Market Analysis

In-depth Analysis of Airport Surveillance Radar Market Industry Landscape

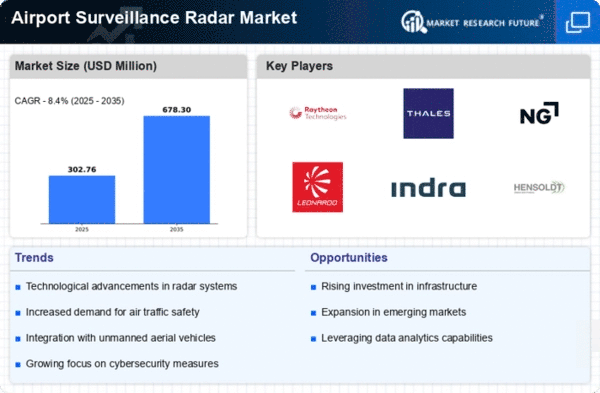

The dynamics of the airport surveillance radar (ASR) market are influenced by several factors that collectively shape its growth, demand, and competition landscape. One key factor includes increasing global air traffic along with the requirement for improved safety & security measures. This means that despite obstacles like high costs and complex upgrades, the airport surveillance radar market is about to take off and is expected to hit USD 2.5 billion by 2030 at a 6% CAGR. A combination of drivers, such as surging worldwide military budgets, booming airport construction activity, and insatiable demand for efficient air space organizations, are propelling the upward trend of this sector. As technology soars, so too will the sophistication of these radars, further enhancing their vital role in safeguarding our skies and ensuring the smooth flow of air traffic. Technological developments are a crucial market factor in the ASR industry. The continuous evolution of radar technology, like digital signal processing shift towards solid-state radar automation features, shapes market dynamics. Regulations standards & compliance are important determinants that shape ASR sectors' market factors. For instance, the International Civil Aviation Organization (ICAO), together with national authorities like the Federal Aviation Administration (FAA), put in place rigorous standard requirements for airport surveillance and air traffic control systems all over the world. On the other hand, global trends toward airport modernization initiatives have significantly impacted ASRs' market factors. Demand for advanced surveillance capabilities rises as airports expand or upgrade to accommodate larger aircraft and increased passenger traffic. Market factors are shaped by the imperative for airports to invest in state-of-the-art ASR solutions as part of their broader modernization strategies. The overall market dynamics of the ASR industry include the need for effective ATMs and improved surveillance. Market drivers in the ASR industry include a focus on air transport security and the need for comprehensive surveillance systems. Airports face changing safety threats, and such concerns are addressed by integrating sophisticated surveillance capabilities into ASR solutions. Interoperability has an important role in determining the behavior of the ASR industry in terms of market factors. The airports require radar solutions that will seamlessly integrate with existing air traffic management infrastructure, communication networks, and surveillance systems. Government funding and airport budget allocations are among some of the economic factors that shape market dynamics within the ASR industry, while competition between manufacturers and suppliers is one of the key market factors that affect the ASR industry. In this context, competitive dynamics involve product innovation, technological differentiation, pricing strategies, and customer relationships.

Leave a Comment