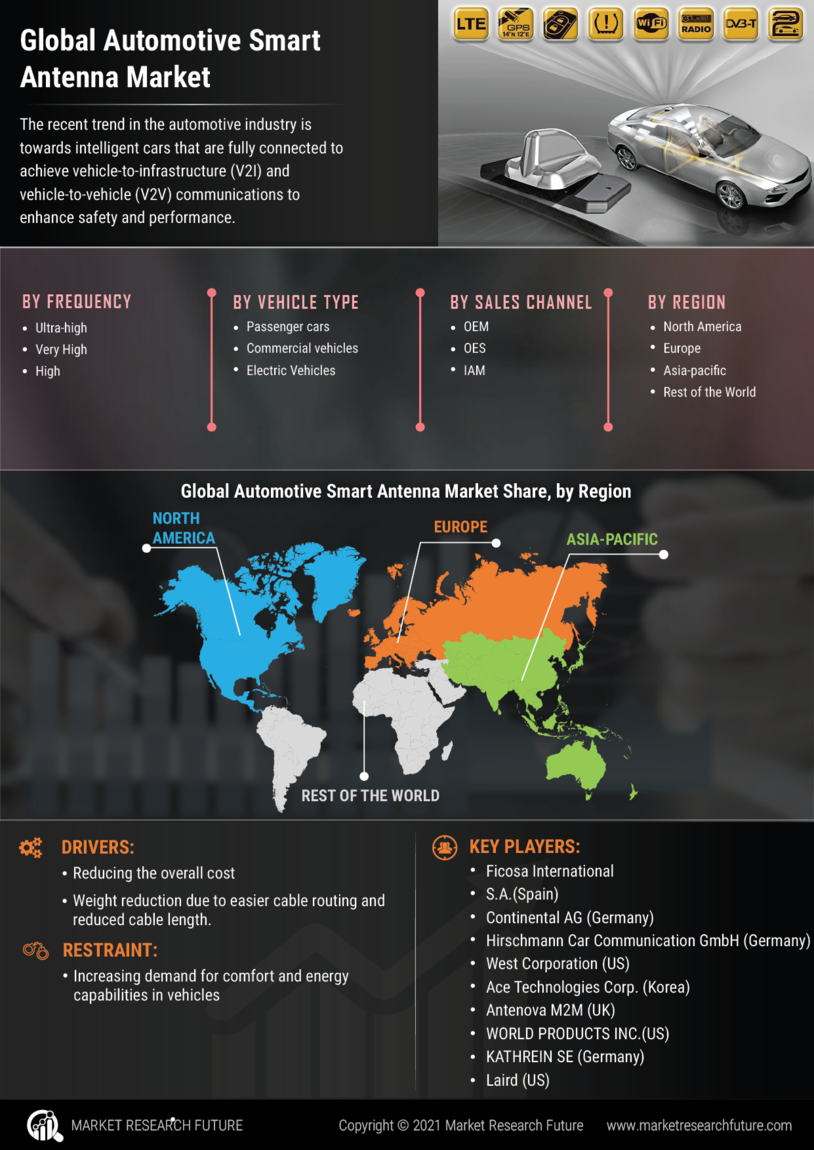

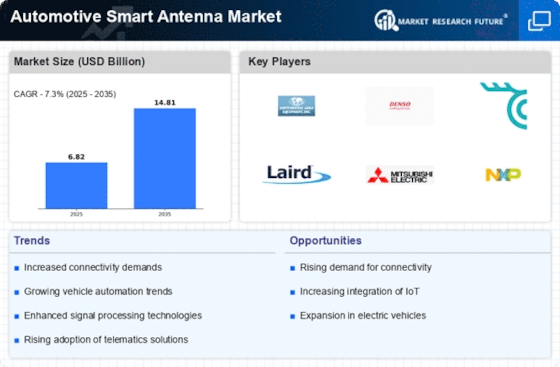

Recent developments in the Automotive Smart Antenna Market have showcased a growing emphasis on advancements in connectivity and in-vehicle communication systems. Companies such as Broadcom and NXP Semiconductors are actively investing in technologies designed to enhance vehicle performance and user experience through smarter and more efficient antennas. Industry leaders like Valeo and Continental are also focusing on integrating smart antennas to support emerging technologies, including 5G, which is expected to increase vehicle connectivity capabilities significantly.

Furthermore, the trend of mergers and acquisitions is evident, particularly as organizations seek to consolidate their positions in this evolving market. For instance, Zebra Technologies and Laird Connectivity are pursuing synergistic partnerships to enhance their product offerings in automotive solutions. Market valuations have experienced notable growth as automakers prioritize integrating smart antenna technology to improve navigation, safety features, and overall vehicular communication.

Additionally, the increasing demand for connected vehicles globally is driving innovation and competition among key players like Denso, Molex, and Mitsubishi Electric, emphasizing the importance of robust antenna solutions in the automotive sector. Overall, this sector is witnessing dynamic shifts driven by technological advancements and strategic corporate movements.

May 2024

Zetifi, in Australia, announced their first-ever location-aware smart antennas, which they claim would transform the market. This product intends to combine it with a vehicle antenna and turn it into an optimizing device to improve mobile phone coverage. As the product is still patent pending, it is unclear when the vehicle antennas will be improved, as mentioned.

April 2024

Calian GNSS, still recognized as Tallysman Wireless released a new GNSS antenna directed toward professionals, which includes the Quectel chipset. This addition significantly enhances the nabízí numerous functionalities, such as dual-band GNSS, extended filtering, low phase center, a low signal-to-noise ratio, and others.

January 2024

Texas Instruments, a firm headquartered in Dallas, announced the launch of newly invented semiconductors to further aid in radar sensor capabilities. Furthermore, the AWR2544 is specially designed to minimize the footprint of radar sensors by integrating a 3d wavelength antenna.

July 2022

A new Hyryder-based SUV by the name of Vitara was rolled out in India by Maruti Suzuki. The vehicle is fitted with a shark fin antenna.

May 2022

Hyundai India introduced an upgraded corporate edition version of its previously launched entry-level grand i10 Nios hatchback that features a shark-fin antenna.

January 2022

MGV, which specializes in electromagnetic wave visualization and professionals able to conduct tests on antenna and wireless connectivity, announced that it has partnered with SGS, a certification and testing firm, to manufacture tools to measure automotive antennas.

September 2021

TE Connectivity, a company that manufactures other businesses, such as sensors and antennas, stated that they strategically acquired Laird, their wired modules and manufacturers for IoT and antennas.

January 2021

Harman International has introduced a 5G TCU with a Smart Conformal Antenna, which resolves several issues caused by packing multiple antennas into one module. This module is designed to be mounted on a vehicle's outside and encased in a waterproof, non-conductive covering.