Oil & Gas Market Growth Challenges the Electric Vehicles Market in 2024

The clean energy transition will gain momentum in 2024 with several initiatives in the energy market. Industries are gradually turning towards renewables as the energy source to boost renewables. However, the oil market 2024 sees a significant boost in the sales 2024. An increasing fuel demand holds an optimistic outlook for the oil market 2024.

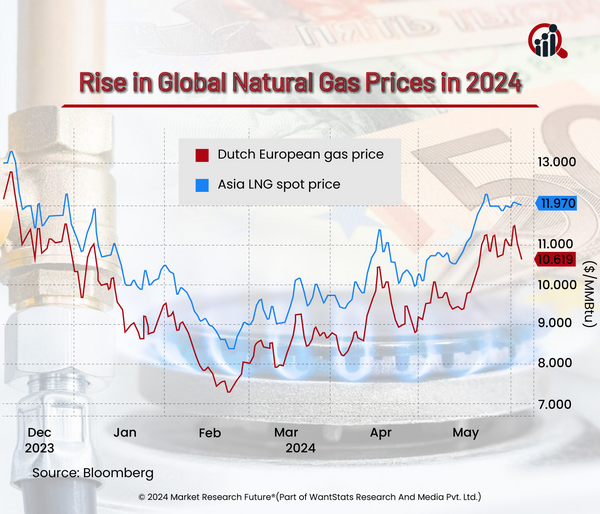

According to recent data from the survey, oil markets see increasing fuel demand in the summer of 2024. This is due to increasing travel in the summer months of the year. Moreover, the oil market experiences the same situation yearly during peak summer travel. Data shows that Brent rises in demand to USD 81 per barrel during the summer of 2024. However, gas prices are increasing in 2024 due to supply disruptions in the energy market. Globally, the energy market will experience higher gas prices in 2024. The energy market suffers from supply chain disruptions due to geopolitical conflicts worldwide. However, rising fuel demand is driving the oil market's outlook for 2024. The increase in oil demand threatens electric vehicle sales in 2024. In earlier surveys, it was seen that electric vehicle demand will be less in 2024. Electric vehicles have higher cost prices than conventional vehicles.

Additionally, the lack of charging infrastructure is another reason for less demand for electric vehicles. Electric vehicle sales 2023 were higher in China and the United States than in 2024. Electric vehicle sales slowed down in 2024, making the future challenging.

The survey reports show that the oil inventories in the United States fell to 2.4 million barrels in 2024. Hence, it increases oil prices even if solid demand exists in the summer of 2024. Due to increasing oil demand, the International Energy Agency shows that global spending at a primary level of the oil market would rise 7 percent in 2024. However, the expenditure in the oil market for 2203 was 9 percent. The difference does not hinder any process, as the experts claim.