Europe’s Airlines Embrace Smaller M&A Deals to Navigate Regulatory Turbulence in 2025

Europe's main airlines are choosing smaller mergers and acquisitions (M&A) agreements instead of complete takeovers in the face of rising regulatory obstacles and financial worries. Minority stakes are also their preferred choice. With this calculated change, they want to improve their market share while cutting costs and facing less attention in 2025.

Insiders in the business disclose that carriers like Lufthansa and Air France-KLM are changing their strategy by purchasing partial interests in other airlines, therefore avoiding lengthy legal clearance procedures. As European airlines try to compete with the more consolidated U.S. market and state-backed carriers from the Middle East in 2025, this represents a notable break from past major mergers.

Deals lately show this tendency. For €14 million (USD14.72 million), Lufthansa bought a 10% share in Latvian airline airBaltic last month, thereby strengthening their wet lease agreement to simplify aircraft, crew, and pilot sharing. Following British Airways-owner IAG's aborted complete acquisition offer in 2024, both Air France-KLM and Lufthansa are investigating the prospect of buying a 20% share in Spain's Air Europa. Industry sources project this investment to be between €200-240 million, highlighting the trend towards smaller deals in 2025.

Portuguese airline TAP, valued at about USD 1 billion, is another main candidate for partial purchase. Air France-KLM is publicly showing interest in a minority share as part of TAP's privatization strategy. These piecemeal purchases, according to analysts, enable airlines to retain strategic influence in 2025 while avoiding close government inspection.

Experts contend that worries about declining competition and rising flight pricing keep European authorities wary of big airline mergers. This attitude already drove the IAG-Air Europa merger off course. But after a year-long negotiating procedure with EU authorities, Lufthansa effectively obtained a 41 percent share in ITA Airways in January, thereby underscoring the difficulties of full-scale purchases in 2025.

According to aviation experts, smaller stakes allow airlines to "test the waters" free from financial commitments or legal obstacles. However, the Directorate-General for Competition of the European Commission has made comprehensive mergers more difficult, forcing airlines to choose other approaches, such as network-sharing agreements and joint ventures, in 2025 instead.

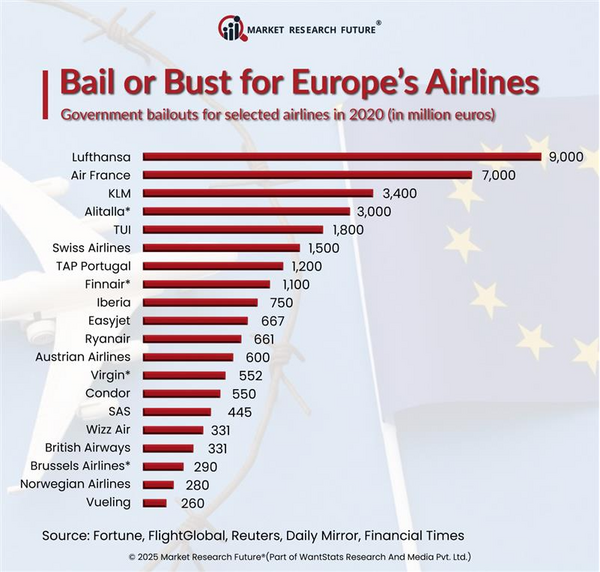

Minority interests carry hazards along with their advantages. Stories of caution abound from Etihad Airways' poor investments in Air Berlin, Aer Lingus, and Alitalia. Furthermore, because authorities carefully monitor any anti-competitive activity in 2025, regulatory scrutiny remains a possibility, even with limited stakes.

Six large airlines hold seventy-two percent of Europe's airline capacity; hence, authorities are cautious about further consolidation. Airlines advocate for market unity, but regulators still balance consumer concerns with competition to determine how European aviation will develop in 2025.