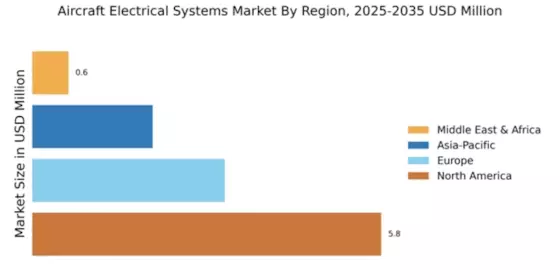

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Aircraft Electrical Systems market, holding a significant share of 5.8 in 2024. The region's growth is driven by increasing demand for advanced avionics and the modernization of existing aircraft fleets. Regulatory support from agencies like the FAA promotes innovation and safety, further enhancing market dynamics. The push for sustainable aviation solutions is also a key driver, as manufacturers seek to reduce emissions and improve fuel efficiency.

The competitive landscape in North America is robust, featuring key players such as Honeywell, General Electric, and Boeing. These companies are at the forefront of technological advancements, focusing on integrating smart systems and automation into aircraft. The presence of major defense contracts and commercial aviation projects in the U.S. and Canada bolsters market growth. As the region continues to invest in R&D, it is expected to remain a hub for cutting-edge aircraft electrical systems.

Europe : Emerging Market with Growth Potential

Europe's Aircraft Electrical Systems market is projected to grow, with a market size of 3.2 by 2025. The region benefits from stringent regulatory frameworks that promote safety and efficiency in aviation. The European Union Aviation Safety Agency (EASA) plays a crucial role in setting standards that drive innovation and compliance. Additionally, the increasing focus on reducing carbon emissions is pushing manufacturers to adopt more efficient electrical systems, aligning with the EU's sustainability goals.

Leading countries in this region include France, Germany, and the UK, where companies like Thales and Safran are key players. The competitive landscape is characterized by collaborations between manufacturers and technology firms to enhance system capabilities. As Europe invests in next-generation aircraft, the demand for advanced electrical systems is expected to rise, positioning the region as a significant player in the global market.

Asia-Pacific : Rapidly Growing Aviation Sector

The Asia-Pacific region is witnessing rapid growth in the Aircraft Electrical Systems market, with a projected size of 2.0 by 2025. This growth is fueled by increasing air travel demand, particularly in countries like China and India, where rising disposable incomes and urbanization are driving the expansion of the aviation sector. Additionally, government initiatives to enhance regional connectivity and invest in airport infrastructure are significant catalysts for market growth.

Key players in this region include major companies such as Boeing and Raytheon Technologies, which are focusing on partnerships with local firms to penetrate the market effectively. The competitive landscape is evolving, with an emphasis on developing cost-effective and efficient electrical systems to meet the needs of emerging airlines. As the region continues to modernize its fleet, the demand for advanced aircraft electrical systems is expected to surge, making it a vital market for future investments.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa region is gradually emerging in the Aircraft Electrical Systems market, with a size of 0.6 by 2025. The growth is primarily driven by increasing investments in aviation infrastructure and the expansion of airline networks. Countries like the UAE and South Africa are leading the way, with government initiatives aimed at enhancing air travel connectivity and boosting tourism. The region's strategic location as a The Aircraft Electrical Systems development.

Despite its smaller market size, the competitive landscape is evolving, with local and international players vying for market share. Companies are focusing on establishing partnerships to leverage technological advancements and improve system efficiencies. As the region continues to invest in modernizing its aviation sector, the demand for advanced aircraft electrical systems is expected to grow, presenting opportunities for new entrants and established players alike.