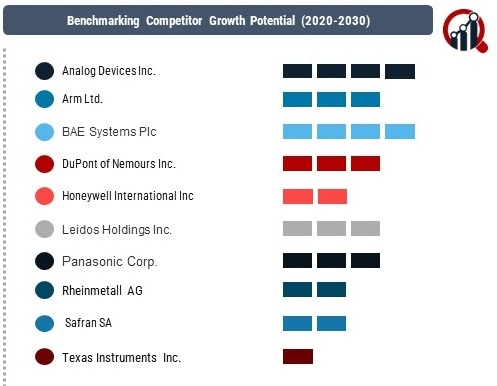

Top Industry Leaders in the Military Wearable Sensors Market

Key Players:

Analog Devices Inc.

Arm Ltd.

BAE Systems Plc

DuPont of Nemours Inc.

Honeywell International Inc.

Leidos Holdings Inc.

Panasonic Corp.

Rheinmetall AG

Safran SA

Texas Instruments Inc.

Strategies Adopted:

The key players in the military wearable sensors market adopt various strategies to gain a competitive edge:

Research and Development (R&D): Companies invest significantly in R&D to develop advanced and innovative wearable sensor technologies. This allows them to stay ahead in terms of product offerings and cater to the evolving needs of defense forces.

Strategic Partnerships and Collaborations: Collaboration with other defense contractors, technology companies, or research institutions enables players to leverage complementary strengths and create synergies in developing and delivering military wearable sensor solutions.

Customization and Flexibility: Offering customizable solutions that can be adapted to the specific requirements of different military units enhances a company's competitiveness. Flexibility in product offerings ensures that the solutions meet the diverse needs of various defense applications.

Global Expansion: Companies often focus on expanding their global footprint to tap into emerging markets and secure contracts with different defense forces worldwide. This global presence not only broadens the customer base but also provides access to diverse opportunities.

Factors for Market Share Analysis:

Several factors contribute to the analysis of market share in the military wearable sensors sector:

Technological Innovation: The ability to innovate and introduce state-of-the-art technologies is a significant determinant of market share. Companies that consistently invest in R&D and offer cutting-edge solutions are likely to capture a larger market share.

Product Portfolio: The diversity and quality of a company's product portfolio play a crucial role in market share analysis. A comprehensive range of military wearable sensor solutions catering to various applications enhances a company's competitive position.

Customer Relationships: Establishing and maintaining strong relationships with defense forces and government agencies is vital for market share. Companies with a proven track record of delivering reliable solutions and excellent customer support are likely to retain and expand their market share.

Regulatory Compliance: Adherence to stringent regulatory standards and certifications is essential in the defense sector. Companies that consistently meet or exceed these standards gain the trust of customers and regulatory authorities, positively impacting market share.

New and Emerging Companies:

In addition to established players, new and emerging companies are entering the military wearable sensors market, contributing to its dynamism. These companies often bring fresh perspectives and innovative approaches. Some noteworthy newcomers include:

AeroVironment, Inc.: Specializing in unmanned aircraft systems, AeroVironment has ventured into military wearable sensors, offering unique solutions for soldiers in the field.

Revision Military: Known for its protective eyewear, Revision Military has expanded its product line to include advanced headgear with integrated sensor technologies for military applications.

QinetiQ Group plc: QinetiQ has made strides in developing wearable sensor technologies for defense applications, showcasing its commitment to innovation in the military sector.

Industry News and Trends:

Recent developments and ongoing trends in the military wearable sensors market provide insights into the competitive landscape:

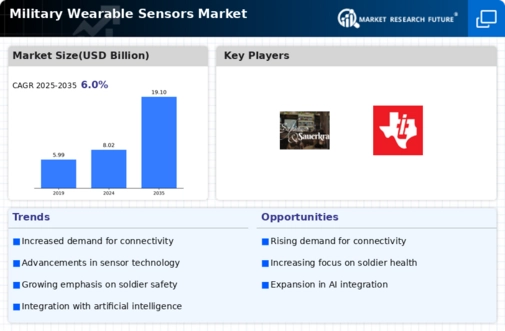

Integration of Artificial Intelligence (AI): The incorporation of AI in wearable sensor technologies is a growing trend. AI enhances data processing capabilities, providing real-time insights for military personnel and improving overall operational efficiency.

Focus on Health Monitoring: Beyond traditional military applications, there is an increasing focus on incorporating health monitoring features in wearable sensors. This includes tracking vital signs, fatigue levels, and overall well-being of soldiers in the field.

Cybersecurity Concerns: As wearable sensor technologies become more interconnected, there is a growing emphasis on cybersecurity. Companies are investing in robust cybersecurity measures to protect sensitive military data transmitted by wearable devices.

Current Company Investment Trends:

Companies in the military wearable sensors market are allocating significant investments to key areas:

R&D and Innovation: A substantial portion of investments is directed towards research and development to create advanced and competitive wearable sensor technologies.

Cybersecurity Infrastructure: Given the rising concerns about cybersecurity, companies are investing in developing and enhancing robust cybersecurity infrastructure to safeguard military wearable sensor systems.

Global Expansion Initiatives: Investments are being made to expand global operations, establishing a strong presence in key markets and forming strategic partnerships with local entities.

Overall Competitive Scenario:

The military wearable sensors market is characterized by intense competition, with established players, new entrants, and emerging companies vying for dominance. The competitive scenario is shaped by a combination of factors, including technological innovation, strategic partnerships, product portfolio strength, and regulatory compliance. As the market continues to evolve, the integration of AI, a focus on health monitoring, and heightened cybersecurity measures are driving current trends. Companies that effectively navigate these dynamics through strategic investments and a commitment to innovation are poised to succeed in this dynamic and critical sector, ensuring the continued advancement of military wearable sensor technologies for the modern battlefield.

Company News :

BAE Systems plc: Known for its expertise in defense and aerospace solutions, BAE Systems is a major player in the military wearable sensors sector. The company's diverse range of products, including wearable technologies, positions it as a key competitor in this market.

Raytheon Technologies Corporation: As a leading aerospace and defense company, Raytheon Technologies plays a pivotal role in shaping the military wearable sensors landscape. The company's commitment to research and development has led to the creation of cutting-edge sensor technologies for military applications.

Thales Group: Thales Group has been actively involved in providing defense solutions, including military wearable sensors. With a global presence and a focus on innovation, Thales remains a significant player in this competitive market.

General Dynamics Corporation: General Dynamics has a strong presence in the military industry, offering a range of products, including wearable sensor technologies. The company's strategic approach and commitment to technological advancements contribute to its competitiveness in the market.