Research Methodology on Business Aircraft Market

1. Introduction

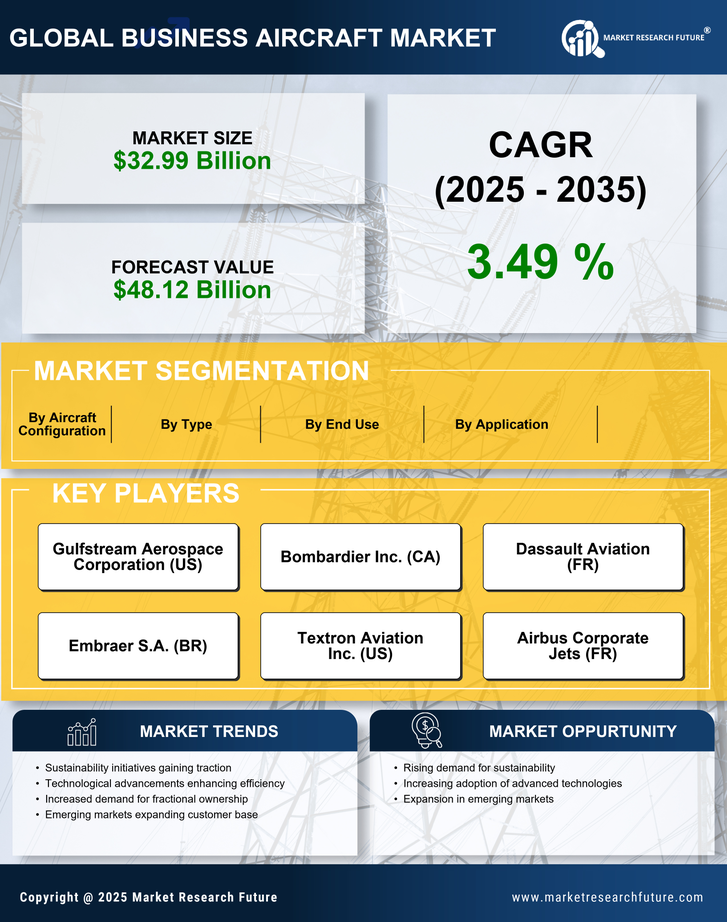

The purpose of this research is to analyze the current market for business aircraft, assessing both the demand and supply sides of the market and providing insights into future market growth and potential opportunities. The research process will utilise both primary and secondary research, analyzing qualitative data from experts in the business aircraft industry, as well as collecting quantitative data from public and private sources such as manufacturing companies, regulatory authorities, and airline associations. The research will analyse both current and historical data to understand the current market state and extrapolate potential opportunities for growth in the future.

2. Research Objectives

The overall research objective of the report is to provide a comprehensive overview and analysis of the Business Aircraft market, analyzing both the demand and supply sides of the market and analysing the current market state and potential rate of growth in the next seven years. The specific objectives are outlined as follows:

- To analyze the current market conditions, growth rate, and future potential of the Business Aircraft market

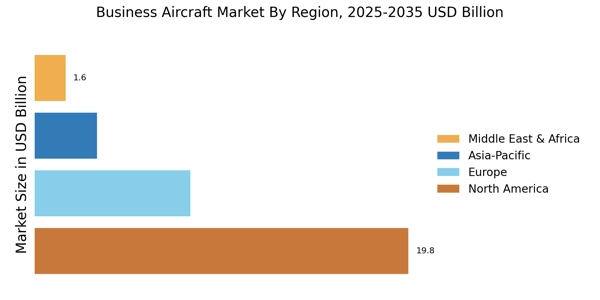

- To develop an understanding of the regional market share in the global Business Aircraft market

- To assess key vendors in the Global Business Aircraft market

- To analyse the drivers and restraints of the Business Aircraft market

- To provide insights into the competitive landscape of the sector

3. Methodology

The research methodology used in this report employs both primary and secondary sources. Primary sources such as industry experts and key market vendors were interviewed to gather qualitative insights into the sector, while a structured questionnaire was sent out with a set of questions to assess the current market state and potential rate of growth. Secondary research utilised sources such as industry publications, government databases, reports from various associations, and press releases. Additionally, financials, company news, and announcements were used to get the most up-to-date insights into the sector.

3.1 Research approach

This research project has adopted a mixed approach of qualitative and quantitative methods of research to ensure that the most accurate insights are collected and discussed. The approach includes a range of different methods such as desk research, primary research, bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand side and supply side data triangulation.

3.2 Desk Research

The desk research component of this research project has utilised a range of sources in order to get the most up-to-date insights into the current state of the business aircraft market. Secondary sources such as industry publications, reports from regulatory authorities, and airline associations have been used to gain quantitative insights into the sector. Additionally, financials, company news, and announcements were also used to get an overview of the market.

3.3 Primary Research

As part of the research process, primary research is conducted by interviewing key market vendors and industry experts to gain qualitative insights into the business aircraft market. The primary research is further supplemented by structured questionnaires which were sent out to industry experts to gain quantitative insights into the sector. These questionnaires were used to assess the current market sizes, growth rates, and potential rate of growth in the next seven years.

3.4 Bottom-up Approach

To obtain a comprehensive overview of the market and to assess potential growth opportunities, a bottom-up approach is used. This approach involved gathering data from the companies in the sector to assess the current market state, potential growth opportunities, and possible sources of revenue. This data was then analysed and extrapolated to form a holistic picture of the sector.

3.5 Factor Analysis

Additionally, a factor analysis approach was used to analyse the macro and micro-level factors that are influencing the business aircraft market. This approach was used to identify the key drivers and restraints of the sector, as well as to analyse the competitive landscape of the market.

3.6 Time-Series Analysis

Time-series analysis has also been performed to analyse the performance of the sector over a period of time and to build a scenario for future market growth. This was done by using historical data from the sector, extrapolating trends over a period of time, and analysing the performance of the sector over a period of time.

3.7 Demand Side and Supply Side Data Triangulation

Finally, to gain a deeper understanding of the sector, demand-side and supply-side data triangulation was used. This process involves gathering data from both the demand side and the supply side of the sector to identify any potential growth opportunities. This data was then analysed and extrapolated to form a comprehensive picture of the sector.

4. Conclusion

This research report has utilized a range of methods to understand the current state of the business aircraft market and to assess potential growth opportunities in the sector. Both primary and secondary sources have been used to get the most accurate insights into the sector, and a range of analytical tools such as bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand side and supply side data triangulation were used to form an accurate picture of the current market state and potential rate of growth during 2023 to 2030.