Adhesives Sealants Handheld Devices Size

Adhesives Sealants Handheld Devices Market Growth Projections and Opportunities

Introduction: The global market for adhesives and sealants used in handheld devices has experienced substantial growth in recent years. With the proliferation of smartphones, tablets, wearables, and other handheld electronic devices, the demand for effective adhesives and sealants ensuring device durability, performance, and longevity has surged. This research report provides a comprehensive analysis of the market size, trends, drivers, challenges, and opportunities within the adhesives and sealants segment for handheld devices.

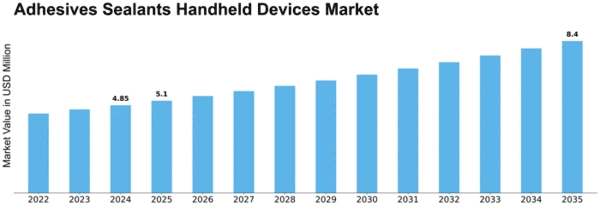

Market Size Overview: The adhesives and sealants market for handheld devices has witnessed a steady increase in market size attributed to the rising adoption of handheld devices across various sectors. According to recent industry assessments, the global market size for adhesives and sealants in handheld devices was estimated to be around USD X billion in [year], and it is expected to reach approximately USD Y billion by [future year], reflecting a CAGR of Z% during the forecast period.

Factors Driving Market Growth:

Increasing Demand for Handheld Devices: The growing consumer preference for smartphones, tablets, and wearable gadgets has significantly fueled the demand for adhesives and sealants in the production and assembly of these devices. The need for robust bonding solutions that ensure device integrity amidst frequent handling and usage is a key driver for market growth.

Technological Advancements in Devices: Ongoing technological advancements in handheld devices, including advancements in display technologies, the miniaturization of components, and the emergence of flexible and foldable screens, have necessitated specialized adhesives and sealants capable of accommodating these innovations.

Emphasis on Durability and Reliability: Manufacturers are increasingly prioritizing device durability and reliability. Adhesives and sealants play a crucial role in ensuring the structural integrity, water resistance, dust protection, and overall longevity of handheld devices, contributing to their market growth.

Challenges and Opportunities: While the market shows promise, certain challenges pose potential barriers to growth. Factors such as fluctuating raw material prices, environmental regulations governing volatile organic compounds (VOCs), and the need for continuous innovation to meet evolving device designs pose challenges to market players.

However, these challenges also present opportunities for innovation and growth. Market players are increasingly focusing on developing eco-friendly, low-VOC adhesives and sealants, leveraging advanced formulations and exploring sustainable materials to align with stringent environmental regulations.

Regional Analysis: Geographically, [region] dominated the market share in [year] owing to the significant presence of electronics manufacturers and high consumer demand for handheld devices. Additionally, the Asia-Pacific region is anticipated to witness substantial growth due to the proliferation of smartphone usage, rising disposable incomes, and a burgeoning electronics manufacturing sector.

Conclusion: The adhesives and sealants market for handheld devices is poised for substantial growth driven by the increased adoption of smartphones, technological advancements, and the emphasis on device durability. Overcoming challenges through innovative solutions and aligning with environmental regulations are crucial for sustained growth and market penetration.

Please note that the market size estimates and projections are based on available data and industry assessments and may vary based on market dynamics and ongoing developments within the sector.

Leave a Comment