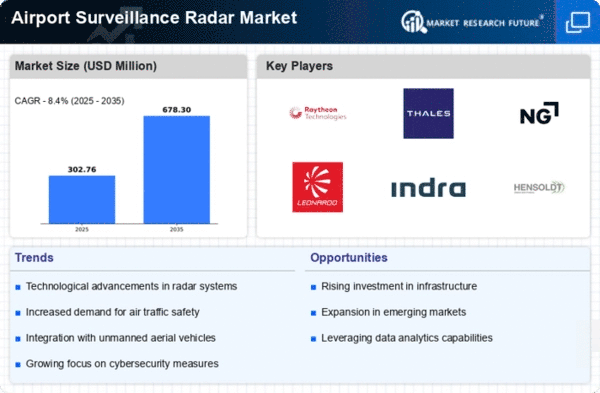

Airport Surveillance Radar Market Growth Projections and Opportunities

The airport surveillance radar (ASR) market is positioned within a dynamic environment that influences various drivers of demand, technology trends, and competitors in the sector. One of the major drivers of market forces is the global expansion and modernization of airports. Airports across the world are investing in advanced radar systems due to continuous growth in air travel and the need for improved safety and efficiency. Technological progress plays an important role in the dynamics of ASR markets. Continuous innovation in radar technology, including digital signal processing integration, automation features, and multi-mode capabilities, helps to enhance the performance as well as efficiency of ASR systems. On top of these, there has been a move towards solid-state radar technology and the incorporation of advanced signal processing algorithms, all of which have led to improved detection capabilities with reduced maintenance requirements, thereby affecting market dynamics and promoting more sophisticated and capable ASR adoption. Regulatory standards and compliance remain key factors that shape airport surveillance radars' market dynamics. International Civil Aviation Organization (ICAO) and Federal Aviation Authority (FAA), among other aviation regulatory agencies, put up stringent requirements for airport surveillance as well as air traffic control (ATC) systems. The focus on airport security coupled with comprehensive surveillance contributes to ASR's market dynamics. To counteract evolving threats such as unauthorized intrusions, wildlife hazards, or potential airspace violations, airports all over the world must concentrate on their security measures. Secondary Surveillance Radar (SSR) and conflict Detection Technologies are some of the advanced surveillance capabilities embedded into ASRs that address these security concerns, thereby aligning market dynamics with the prevailing security needs of modern airports. The global trend towards modernization initiatives for air traffic management is another factor determining how ASRs work out their market dynamics. As countries/regions are implementing modern ATMs, airports have to improve their monitoring infrastructure so that it can assist better airspace management that will be more efficient, hence creating harmony between them and other neighboring ATCs or even airports respectively within one region/country. Interoperability and integration into other ATC and airport systems are key dynamics of the ASR market. Economic factors such as allocations made by governments within their budgets to cater to aviation infrastructures affect the market dynamics of ASR. Competitive forces in the ASR market are shaped by factors like vendor partnerships, mergers & acquisitions (M&As), and strategic alliances, among others. In many cases, radar system manufacturers and suppliers usually collaborate to gain from complementary technologies, enlarge product portfolios, or even improve their worldwide coverage.

Leave a Comment