Automotive Industry Innovations

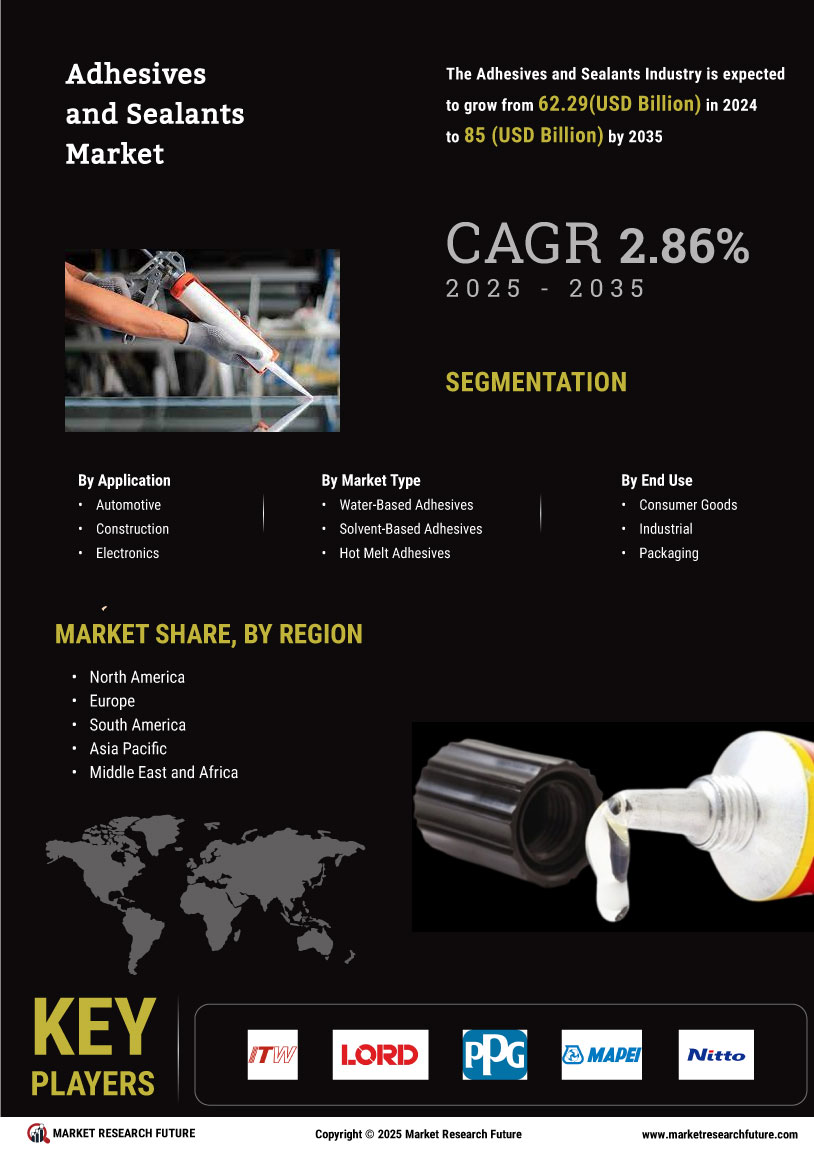

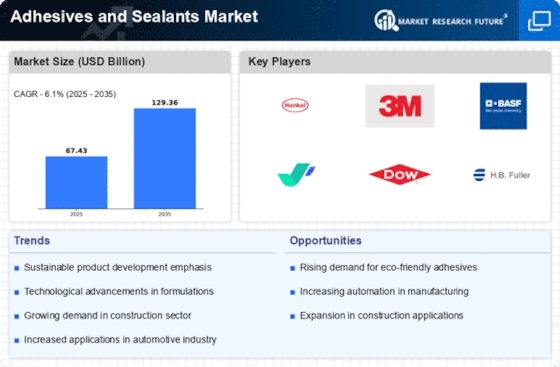

The automotive sector significantly influences the Adhesives and Sealants Market, as manufacturers increasingly adopt advanced bonding solutions. The shift towards lightweight materials, such as composites and plastics, necessitates the use of high-performance adhesives that ensure structural integrity while reducing vehicle weight. In 2023, the automotive industry represented around 25% of the adhesive market, reflecting a growing reliance on these materials for assembly and repair processes. Innovations in adhesive formulations, such as those that withstand extreme temperatures and environmental conditions, are likely to enhance vehicle performance and safety. As the automotive industry continues to evolve, the demand for specialized adhesives and sealants is expected to rise, further propelling the market.

Growth in Electronics Manufacturing

The Adhesives and Sealants Market is poised for growth due to the expanding electronics manufacturing sector. With the proliferation of smart devices and consumer electronics, the need for reliable bonding solutions is critical. Adhesives play a vital role in the assembly of electronic components, providing insulation and protection against environmental factors. In 2023, the electronics sector accounted for approximately 15% of the total adhesive consumption, underscoring its importance. As manufacturers seek to enhance product performance and durability, the demand for innovative adhesive technologies, such as conductive and thermally conductive adhesives, is likely to increase. This trend suggests a promising outlook for the Adhesives and Sealants Market in the electronics domain.

Rising Demand in Construction Sector

The Adhesives and Sealants Market experiences a notable surge in demand driven by the construction sector. As urbanization accelerates, the need for efficient bonding solutions in residential and commercial buildings becomes paramount. In 2023, the construction industry accounted for approximately 40% of the total adhesive