Regulatory Compliance

Regulatory compliance plays a crucial role in the aerospace interior Market, as manufacturers must adhere to stringent safety and quality standards. Compliance with regulations set by aviation authorities ensures that materials and designs meet safety requirements, which is paramount in the aerospace sector. The increasing complexity of regulations may drive innovation, as companies seek to develop compliant yet aesthetically pleasing interiors. Additionally, the need for compliance can influence material selection and design processes, potentially impacting costs. As the industry evolves, staying abreast of regulatory changes will be essential for manufacturers aiming to maintain market relevance.

Sustainability Initiatives

The Aerospace Interior Market is increasingly influenced by sustainability initiatives. Manufacturers are adopting eco-friendly materials and processes to reduce environmental impact. This shift is driven by regulatory pressures and consumer demand for greener solutions. For instance, the use of lightweight composite materials not only enhances fuel efficiency but also minimizes waste during production. The market for sustainable aerospace interiors is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. Companies that prioritize sustainability are likely to gain a competitive edge, as airlines and manufacturers seek to align with environmental goals.

Technological Advancements

Technological advancements are reshaping the Aerospace Interior Market, with innovations in materials and design processes. The integration of smart technologies, such as in-flight entertainment systems and connectivity solutions, is enhancing passenger comfort and engagement. Moreover, advancements in manufacturing techniques, such as 3D printing, are streamlining production and reducing lead times. The market is witnessing a shift towards more efficient and flexible manufacturing processes, which could potentially lower costs and improve product offerings. As technology continues to evolve, the Aerospace Interior Market is expected to adapt, leading to more sophisticated and user-friendly cabin environments.

Customization and Personalization

Customization and personalization are becoming pivotal in the Aerospace Interior Market. Airlines are increasingly focusing on passenger experience, leading to a demand for tailored interiors that reflect brand identity and meet specific customer preferences. This trend is evident in the rise of bespoke seating arrangements and cabin layouts. Market data indicates that the segment for customized interiors is expected to expand, with a projected growth rate of around 6% annually. As airlines strive to differentiate themselves in a competitive landscape, the ability to offer unique and personalized experiences is likely to drive investment in innovative interior designs.

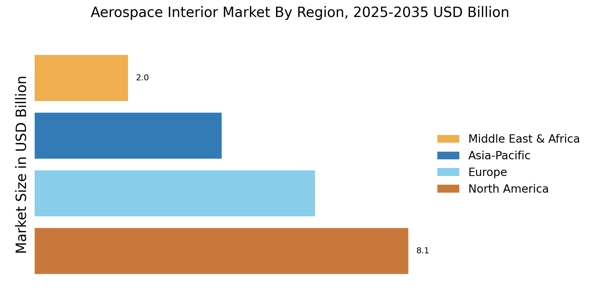

Market Expansion in Emerging Economies

The Aerospace Interior Market is experiencing notable expansion in emerging economies, driven by increasing air travel demand and investments in aviation infrastructure. Countries in Asia and the Middle East are witnessing a surge in new airline entrants and fleet modernization efforts, which in turn fuels the need for advanced aerospace interiors. Market analysis suggests that the demand for new aircraft interiors in these regions could grow at a rate of approximately 7% annually. This trend presents opportunities for manufacturers to tap into new markets and cater to the unique preferences of diverse customer bases, thereby enhancing their global footprint.