Growth in DIY Projects

The Circular Saw Blade Market is witnessing a significant boost from the growing trend of do-it-yourself (DIY) projects among consumers. As individuals increasingly engage in home improvement and renovation activities, the demand for circular saw blades rises correspondingly. In recent years, the DIY market has expanded, with a reported increase of around 20% in consumer spending on home improvement tools. This trend indicates a shift in consumer behavior, where more people are opting to undertake projects themselves rather than hiring professionals. Consequently, the availability of various circular saw blades tailored for different materials and applications caters to this burgeoning market, thus driving sales and innovation within the industry.

Technological Innovations

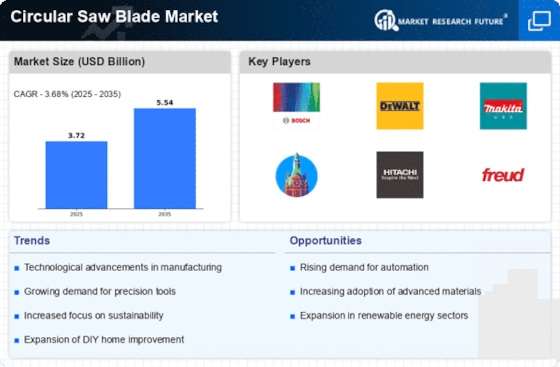

Technological advancements play a pivotal role in shaping the Circular Saw Blade Market. The introduction of high-performance materials and innovative designs has led to the development of blades that offer enhanced durability and precision. For instance, the integration of carbide-tipped and diamond-coated blades has significantly improved cutting efficiency and longevity. In 2025, the market for advanced circular saw blades is expected to account for a substantial portion of overall sales, reflecting a growing preference for high-quality tools among professionals and hobbyists alike. These innovations not only enhance performance but also reduce operational costs, making them attractive options for users across various sectors.

Focus on Safety and Ergonomics

The Circular Saw Blade Market is increasingly prioritizing safety and ergonomic design in response to consumer demand for safer tools. As awareness of workplace safety rises, manufacturers are developing circular saw blades that minimize risks associated with cutting tools. Features such as anti-kickback designs and improved blade guards are becoming standard, enhancing user safety. Additionally, ergonomic handles and lightweight materials are being integrated to reduce user fatigue during prolonged use. This focus on safety and comfort is likely to attract more users to the market, particularly in sectors where cutting tools are frequently employed, thus contributing to the overall growth of the circular saw blade market.

Rising Construction Activities

The Circular Saw Blade Market is experiencing a notable surge due to the increasing construction activities across various sectors. As urbanization accelerates, the demand for residential and commercial buildings rises, leading to a higher requirement for efficient cutting tools. In 2025, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5%, which directly influences the demand for circular saw blades. These blades are essential for cutting wood, metal, and other materials, making them indispensable in construction projects. Furthermore, the expansion of infrastructure projects, such as roads and bridges, further propels the need for high-quality circular saw blades, thereby enhancing market growth.

Increased Demand from the Manufacturing Sector

The Circular Saw Blade Market is significantly influenced by the rising demand from the manufacturing sector. As industries such as automotive, aerospace, and furniture production expand, the need for precise cutting tools becomes paramount. In 2025, the manufacturing sector is anticipated to grow at a rate of approximately 4%, which will likely drive the demand for circular saw blades. These blades are essential for cutting various materials, including metals and composites, which are widely used in manufacturing processes. The ability of circular saw blades to deliver clean cuts and maintain efficiency under high workloads makes them a preferred choice among manufacturers, thereby bolstering market growth.