consumption, indicating a robust growth trajectory. This trend is likely to continue as infrastructure projects expand, necessitating advanced adhesive technologies that offer durability and performance. Furthermore, the increasing focus on energy-efficient buildings may propel the adoption of specialized sealants that enhance insulation and reduce energy costs. Consequently, the construction sector's growth is a pivotal driver for the Adhesives and Sealants Market.

Environmental Regulations and Compliance

The Adhesives and Sealants Market is increasingly shaped by stringent environmental regulations aimed at reducing volatile organic compounds (VOCs) and promoting sustainable practices. Regulatory bodies are implementing guidelines that encourage the use of low-emission adhesives and sealants, driving manufacturers to innovate and reformulate their products. In 2023, the market for eco-friendly adhesives grew by approximately 20%, reflecting a shift towards sustainability. This trend not only aligns with regulatory compliance but also meets consumer demand for greener products. As companies strive to enhance their environmental footprint, the Adhesives and Sealants Market is likely to witness a significant transformation, with a growing emphasis on sustainable materials and practices.

Emerging Markets and Economic Development

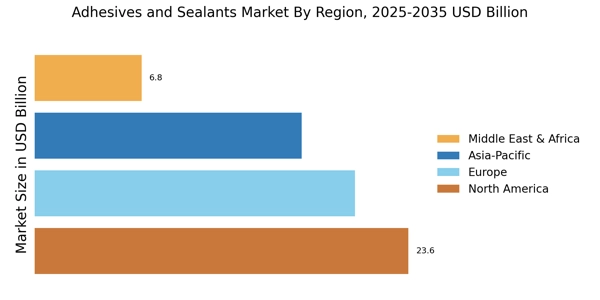

The Adhesives and Sealants Market is experiencing growth in emerging markets, where economic development is driving increased industrial activity. Countries with expanding manufacturing sectors, such as those in Asia and Latin America, are witnessing a rise in demand for adhesives and sealants across various applications. In 2023, these regions contributed to approximately 30% of the global adhesive consumption, indicating a robust market potential. As industries such as packaging, automotive, and construction flourish, the need for effective bonding solutions becomes more pronounced. This trend suggests that the Adhesives and Sealants Market will continue to thrive as emerging economies invest in infrastructure and manufacturing capabilities.