Rising Food Demand

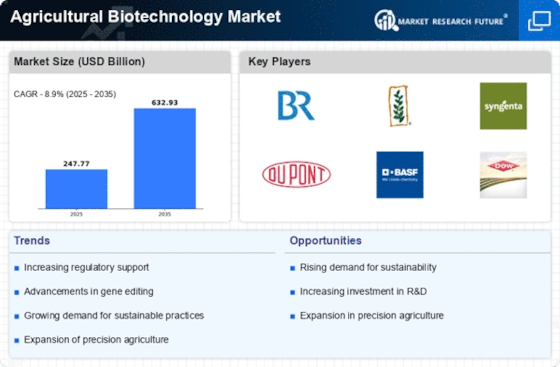

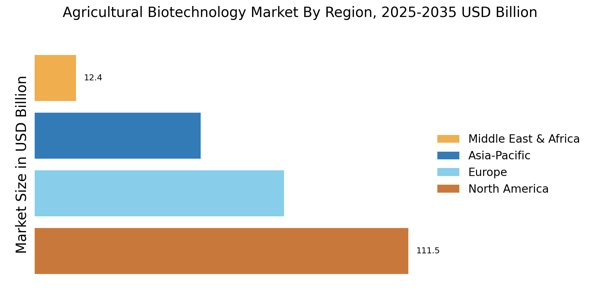

The Agricultural Biotechnology Market is experiencing a surge in demand due to the increasing global population, which is projected to reach approximately 9.7 billion by 2050. This demographic shift necessitates a significant increase in food production, estimated to be around 70%. Agricultural biotechnology offers innovative solutions such as genetically modified organisms (GMOs) that can enhance crop yields, improve resistance to pests and diseases, and reduce reliance on chemical inputs. As a result, the industry is likely to witness substantial growth as stakeholders seek to address food security challenges while ensuring sustainable agricultural practices.

Climate Change Resilience

Climate change poses a formidable challenge to agriculture, affecting crop yields and food security. The Agricultural Biotechnology Market is poised to play a crucial role in developing crops that can withstand extreme weather conditions, such as droughts and floods. Biotechnological advancements enable the creation of resilient crop varieties that can adapt to changing climates, thereby ensuring stable food supplies. According to recent studies, crops developed through biotechnology can potentially increase yields by 20 to 30% under adverse conditions. This resilience is becoming increasingly vital as climate-related disruptions are expected to intensify in the coming years.

Technological Advancements

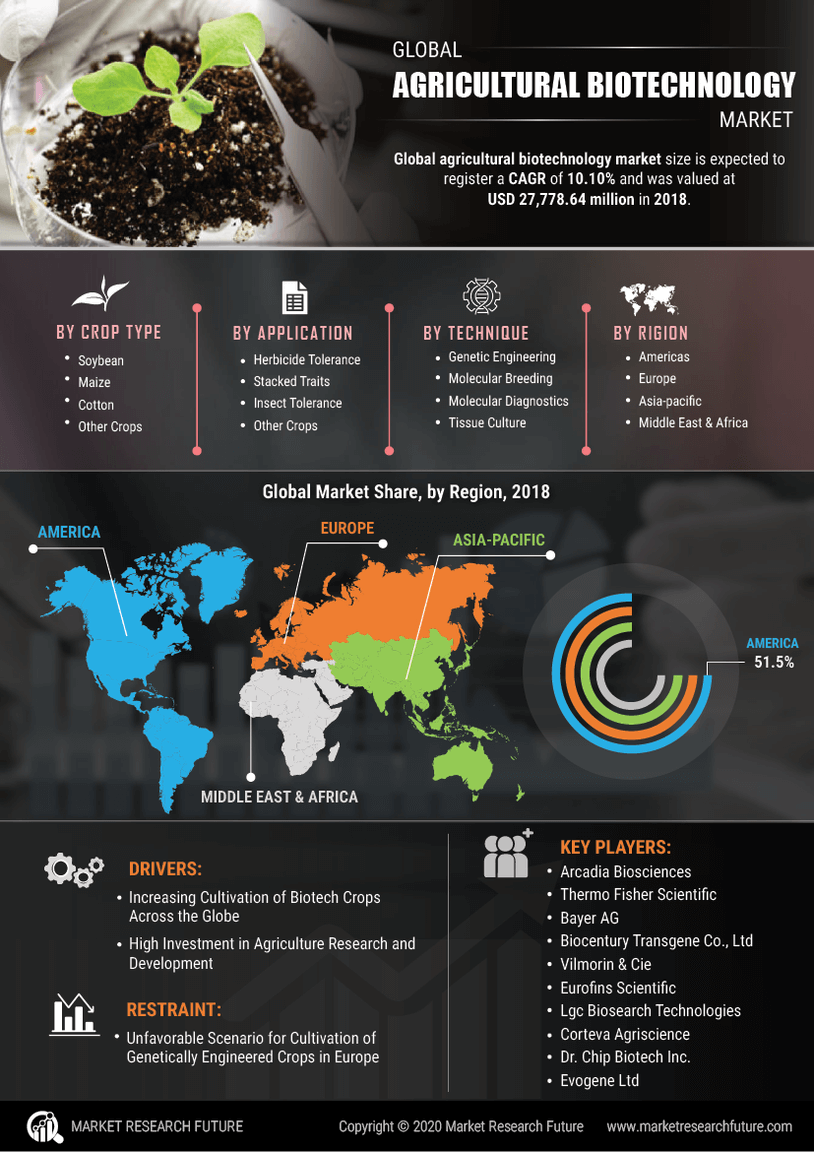

The Agricultural Biotechnology Market is significantly influenced by rapid technological advancements in genetic engineering, molecular biology, and bioinformatics. These innovations facilitate the development of more precise and efficient biotechnological applications, such as CRISPR gene editing, which allows for targeted modifications in crops. The market is projected to grow as these technologies become more accessible and cost-effective for farmers. Furthermore, the integration of biotechnology with data analytics and artificial intelligence is likely to enhance decision-making processes in agriculture, leading to improved productivity and sustainability.

Government Support and Funding

Government policies and funding initiatives are pivotal in shaping the Agricultural Biotechnology Market. Many governments are recognizing the potential of biotechnology to address food security and environmental challenges. As a result, they are implementing supportive regulatory frameworks and providing financial incentives for research and development in agricultural biotechnology. For instance, funding for biotech research has seen a notable increase, with several countries allocating substantial budgets to support innovation in this sector. This governmental backing is expected to foster growth and encourage collaboration between public and private entities, further propelling the industry forward.

Consumer Awareness and Acceptance

There is a growing awareness among consumers regarding the benefits of biotechnology in agriculture, which is positively impacting the Agricultural Biotechnology Market. As consumers become more informed about food production methods, there is an increasing acceptance of genetically modified foods that offer enhanced nutritional profiles and longer shelf lives. Market Research Future indicates that a significant portion of consumers is willing to pay a premium for products derived from biotechnological processes. This shift in consumer preferences is likely to drive demand for biotech crops and products, encouraging further investment in the industry.