Expansion of 5G Networks

The rollout of 5G networks is poised to significantly impact the Global Distributed Antenna Market Industry. With its promise of higher speeds and lower latency, 5G technology necessitates advanced infrastructure, including distributed antenna systems. DAS plays a crucial role in enhancing 5G coverage, particularly in urban areas where traditional cell towers may be insufficient. As 5G adoption accelerates, the market is expected to grow at a CAGR of 6.78% from 2025 to 2035. This growth indicates a strong correlation between the expansion of 5G networks and the increasing deployment of DAS, as service providers seek to optimize their network performance.

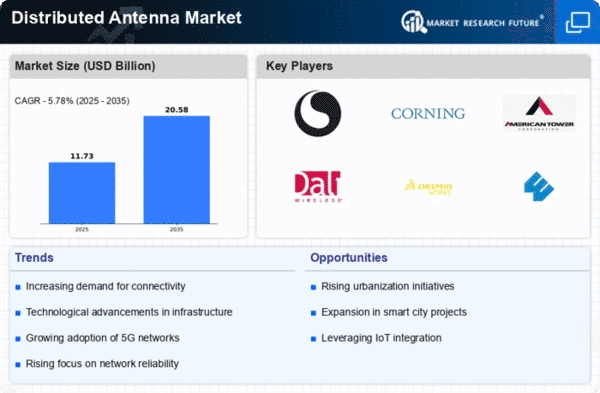

Market Growth Projections

The Global Distributed Antenna Market Industry is projected to experience substantial growth in the coming years. With a market value expected to reach 9.72 USD Billion in 2024 and an anticipated increase to 20 USD Billion by 2035, the industry is on a promising trajectory. The compound annual growth rate (CAGR) of 6.78% from 2025 to 2035 suggests a sustained demand for distributed antenna systems as connectivity needs evolve. This growth is likely to be fueled by advancements in technology, increasing urbanization, and the expansion of 5G networks, positioning DAS as a critical element in the future of telecommunications.

Increased Adoption of Smart Devices

The proliferation of smart devices is a significant driver for the Global Distributed Antenna Market Industry. As consumers increasingly rely on smartphones, tablets, and IoT devices, the demand for seamless wireless connectivity intensifies. Distributed antenna systems are essential in ensuring that these devices maintain optimal performance, particularly in environments with high user density. The anticipated growth of the market to 20 USD Billion by 2035 underscores the importance of DAS in supporting the connectivity needs of a growing number of smart devices. This trend suggests that businesses and service providers must invest in robust DAS solutions to meet consumer expectations.

Rising Need for Network Reliability

The increasing reliance on wireless communication for both personal and business applications underscores the need for network reliability within the Global Distributed Antenna Market Industry. Distributed antenna systems enhance the reliability of wireless networks by mitigating dead zones and improving signal quality. As organizations prioritize uninterrupted connectivity for critical operations, the adoption of DAS is likely to rise. This trend is particularly relevant in sectors such as healthcare, education, and public safety, where reliable communication is essential. The anticipated growth of the market to 20 USD Billion by 2035 reflects the increasing recognition of DAS as a vital component of modern communication infrastructure.

Growing Demand for Enhanced Connectivity

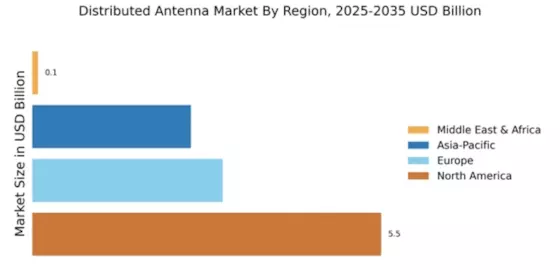

The Global Distributed Antenna Market Industry is experiencing a surge in demand for enhanced connectivity solutions. As urbanization continues to rise, the need for reliable wireless communication becomes paramount. Distributed antenna systems (DAS) provide a solution by improving signal strength and coverage in densely populated areas. This trend is particularly evident in metropolitan regions where high data traffic is prevalent. The market is projected to reach 9.72 USD Billion in 2024, indicating a robust growth trajectory. Enhanced connectivity not only supports mobile users but also facilitates the deployment of smart city initiatives, further driving the adoption of DAS.

Regulatory Support for Infrastructure Development

Government regulations and initiatives aimed at improving telecommunications infrastructure are driving the Global Distributed Antenna Market Industry. Many countries are implementing policies to facilitate the deployment of advanced communication technologies, including DAS. This regulatory support is crucial for ensuring that urban areas receive the necessary infrastructure to support growing connectivity demands. As governments recognize the importance of robust telecommunications networks for economic growth, investments in DAS are likely to increase. This trend may contribute to the market's projected growth, as stakeholders align their strategies with government objectives to enhance connectivity.