Increasing Geopolitical Tensions

The air defense systems Market is experiencing a surge in demand due to escalating geopolitical tensions across various regions. Nations are increasingly investing in advanced air defense capabilities to safeguard their airspace from potential threats. For instance, military budgets have seen a notable increase, with countries like India and Japan allocating substantial funds for modernizing their air defense systems. This trend indicates a growing recognition of the need for robust defense mechanisms, particularly in areas with heightened military activity. The market is projected to grow at a compound annual growth rate of approximately 5.5% over the next five years, reflecting the urgency for nations to enhance their aerial security. As threats evolve, the Air Defense Systems Market is likely to adapt, incorporating cutting-edge technologies to address emerging challenges.

Focus on Cybersecurity in Defense Systems

As cyber threats become more sophisticated, the Air defense Systems Market is increasingly focusing on integrating cybersecurity measures into defense systems. The potential for cyberattacks on air defense infrastructure necessitates robust security protocols to protect sensitive data and operational capabilities. Governments are recognizing the importance of safeguarding their air defense systems from cyber threats, leading to increased investments in cybersecurity solutions. Reports suggest that the cybersecurity market within the defense sector could reach USD 30 billion by 2026, reflecting the urgency of this issue. This focus on cybersecurity not only enhances the resilience of air defense systems but also ensures the integrity of operations within the Air Defense Systems Market.

Rising Threat of Unmanned Aerial Vehicles

The proliferation of unmanned aerial vehicles (UAVs) poses a significant challenge to national security, thereby driving growth in the Air Defense Systems Market. As UAV technology becomes more accessible, the potential for their use in hostile actions increases. Countries are compelled to enhance their air defense capabilities to counteract this emerging threat. Reports indicate that the UAV market is expected to reach USD 40 billion by 2025, which correlates with the rising demand for effective air defense solutions. Consequently, defense contractors are focusing on developing systems specifically designed to detect and neutralize UAVs. This trend highlights the necessity for continuous innovation within the Air Defense Systems Market to address evolving threats and ensure comprehensive airspace security.

Government Initiatives and Defense Spending

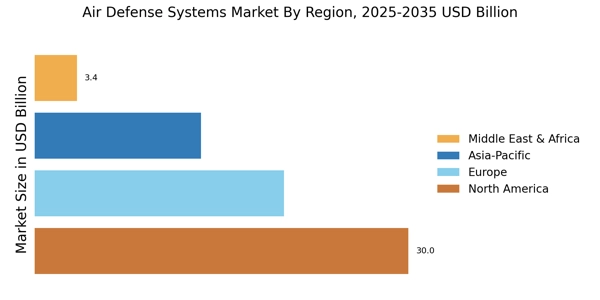

Government initiatives aimed at bolstering national defense are a key driver of the Air Defense Systems Market. Many nations are revising their defense strategies, leading to increased military spending. For instance, the United States has proposed a defense budget exceeding USD 700 billion, with a significant portion allocated to air defense systems. This trend is mirrored in Europe and Asia, where countries are prioritizing the enhancement of their air defense capabilities. Such initiatives not only stimulate market growth but also encourage collaboration between governments and defense contractors. The Air Defense Systems Market is likely to benefit from these partnerships, fostering innovation and the development of next-generation defense solutions.

Technological Advancements in Defense Systems

The Air Defense Systems Market is significantly influenced by rapid technological advancements. Innovations such as artificial intelligence, machine learning, and advanced radar systems are transforming the landscape of air defense. These technologies enhance detection capabilities, improve response times, and increase the overall effectiveness of defense systems. For example, the integration of AI in missile defense systems allows for real-time data analysis, enabling quicker decision-making processes. The market is expected to witness a substantial increase in the adoption of these advanced technologies, with projections indicating a market value exceeding USD 100 billion by 2030. This growth underscores the importance of staying at the forefront of technological developments to maintain a competitive edge in the Air Defense Systems Market.