Top Industry Leaders in the Airport Surveillance Radar Market

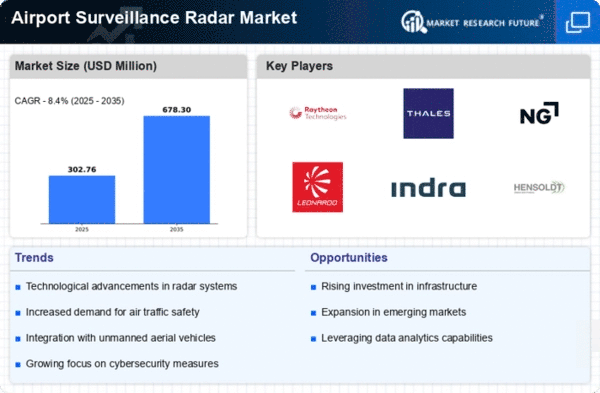

The Airport Surveillance Radar (ASR) market is a crucial component of airport infrastructure, providing essential capabilities for air traffic control and ensuring the safe and efficient movement of aircraft on the ground and in the airspace. Key players in this market include established aerospace and defense companies, radar system manufacturers, and technology integrators, all contributing to the advancement of ASR technologies.

Key Players:

- BAE Systems (UK)

- Northrop Grumman Corporation (US)

- Thales Group (France)

- Raytheon Company (US)

- Lockheed Martin Corporation (US)

- Leonardo SpA (Italy)

- L3Harris Technologies, Inc. (the US)

- Intelcan Technosystems Inc. (Canada)

- Blighter Surveillance Systems Ltd (UK)

- NEC Corporation (Japan)

- HENSOLDT (Germany)

- Shoghi Communications Ltd (India)

- TERMA (Denmark)

- ASELSAN AS (Turkey)

- Easat Radar Systems Limited (UK)

- Airbus SAS (Netherlands)

- DeTect, Inc (US)

- Saab AB (Sweden)

- Israel Aerospace Industries Ltd (Israel)

- Telephonics Corporation (US)

- Indra Sistemas, SA (Spain)

Strategies Adopted: Strategies adopted by key players in the Airport Surveillance Radar market revolve around innovation, strategic partnerships, and global market presence. Continuous investment in research and development is essential to enhance radar capabilities, improve detection accuracy, and address the challenges posed by evolving air traffic patterns. Strategic collaborations with air navigation service providers, airport authorities, and regulatory bodies are common, facilitating the development and deployment of state-of-the-art ASR systems. Moreover, global expansion efforts, including establishing regional partnerships and deploying radar solutions in diverse environments, contribute to the market presence of leading companies.

Factors for Market Share Analysis: Market share analysis in the Airport Surveillance Radar sector considers various factors, including the range and accuracy of radar systems, adaptability to different airport sizes, compliance with aviation standards, and integration capabilities with air traffic management systems. The ability to provide ASR solutions that meet the stringent requirements of civil aviation authorities and enhance airport safety and efficiency plays a significant role in determining market share. Additionally, factors such as system reliability, ease of maintenance, and adaptability to varying weather conditions contribute to the overall competitiveness of Airport Surveillance Radar providers.

New and Emerging Companies: The Airport Surveillance Radar market is witnessing the emergence of new and innovative companies focusing on niche areas such as digital radar technologies, advanced signal processing, and artificial intelligence integration. Start-ups like ERA a.s. and HENSOLDT bring fresh perspectives to the radar landscape, offering solutions that enhance surveillance capabilities and address specific challenges associated with modern airport environments. These companies often emphasize agility, flexibility, and the incorporation of cutting-edge technologies, challenging traditional players and contributing to the evolution of ASR technologies.

Industry News: Industry news in the Airport Surveillance Radar market frequently highlights successful implementations, advancements in radar technologies, and collaborations between radar system providers and aviation authorities. Recent developments, such as the deployment of digital beamforming radar systems, the integration of secondary surveillance radar (SSR) functionalities, and partnerships for the development of multilateration solutions, showcase the industry's commitment to innovation and addressing the evolving needs of air traffic management. News related to successful system upgrades, regulatory approvals, and the adoption of emerging technologies further shape industry perceptions and influence competitive dynamics.

Current Company Investment Trends: Investments in technology, digitalization, and system upgrades remain key trends in the Airport Surveillance Radar market. Key players allocate substantial resources to research and development activities aimed at enhancing radar technologies, improving data processing capabilities, and addressing emerging air traffic challenges. Investments also focus on the integration of digital radar technologies, artificial intelligence for automated target recognition, and the development of radar systems compatible with future air traffic management concepts. Strategic acquisitions and partnerships contribute to expanding product portfolios, addressing emerging market needs, and strengthening the overall competitiveness of Airport Surveillance Radar solution providers.

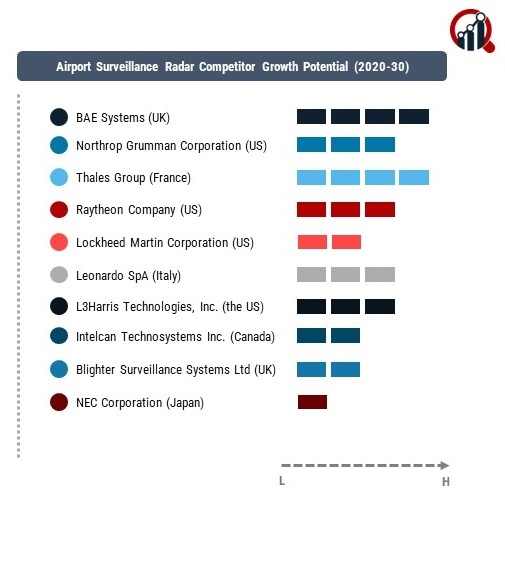

Overall Competitive Scenario: The overall competitive scenario in the Airport Surveillance Radar market is marked by a balance between established aerospace and defense giants and innovative newcomers. Established players leverage their experience, global reach, and diversified radar portfolios to maintain a competitive edge. Simultaneously, emerging companies contribute to the market's dynamism by introducing novel radar technologies and addressing specific challenges associated with modern air traffic management. The trend towards integrated surveillance solutions, incorporating radar, multiliterate, and data fusion capabilities, further intensifies competition in this market.

Recent Developments:

Raytheon Technologies:

Successfully completed the first production unit of its new ASR-11 next-generation primary radar. The ASR-11 features advanced digital signal processing and enhanced target tracking capabilities, providing improved airspace visibility for air traffic controllers.

Investing in research and development of multi-mode ASR systems that combine primary and secondary radar functionalities into a single platform. This improves operational efficiency and reduces equipment costs for airports.

Thales Group:

Secured a €40 million contract from the French civil aviation authority to supply its Ground Master 400 (GM400) multi-sensor radar systems for several French airports. The GM400 combines radar, electro-optical sensors, and electronic warfare capabilities for comprehensive airport surveillance and threat detection.