Increased Defense Budgets

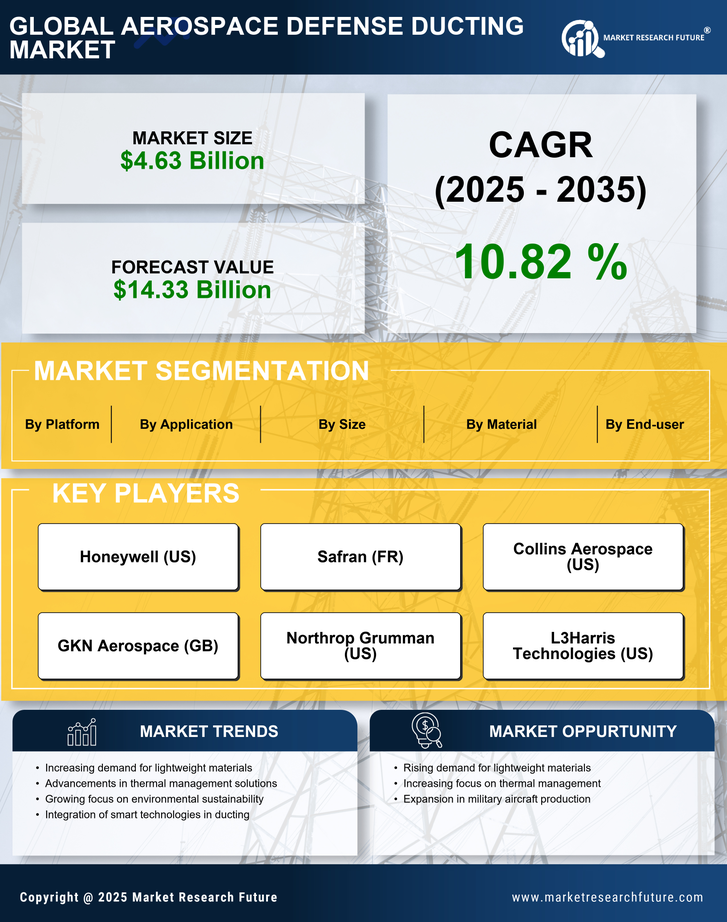

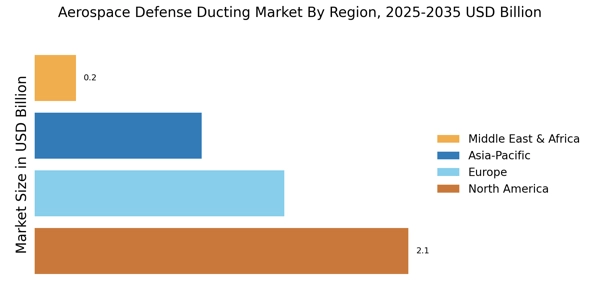

The aerospace defense ducting Market is experiencing a notable surge due to increased defense budgets across various nations. Governments are prioritizing military modernization, which includes upgrading aircraft and defense systems. This trend is particularly evident in regions where geopolitical tensions are rising. For instance, defense spending in North America and Europe has seen a consistent upward trajectory, with projections indicating a compound annual growth rate of approximately 3-5% over the next few years. This financial commitment translates into higher demand for advanced ducting solutions that ensure optimal performance and reliability in aerospace applications. As nations invest in next-generation aircraft, the Aerospace Defense Ducting Market is poised to benefit significantly from these budgetary allocations.

Growing Demand for Lightweight Materials

The Aerospace defense Ducting Market is increasingly influenced by the growing demand for lightweight materials. As aerospace manufacturers strive to enhance fuel efficiency and reduce emissions, the adoption of lightweight ducting solutions becomes paramount. Materials such as carbon fiber and advanced composites are gaining traction, as they offer superior strength-to-weight ratios. This shift is not merely a trend; it is a necessity driven by stringent environmental regulations and the need for cost-effective operations. The market for lightweight aerospace components is projected to expand, with estimates suggesting a growth rate of around 4-6% annually. Consequently, the Aerospace Defense Ducting Market is likely to see a corresponding increase in the adoption of innovative ducting materials that align with these industry demands.

Emerging Markets and Defense Collaborations

The Aerospace Defense Ducting Market is witnessing growth due to emerging markets and international defense collaborations. Countries in Asia-Pacific and the Middle East are ramping up their defense capabilities, leading to increased investments in aerospace technologies. Collaborative defense initiatives, such as joint military exercises and technology sharing agreements, are fostering innovation and expanding market opportunities. For instance, partnerships between established defense contractors and local manufacturers are becoming more common, facilitating the transfer of advanced ducting technologies. This trend is expected to drive market expansion, with forecasts suggesting a growth rate of 4-5% in these regions. As a result, the Aerospace Defense Ducting Market is likely to see a diversification of its customer base and an increase in demand for tailored ducting solutions.

Technological Innovations in Ducting Solutions

Technological innovations are reshaping the Aerospace Defense Ducting Market, as manufacturers seek to enhance the performance and durability of ducting systems. Advancements in manufacturing processes, such as 3D printing and automated production techniques, are enabling the creation of more complex and efficient ducting designs. These innovations not only improve the functionality of ducting systems but also reduce production costs and lead times. Furthermore, the integration of smart technologies, such as sensors and monitoring systems, is becoming more prevalent, allowing for real-time performance tracking. This trend is expected to drive market growth, with estimates indicating a potential increase in market size by 5-7% over the next few years. As a result, the Aerospace Defense Ducting Market is likely to witness a wave of new products that leverage these technological advancements.

Rising Focus on Maintenance and Repair Operations

The Aerospace Defense Ducting Market is significantly impacted by the rising focus on maintenance and repair operations (MRO). As aircraft fleets age, the need for regular maintenance and upgrades becomes critical to ensure operational efficiency and safety. This trend is particularly pronounced in military aviation, where the reliability of ducting systems is paramount. The MRO market is projected to grow at a rate of approximately 3-4% annually, driven by the increasing complexity of aircraft systems and the need for specialized components. Consequently, the Aerospace Defense Ducting Market stands to benefit from this focus on MRO, as operators seek high-quality ducting solutions that can withstand rigorous operational demands and extend the lifespan of their aircraft.