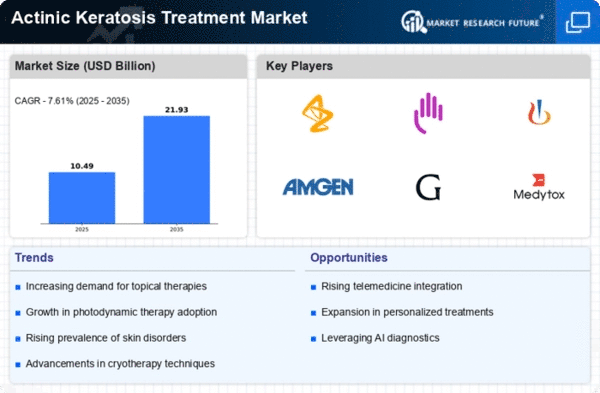

Market Growth Projections

The Global Actinic Keratosis Treatment Market Industry is poised for substantial growth, with projections indicating a market value of 1.2 USD Billion in 2024 and an anticipated increase to 4.78 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 13.39% from 2025 to 2035. Such figures underscore the increasing recognition of actinic keratosis as a significant public health concern, driving investments in research, treatment development, and patient education initiatives. As the market evolves, stakeholders are likely to focus on enhancing treatment accessibility and effectiveness.

Growing Geriatric Population

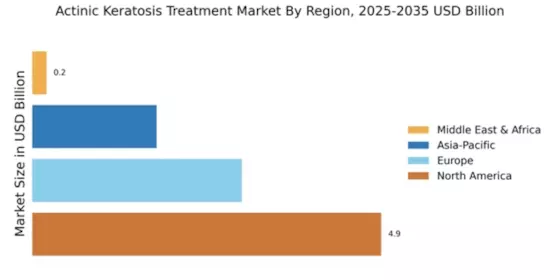

The global demographic shift towards an aging population is a significant factor influencing the Global Actinic Keratosis Treatment Market Industry. Older adults are more susceptible to skin conditions, including actinic keratosis, due to cumulative sun exposure over their lifetimes. As the proportion of elderly individuals increases, so does the demand for effective treatment options. This demographic trend is particularly pronounced in developed nations, where healthcare systems are adapting to meet the needs of older patients. Consequently, the market is likely to expand, driven by the necessity for targeted therapies that address the unique challenges faced by this population.

Regulatory Support and Approval

Regulatory bodies are playing a crucial role in shaping the Global Actinic Keratosis Treatment Market Industry by facilitating the approval of new therapies. Streamlined processes for clinical trials and drug approvals are encouraging pharmaceutical companies to invest in research and development for actinic keratosis treatments. This supportive regulatory environment not only accelerates the introduction of innovative therapies but also enhances market competition. As more treatment options become available, patients benefit from increased choice and improved outcomes, further stimulating market growth.

Increased Awareness and Education

Heightened awareness about actinic keratosis and its potential risks is driving growth in the Global Actinic Keratosis Treatment Market Industry. Educational campaigns by health organizations and dermatology associations are informing the public about the importance of early detection and treatment. This increased knowledge encourages individuals to seek medical advice and treatment options, leading to higher diagnosis rates. Furthermore, healthcare providers are becoming more vigilant in screening for actinic keratosis, contributing to a larger patient base. As a result, the market is expected to experience a compound annual growth rate of 13.39% from 2025 to 2035.

Advancements in Treatment Modalities

Innovations in treatment options for actinic keratosis are shaping the Global Actinic Keratosis Treatment Market Industry. New therapies, including topical medications, cryotherapy, and photodynamic therapy, are being developed and refined, offering patients more effective and less invasive choices. For instance, the introduction of novel topical agents has shown promising results in clinical trials, enhancing patient compliance and satisfaction. As these advancements continue to emerge, they are likely to attract more patients seeking treatment, thereby expanding the market. The anticipated growth trajectory suggests that the market could reach 4.78 USD Billion by 2035.

Rising Incidence of Actinic Keratosis

The increasing prevalence of actinic keratosis globally is a primary driver for the Global Actinic Keratosis Treatment Market Industry. Factors such as prolonged sun exposure and aging populations contribute to this rise. It is estimated that millions of individuals are affected by this condition, particularly in regions with high UV radiation. As awareness grows regarding the potential progression of actinic keratosis to skin cancer, there is a corresponding surge in demand for effective treatments. This trend is expected to propel the market significantly, with projections indicating a market value of 1.2 USD Billion in 2024.