U.S. Retail Sales Rebound in 2025: Inflation Fuels Spending Amid Economic Uncertainty

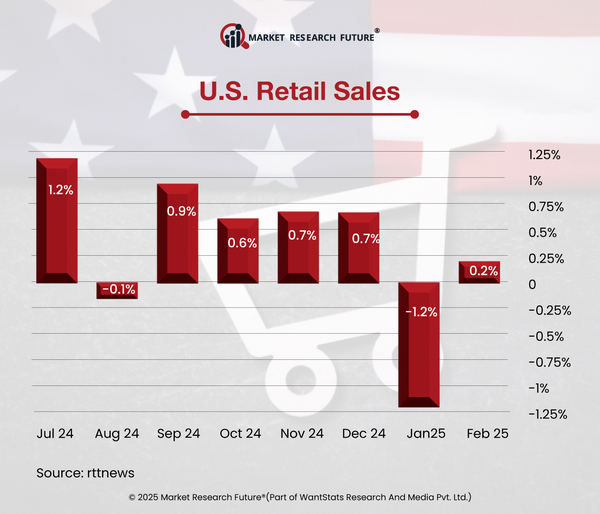

The United States (U.S.) Census Bureau reports that U.S. retail sales barely increased by 0.2 percent in February 2025 to reach USD 722.7 Billion. This countered the notable 1.2 percent drop seen in January 2025. Retail sales grew 3.1 percent year over year from February 2024, indicating a strong consumer spending trend despite recent economic swings.

Total sales during the three-month period ending in February 2025 increased 3.8 percent over the same period a year prior. Given that about 70 percent of the U.S. GDP is derived from consumer expenditures, this consistency is vital. Steady retail activity suggests that the economy is steering clear of a recession in 2025 for now.

Nevertheless, when assessing these numbers, one should take inflation into account. Retail sales and the Consumer Price Index (CPI) rose by 0.2 percent in February 2025, suggesting that, when inflation-adjusted, consumer expenditure stayed steady for the month. Retail sales increased by 3.1 percent, but consumer prices rose 2.8 percent, therefore producing a minor "real" expenditure increase of 0.3 percent.

After seasonal fluctuations, monthly retail and food services sales rose by 11.1 percent over a three-year timeframe from February 2022 to February 2025. When including CPI inflation, however, sales dropped 1.1 percent. This little decline over three years emphasizes the financial burden inflation has placed on families. Still, consumer spending has been robust throughout this inflationary era; consumers still buy comparable volumes of comparable products, just at higher costs.

Two particular sectors exhibited different results in February 2025. Health and personal care shops reported a 1.7 percent increase in sales, while online businesses witnessed a notable 2.4 percent increase in sales. Restaurants and food and beverage stores saw a little 0.4 percent increase. On the other hand, fuel stations witnessed a 1 percent drop in revenue, while food service and drinking venues had a clear 1.5 percent drop.

Early 2025's more general economic scene shows conflicting signs. Dubbed the "Trumpcession," worries about a possible recession have surfaced because of President Donald Trump's erratic economic policies, including punishing tariffs applied to many countries. Declining business and consumer confidence follow from these activities. Rising trade imbalance and more gold imports are predicted to cause the U.S. GDP to drop by 2 percent. With the CPI in February 2025 at 2.8 percent, inflation increased. Notwithstanding these difficulties, the employment rate is still low at 4.1 percent; job and pay increases help to enhance household buying capability.

In February 2025, import prices also unexpectedly rose by 0.4 percent. Companies boosting imports ahead of President Trump's impending taxes are blamed for this rise. This surge may have resulted from companies "stockpiling" or ordering before tariffs start. Particularly, orders for industrial supplies, excluding energy, jumped 1.8 percent after a prior 0.6 percent rise. Although these import price hikes have hardly helped to explain U.S. inflation, analysts are alert about how the tariffs can affect the economy in the future in 2025.

In essence, even if U.S. retail sales in February 2025 show a strong consumer base, the interaction of inflation, trade policy, and world economic events calls for cautious optimism. The course of consumer expenditure and general financial health in 2025 will depend much on the following months.