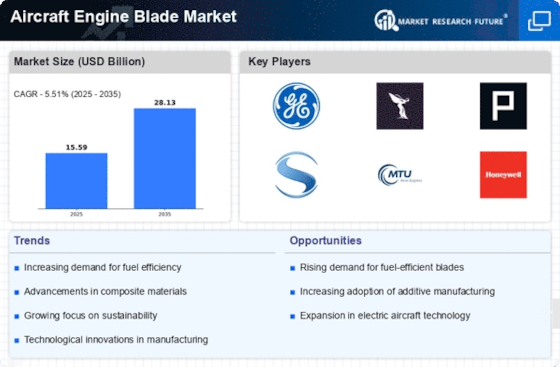

Growth of the Aviation Sector

The aircraft engine blade Market is closely tied to the growth of the aviation sector, which continues to expand due to rising passenger traffic and cargo demand. As airlines increase their fleets to accommodate this growth, the need for high-performance engine blades becomes paramount. Recent statistics indicate that the aviation industry is expected to grow at a rate of 5% annually, leading to increased orders for new aircraft and, consequently, engine blades. This growth presents a lucrative opportunity for manufacturers in the Aircraft Engine Blade Market to capitalize on the increasing demand for advanced engine technologies that enhance performance and reliability.

Emergence of Advanced Materials

The Aircraft Engine Blade Market is witnessing a shift towards the use of advanced materials, which are crucial for enhancing the performance and durability of engine blades. Materials such as titanium alloys and composite materials are increasingly being utilized to withstand extreme temperatures and pressures. This trend is driven by the need for lighter and more efficient components that can improve overall engine performance. The market for advanced materials in the aviation sector is projected to grow significantly, with estimates suggesting a growth rate of around 7% over the next few years. As a result, manufacturers in the Aircraft Engine Blade Market are likely to focus on developing blades that leverage these advanced materials to meet the demands of modern aviation.

Rising Demand for Fuel Efficiency

The Aircraft Engine Blade Market experiences a notable surge in demand for fuel-efficient engines. Airlines and manufacturers are increasingly prioritizing fuel economy to reduce operational costs and meet environmental regulations. The integration of advanced materials and aerodynamic designs in engine blades contributes to enhanced fuel efficiency. According to recent data, the market for fuel-efficient aircraft is projected to grow significantly, with a compound annual growth rate of approximately 4.5% over the next decade. This trend indicates a robust opportunity for manufacturers in the Aircraft Engine Blade Market to innovate and develop blades that optimize performance while minimizing fuel consumption.

Regulatory Compliance and Environmental Standards

The Aircraft Engine Blade Market is significantly influenced by stringent regulatory compliance and environmental standards. Governments and aviation authorities worldwide are implementing regulations aimed at reducing emissions and enhancing sustainability in aviation. This regulatory landscape compels manufacturers to invest in research and development to create engine blades that meet these evolving standards. The market is witnessing a shift towards blades designed with eco-friendly materials and technologies that reduce noise and emissions. As a result, the Aircraft Engine Blade Market is likely to see increased demand for innovative solutions that align with these regulatory requirements, fostering growth and sustainability.

Technological Innovations in Manufacturing Processes

Technological advancements in manufacturing processes are reshaping the Aircraft Engine Blade Market. Innovations such as additive manufacturing and advanced machining techniques enable the production of complex blade geometries with enhanced performance characteristics. These technologies not only improve the efficiency of the manufacturing process but also allow for the creation of lighter and stronger blades. The adoption of such technologies is expected to drive market growth, with projections indicating a potential increase in market size by 6% annually over the next five years. Consequently, manufacturers in the Aircraft Engine Blade Market are likely to invest in these technologies to maintain a competitive edge.