Tesla Focuses on Autonomous Driving and AI to Boost Sales

Electric vehicles are gaining momentum due to the clean energy transition. Net-zero goals aim to set up electric vehicles (EVs) as the primary mode of transportation. Electrification in transportation can transform the automotive industry in 2024: Tesla, one of the central electric vehicle makers in the automotive industry.

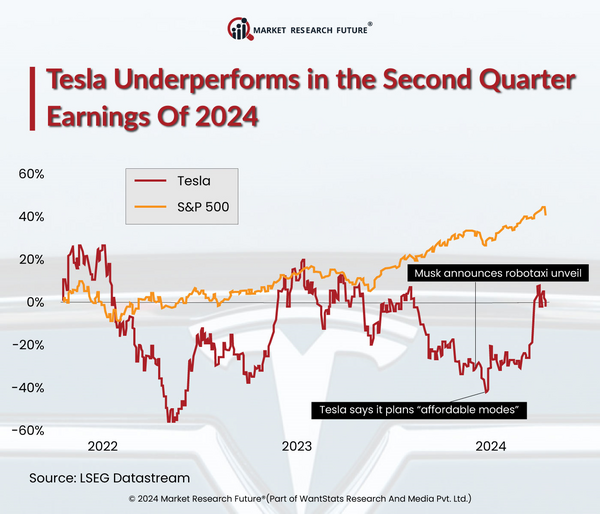

A survey shows that Tesla's revenues in the second quarter of 2024 are anticipated to decline. Tesla will experience slow growth in the electric vehicle market in 2024. Hence, the company will go through decreasing profits in the 2024 market. The electric vehicle maker Tesla aims to focus on autonomy and artificial intelligence (AI) to boost EV sales. Tesla will deliver about 443,956 electric vehicles in the second quarter of 2024. However, this figure is lower by 4.8 percent compared to the results of 2023 around the same time.

Experts claim that Tesla is focusing more on artificial intelligence and self-driving in 2024. Since the company struggles with sluggish electric vehicle sales, these two technologies in the vehicles can drive the economic factors. Artificial intelligence brings out decent but low outputs from Tesla in the first quarter of 2024. It continues to be the same in the second quarter of the year. Tesla aims its company's future with artificial intelligence, autonomous driving, and humanoid robots. It will be helpful to integrate these technologies into factories to cut manufacturing costs. However, the company may suffer certain losses until Tesla integrates these technologies. It may bring specific downturns to the company due to slow sales in the competitive market.

Tesla's second-quarter income in 2024 shows that it falls behind by 45 percent yearly to USD 1.5 billion. The company fails to profit despite cost cuts in manufacturing units, unavoidable employment-related layoffs, and others. Therefore, Tesla's balance in the competitive landscape is shaking in 2024. It can result in severe financial losses if these technical issues are not solved correctly.