Integration of Antenna Systems in Aircraft Design

The aircraft antenna Market is experiencing a shift towards the integration of antenna systems into the overall aircraft design. This trend is driven by the need for improved aerodynamics and reduced drag, which can enhance fuel efficiency. Manufacturers are increasingly collaborating with aircraft designers to create antennas that are seamlessly incorporated into the airframe, minimizing their impact on the aircraft's performance. This integration not only improves the aesthetic appeal of the aircraft but also optimizes the functionality of the antenna systems. As a result, the market is likely to see a rise in demand for integrated antenna solutions, reflecting a broader trend towards innovation in aircraft design.

Technological Advancements in Aircraft Antenna Market

The Aircraft Antenna Market is experiencing a surge in technological advancements, particularly in the development of multi-band and software-defined antennas. These innovations enhance communication capabilities, enabling aircraft to maintain connectivity across various frequencies. The integration of advanced materials, such as lightweight composites, contributes to improved performance and reduced weight, which is crucial for fuel efficiency. Furthermore, the rise of satellite communication systems necessitates the adoption of sophisticated antennas that can support high data rates. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years, driven by these technological enhancements.

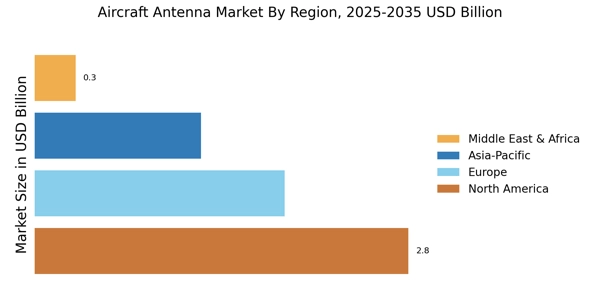

Emerging Markets and Expansion in Aircraft Antenna Market

The Aircraft Antenna Market is poised for growth in emerging markets, where the expansion of air travel infrastructure is underway. Countries in Asia-Pacific and Latin America are investing heavily in their aviation sectors, leading to an increased demand for advanced aircraft antennas. The rise of low-cost carriers in these regions is also contributing to the need for cost-effective yet efficient antenna solutions. As these markets develop, the demand for modern aircraft equipped with state-of-the-art communication systems is expected to rise. This trend suggests a potential increase in market share for manufacturers who can adapt their products to meet the specific needs of these regions.

Regulatory Compliance and Safety in Aircraft Antenna Market

The Aircraft Antenna Market is increasingly influenced by regulatory compliance and safety standards imposed by aviation authorities. These regulations mandate the use of antennas that meet specific performance criteria to ensure reliable communication and navigation. As safety remains a paramount concern in aviation, manufacturers are compelled to innovate and enhance their antenna designs to comply with these regulations. The need for antennas that can withstand harsh environmental conditions and provide redundancy in communication systems is driving research and development efforts. This focus on compliance is likely to propel the market forward, as adherence to safety standards is non-negotiable in the aviation sector.

Increased Demand for Connectivity in Aircraft Antenna Market

The Aircraft Antenna Market is witnessing an increased demand for connectivity solutions, driven by the growing expectations of passengers for in-flight internet access and real-time communication. Airlines are investing in advanced antenna systems to provide seamless connectivity, which is becoming a competitive differentiator in the aviation sector. The rise in air travel, projected to reach 4.5 billion passengers by 2025, further fuels this demand. Consequently, the market for aircraft antennas is expected to expand significantly, with estimates suggesting a market value of over 1.2 billion USD by 2026. This trend indicates a shift towards more integrated and efficient communication systems in aviation.