India Claims Itself as the World’s Fifth-Largest Stock Market

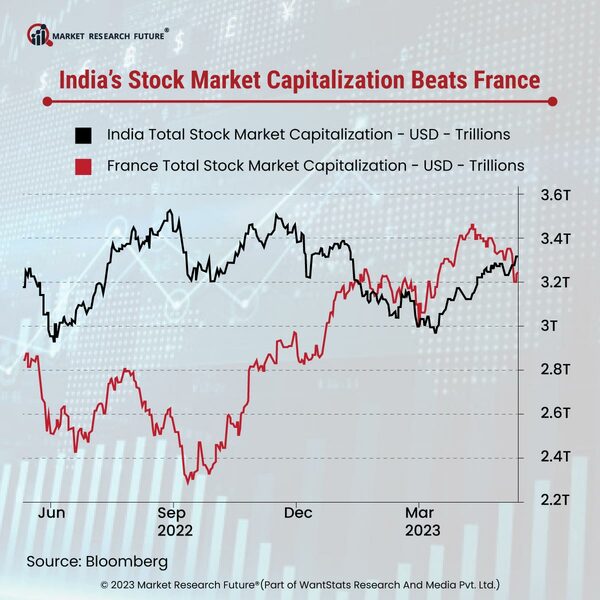

India has again claimed its position in the world's fifth-largest stock market after losing its spot to France in January 2023. The reason behind it being foreign investors have snapped up the Asian nation's shares.

Earlier, India's market capitalization stood at USD 3.3 trillion as of May 29, 2023, which helped to rebound Adani Group's stocks after a seller report of 2023 sparked a rapid selloff. France meanwhile lost more than USD 100 billion in market price in the fourth week of May as the luxury goods makers witnessed a flight amid fears of a slowdown in the U.S. and China. As a result, of a rotation in China's economic recovery, Global funds are piling into Indian stocks, and foreign investors have also added USD 5.7 billion worth of Indian supplies since the very beginning of April 2023, being lured by the stable earnings outlook and highest GDP growth rates among the world's largest economies.

According to the data by Yahoo Finance, S&P BSE Sensex Index has bounced back more than 9 percent after entering correction territory briefly in mid-March by closing in on record high levels. Also, Adani's 10 listed entities contributed around USD 15 billion to their market value in the fourth week of May to cut their losses after Hindenburg's report to USD105 billion from USD 153 billion earlier.