Sustainability Initiatives

The Automotive Interior Material Market is increasingly influenced by sustainability initiatives. Manufacturers are prioritizing eco-friendly materials, such as recycled plastics and bio-based composites, to meet consumer demand for greener vehicles. This shift is not merely a trend; it reflects a broader commitment to reducing the automotive industry's carbon footprint. In fact, the market for sustainable automotive materials is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. As regulations tighten and consumers become more environmentally conscious, the emphasis on sustainable materials in the Automotive Interior Material Market is likely to intensify, driving innovation and investment in this sector.

Technological Advancements

Technological advancements play a pivotal role in shaping the Automotive Interior Material Market. The integration of smart technologies, such as advanced infotainment systems and connectivity features, necessitates the use of innovative materials that can accommodate these functionalities. For instance, lightweight composites and flexible displays are becoming increasingly prevalent, enhancing both aesthetics and performance. The market is witnessing a surge in demand for materials that not only provide comfort but also support the integration of technology. As automakers strive to create more connected and user-friendly interiors, the Automotive Interior Material Market is expected to evolve rapidly, with a focus on materials that enhance the overall driving experience.

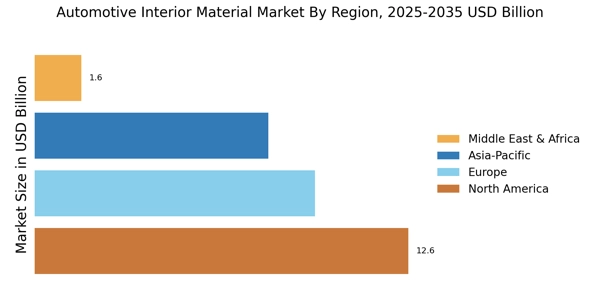

Economic Growth and Vehicle Sales

Economic growth and vehicle sales are closely linked to the dynamics of the Automotive Interior Material Market. As economies recover and consumer confidence rises, there is a corresponding increase in vehicle sales, which directly impacts the demand for interior materials. Market analysis indicates that regions experiencing economic expansion are witnessing a surge in automotive production, leading to heightened demand for high-quality interior materials. This trend is particularly evident in emerging markets, where rising disposable incomes are driving consumers to seek vehicles with enhanced interior features. Consequently, the Automotive Interior Material Market is poised for growth, as manufacturers respond to the increasing demand for premium materials that enhance the overall driving experience.

Consumer Preferences for Customization

Consumer preferences for customization are significantly impacting the Automotive Interior Material Market. Today's consumers seek personalized experiences, which extends to the interior design of their vehicles. This trend has led manufacturers to offer a wider array of materials, colors, and finishes, allowing buyers to tailor their vehicles to their tastes. The demand for unique and customizable interiors is driving innovation in material development, as companies strive to meet these expectations. Market data indicates that the customization segment is growing, with a notable increase in sales of premium materials that enhance the aesthetic appeal of vehicle interiors. As this trend continues, the Automotive Interior Material Market is likely to see a shift towards more diverse and customizable material options.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Automotive Interior Material Market. Governments worldwide are implementing stringent regulations regarding vehicle safety and emissions, compelling manufacturers to adopt materials that meet these requirements. For instance, materials used in interiors must not only be durable but also non-toxic and flame-retardant. This has led to increased investment in research and development to create materials that comply with safety standards while also being aesthetically pleasing. The market is responding to these regulatory pressures by innovating and sourcing materials that fulfill both safety and environmental criteria. As regulations evolve, the Automotive Interior Material Market will likely continue to adapt, ensuring that safety remains a top priority.