Market Share

Airport Surveillance Radar Market Share Analysis

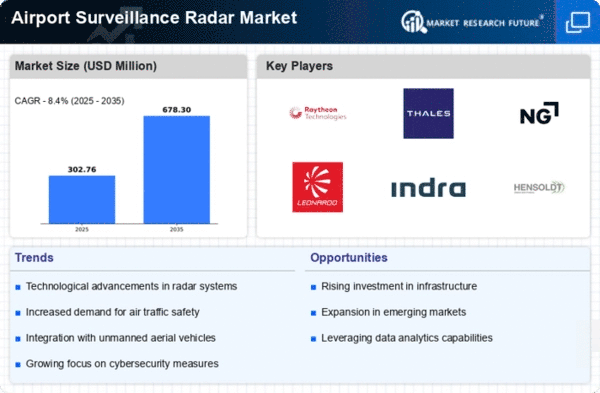

Several important trends reflect changing Airport Surveillance Radar (ASR) markets in relation to the landscape of airport operations, air traffic management, and radar technology. One of these is the adoption of digital radar technology, which has increased rapidly. Traditional analog radars have been increasingly displaced with digital ASRs that provide improved target discrimination and enhanced signal-processing capability, besides being more reliable in operation. Another tendency is automation with AI integration, which affects ASR's market dynamics as well. Automation features such as automated target tracking, conflict detection, and resolution capabilities have become an integral part of modern ASRs'. There are AI algorithms that assist in analyzing radar data, leading to predictive analytics and advanced decision-making support. In the ASR market, the integration of multi-mode radar systems has been going on and is being observed as one of the significant trends. Multi-mode radars allow switching between various operational modes, including Primary Surveillance Radar (PSR) and Secondary Surveillance Radar (SSR). Remote sensing and distributed radar networks are some of the emerging latest fashions in the ASR market. Remote sensing technologies such as satellite-based radar use and distributed radar sensors are potential extensions of surveillance coverage or redundancy. This aligns with the industry's efforts to improve surveillance over large but thinly populated areas like oceanic airspace or places with limited radar coverage. The adoption of remote sensing technologies and distributed radar networks promotes airport surveillance resilience and effectiveness. As a trend in the ASR market, environmental sustainability cannot be ignored. Radar manufacturers and airport operators are considering how to make their radar systems more energy efficient so as to reduce consumption levels while at the same time mitigating ecological footprint. Cybersecurity concerns have become more significant in the field of ASRs. With growing interconnection and their integration into broader ATM networks, there is a realization that cybersecurity challenges must be tackled within this sector. Similarly, modular and scalable architectures have emerged as a noteworthy trend in ASR markets. An exciting trend in modern markets is towards modularization and scalability, among other technical aspects. For example, modularity and scalability are exciting trends in current markets. On another note, this shift towards solid-state technology represents one major trend that keeps the company relevant within industry changes, unlike earlier' traditional magnetron-based radars, now replaced by semiconductors, which are more effective and less prone to failures.

Leave a Comment