Emerging Applications in Tactical Operations

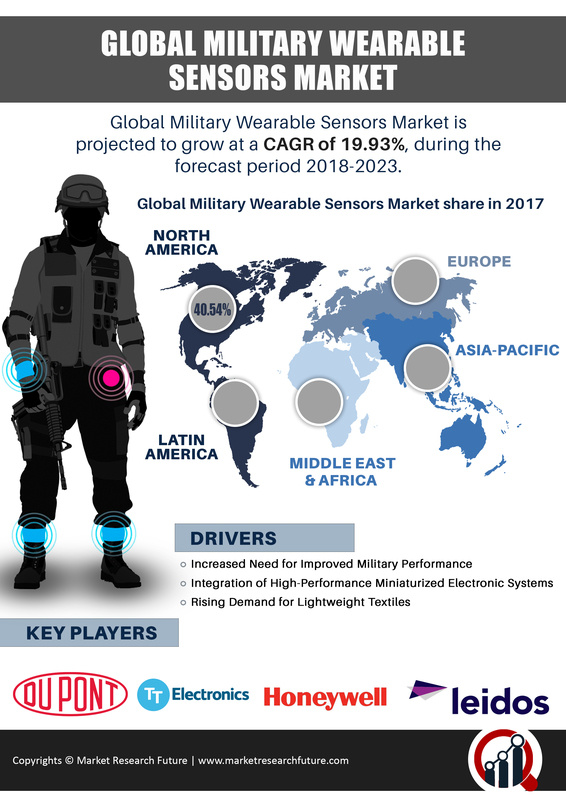

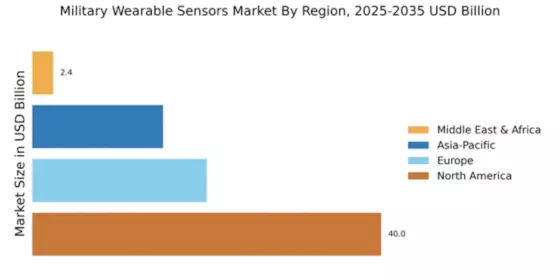

The Global Military Wearable Sensors Industry is witnessing emerging applications in tactical operations, which are driving demand for innovative wearable technologies. These sensors are being utilized for various purposes, including health monitoring, navigation, and communication. For instance, wearable devices that provide real-time location tracking and environmental data can enhance mission effectiveness and soldier safety. As military operations become increasingly complex, the need for integrated wearable solutions that support diverse operational requirements is likely to grow. This trend suggests a robust market trajectory, with a projected CAGR of 8.22% from 2025 to 2035.

Increased Focus on Soldier Health and Safety

The Global Military Wearable Sensors Industry is driven by an increasing emphasis on soldier health and safety. Military organizations worldwide are recognizing the importance of monitoring soldiers' physiological conditions during operations. Wearable sensors that track vital signs, fatigue levels, and environmental conditions can provide commanders with critical data to make informed decisions. This focus on health and safety is likely to enhance operational readiness and reduce casualties. The market's growth trajectory, with a projected CAGR of 8.22% from 2025 to 2035, underscores the military's commitment to investing in technologies that prioritize the well-being of personnel.

Government Investments in Defense Technologies

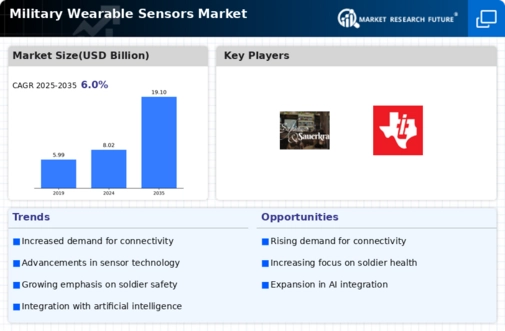

The Global Military Wearable Sensors Industry is bolstered by substantial government investments in defense technologies. Many nations are allocating significant budgets to modernize their military capabilities, with a focus on integrating advanced technologies such as wearable sensors. For example, the U.S. Department of Defense has been actively funding research and development initiatives aimed at enhancing soldier performance through wearable technology. This trend is likely to drive market growth, as governments prioritize the adoption of innovative solutions to maintain a competitive edge in defense capabilities. The anticipated growth from 8.02 USD Billion in 2024 to 19.1 USD Billion by 2035 reflects this commitment.

Technological Advancements in Sensor Technology

The Global Military Wearable Sensors Industry is experiencing rapid technological advancements, particularly in sensor miniaturization and integration. Innovations in materials science and electronics have led to the development of lightweight, durable sensors that can monitor various physiological parameters. For instance, the integration of biometric sensors into wearable devices allows for real-time health monitoring of soldiers in the field. This capability is crucial for enhancing operational effectiveness and ensuring soldier safety. As a result, the market is projected to grow from 8.02 USD Billion in 2024 to 19.1 USD Billion by 2035, reflecting a growing reliance on advanced sensor technologies.

Rising Demand for Enhanced Situational Awareness

The Global Military Wearable Sensors Industry is significantly influenced by the rising demand for enhanced situational awareness among military personnel. Wearable sensors equipped with advanced data analytics capabilities can provide real-time information about the surrounding environment, enabling soldiers to make informed tactical decisions. This capability is particularly vital in complex operational scenarios where timely information can be the difference between success and failure. As military forces seek to improve their operational effectiveness, the integration of wearable sensors into their equipment is becoming increasingly essential, contributing to the market's projected growth.