Leading market players are investing heavily in research and development to introduce new products, which will help the 3D Printing Materials market to expand further. Market participants are also undertaking strategic approaches, whether organic or inorganic, to strengthen their footprint, with important market developments including product line add-ons, contacts & partnerships, mergers and acquisitions, Capex, and strategic alliances with other organizations.

The 3D Printing Materials industry must offer cost-effective solutions and products to compete in a fragmented market. Manufacturing locally to minimize operational expenses is one of the key business tactics organizations use in the 3D Printing Materials industry to benefit consumers and capture a major market share. The 3D Printing Materials industry has recently offered significant advantages to industrialization and urbanization.

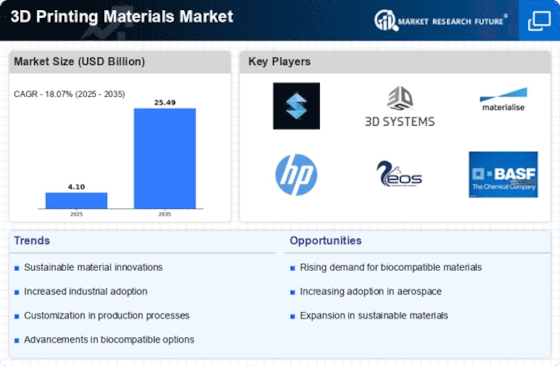

Major players in the 3D Printing Materials market, including Arkema S.A., Koninklijke DSM N.V., ExOne, Stratasys, Ltd., Sandvik AB, 3D Systems, Inc., Höganäs AB, Evonik Industries AG, CeramTec GmbH, SABIC, BASF SE, DuPont, and Materialise NV, are attempting to fulfill market demands by investing in research and development through cost-effective and sustainable products. An international leader in high-tech engineering, Sandvik offers services to the infrastructure, mining, and manufacturing sectors that improve productivity, profitability, and sustainability. The group had over 40,000 workers, sales in 150 countries, and revenues of SEK 112 billion in 2022.

They have made major investments in technological Advancement, customer insights, and a comprehensive understanding of manufacturing procedures and digital solutions. As a result, our portfolio spans the whole customer value chain.

In August 2022, an agreement was reached and concluded by Sandvik to purchase 10% of the stock holdings in Sphinx Tools Ltd., situated in Swartzland, and its fully owned subsidiary Sphinx Tools. Most of the tools offered by Sphinx are surgical cutting tools and precision solid round tools. The aerospace, automotive, and healthcare industries account for most customers. Sandvik Coromant, a section of Sandvik Manufacturing and Machining Solutions, is anticipated to cover the business. Engineering firm Sauber Motorsports AG is based in Switzerland.

Peter Sauber, who advanced via hill climbing and the World Sportscar Championship to enter Formula One in 1993, created this company in 1970. Alfa Romeo Racing is the new name of Sauber Motorsport AG's Formula One racing team, previously known by the same name from 1993 until 2018.

In April to assist with the wind tunnel's operations made possible by 3D system solutions, the 3D systems corporation built a high-production internal factory in partnership with Sauber Motorsports AS over an extended period.

The business supplied high-quality Sauber parts for 3D printing iterations of aerodynamic models. By 2024, TCT has been talking to some of the businesses that have participated in every event throughout its first ten years as TCT Asia 2024 draws near. Among those businesses is Polymaker, a global creator of 3D printing materials based on extrusion. The debut of PolyDryer, our new modular filament drying and storage device, is the exciting announcement. The product is made up of a drying unit and an airtight storage box.

This implies that you only need one dry dock and can install as many boxes as you require. In addition to launching this product, we will showcase pellet printing and our entire material application spectrum.