Expansion of Automotive Electronics

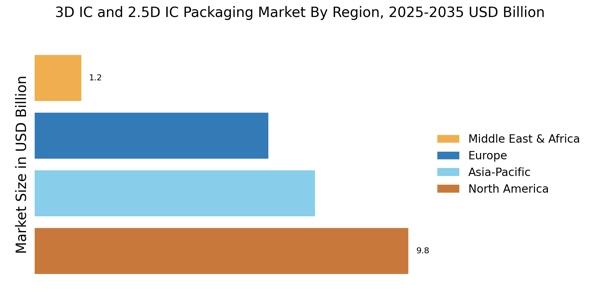

The expansion of automotive electronics is emerging as a crucial driver for the 3D IC and 2.5D IC Packaging Market. With the rise of electric vehicles and advanced driver-assistance systems, the demand for sophisticated semiconductor solutions is on the rise. 3D IC and 2.5D IC packaging technologies enable the integration of multiple functionalities within compact spaces, which is essential for modern automotive applications. The automotive semiconductor market is projected to grow significantly, with estimates indicating it could reach USD 50 billion by 2027. This growth is likely to spur the adoption of 3D IC and 2.5D IC packaging solutions, as manufacturers seek to enhance performance and reliability in automotive electronics.

Increased Focus on Energy Efficiency

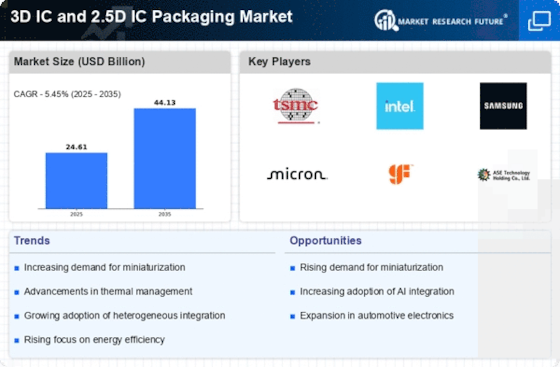

The growing emphasis on energy efficiency in electronic devices is driving the 3D IC and 2.5D IC Packaging Market. As consumers and industries alike become more environmentally conscious, there is a rising demand for semiconductor solutions that minimize power consumption while maximizing performance. 3D IC and 2.5D IC packaging technologies are designed to reduce energy usage through improved thermal management and reduced interconnect lengths. This focus on energy efficiency is reflected in market trends, with energy-efficient semiconductor solutions expected to capture a larger share of the market. As regulations and consumer preferences shift towards sustainability, the adoption of these advanced packaging technologies is likely to increase.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing processes are significantly influencing the 3D IC and 2.5D IC Packaging Market. Innovations such as extreme ultraviolet lithography and advanced packaging techniques are enabling the production of smaller, more powerful chips. These advancements facilitate the integration of multiple functionalities within a single package, thereby enhancing performance and reducing power consumption. The market for semiconductor packaging is expected to reach approximately USD 40 billion by 2026, driven by these technological improvements. As manufacturers strive to meet the increasing demands for miniaturization and efficiency, the adoption of 3D IC and 2.5D IC packaging solutions is likely to accelerate.

Rising Demand for High-Performance Computing

The increasing demand for high-performance computing solutions is a primary driver for the 3D IC and 2.5D IC Packaging Market. As industries such as artificial intelligence, machine learning, and data analytics expand, the need for advanced semiconductor technologies becomes more pronounced. The 3D IC and 2.5D IC packaging solutions offer enhanced performance and efficiency, which are critical for processing large volumes of data. According to recent estimates, the market for high-performance computing is projected to grow at a compound annual growth rate of over 10% in the coming years. This growth is likely to propel the adoption of 3D IC and 2.5D IC packaging technologies, as they provide the necessary speed and power efficiency required for modern computing applications.

Growing Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) devices is a significant driver for the 3D IC and 2.5D IC Packaging Market. As more devices become interconnected, the demand for efficient and compact semiconductor solutions rises. 3D IC and 2.5D IC packaging technologies provide the necessary integration and performance enhancements required for IoT applications, which often involve processing large amounts of data in real-time. The IoT market is anticipated to grow substantially, with estimates suggesting it could reach USD 1 trillion by 2025. This growth is likely to create substantial opportunities for 3D IC and 2.5D IC packaging solutions, as manufacturers seek to optimize their products for performance and energy efficiency.