Rising Demand for Sustainable Agriculture

The Global Agricultural Biologicals Testing Market Industry is experiencing a notable surge in demand for sustainable agricultural practices. As consumers increasingly prioritize eco-friendly products, farmers are seeking alternatives to synthetic chemicals. This shift is reflected in the projected market size, which is expected to reach 7.2 USD Billion in 2024. The adoption of biological testing methods enables farmers to enhance crop yields while minimizing environmental impact. Countries like the United States and Brazil are leading this trend, implementing policies that encourage the use of biologicals, thereby fostering a more sustainable agricultural landscape.

Regulatory Support for Biological Products

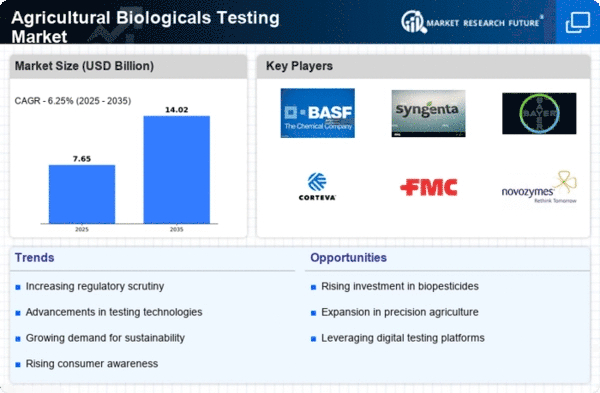

Regulatory frameworks are evolving to support the development and commercialization of biological products in the Global Agricultural Biologicals Testing Market Industry. Governments are recognizing the potential of biologicals to address agricultural challenges, leading to streamlined approval processes. For instance, the European Union has implemented regulations that facilitate the registration of biopesticides, promoting their use among farmers. This regulatory support is crucial as it not only enhances market accessibility but also encourages investment in research and development, ultimately contributing to the market's anticipated growth to 14.0 USD Billion by 2035.

Technological Advancements in Testing Methods

Technological innovations are significantly influencing the Global Agricultural Biologicals Testing Market Industry. Advanced testing methods, such as molecular diagnostics and bioinformatics, are enhancing the accuracy and efficiency of biological assessments. These technologies facilitate the rapid identification of pathogens and beneficial microorganisms, allowing for timely interventions. As a result, the market is poised for growth, with a projected compound annual growth rate of 6.25% from 2025 to 2035. This growth is particularly evident in regions like Europe, where regulatory frameworks are increasingly supportive of innovative testing solutions.

Increasing Awareness of Crop Health Management

There is a growing awareness among farmers regarding the importance of crop health management, which is driving the Global Agricultural Biologicals Testing Market Industry. Farmers are increasingly recognizing that healthy crops lead to better yields and profitability. This awareness is fostering the adoption of biological testing methods that assess soil health, pest resistance, and overall crop vitality. As a result, the market is expected to expand significantly, with a focus on integrated pest management strategies that utilize biologicals. This trend is particularly pronounced in Asia-Pacific, where agricultural practices are rapidly evolving.

Emerging Markets and Global Expansion Opportunities

Emerging markets present substantial growth opportunities for the Global Agricultural Biologicals Testing Market Industry. Countries in Asia, Africa, and Latin America are witnessing a rise in agricultural investments, driven by the need to enhance food security and productivity. These regions are increasingly adopting biological testing methods to improve crop resilience and sustainability. The market's expansion in these areas is supported by international collaborations and investments in agricultural research. As these markets develop, they are likely to contribute significantly to the overall growth trajectory of the industry.