Venture Capitalist Sector to See Growth in Sustainable Development Sector for 2024

The venture capitalist sector is expected to experience exponential growth throughout 2024 due to rising clean energy trends. Sustainability approaches in various market sectors lead to growing interest among consumers in green energy transitions. In 2024, significant steps to develop sustainability will be taken and implemented, such as the broader adoption of electric vehicles. The energy sector is expected to see soar in venture capitalists as the ongoing trend of sustainable development is surging in 2024.According to the surveys, venture capitalist funding in the United States fell to its lowest by 30 percent in 2023. The energy storage sector is growing due to the transition of clean energy at an incredible pace to achieve net zero emissions by the end of 2050. These sectors are essential for the energy transition to reduce carbon emissions, energy storage, setting up a more significant number of smart grids, and other forms of renewable energy sources. Experts say that sustainable and economic development will lead to change in venture capital in 2024. These environmental developments are difficult for the venture capitalist sector to understand. However, the economic shift from these sectors will be responsible for specific investment changes. Venture capital helps empower strategic investments to support sustainable development goals in the clean energy transition.

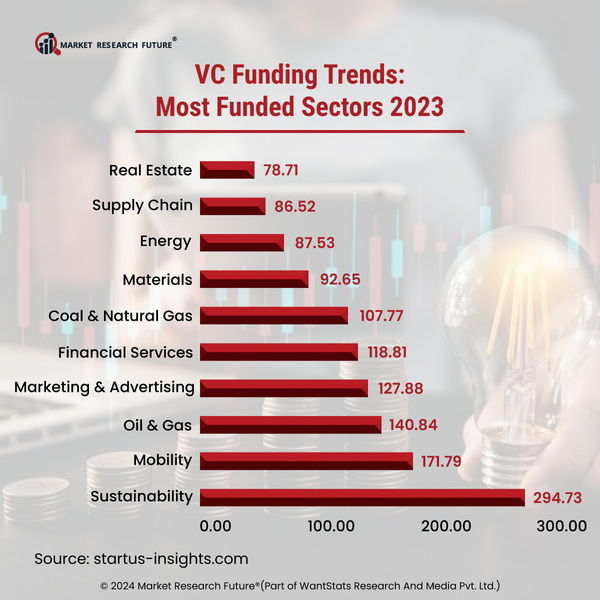

The venture capitalist sector projected the highest support for sustainability, followed by the mobility sector in 2023. Thus, venture capital is expected to follow the same trend in 2024, with sustainability holding the highest investment for the sustainability sector. This is due to growing demands for net zero emissions in the light of clean energy transitions. The increasing number of investments in the clean energy sector veils the venture capital's highest returns throughout 2024.