China Finances Zimbabwe’s Steel Industry to Flourish in 2024

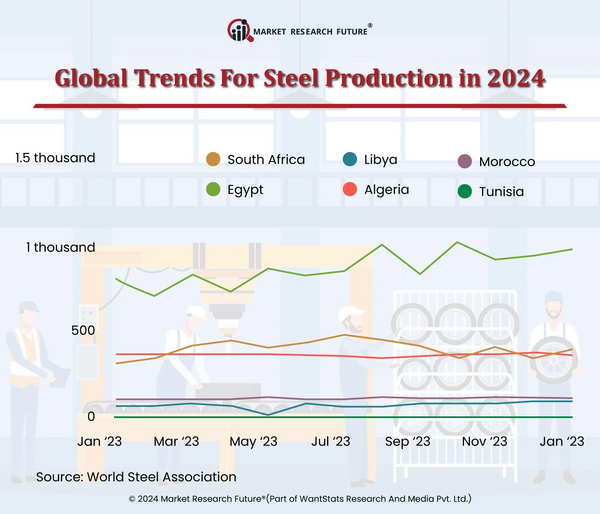

The steel industry will gain momentum in 2024 due to various industrial applications. The steel industry is an important source for the manufacturing and construction sectors. Since the automotive industry sees potential growth in 2024, the steel demand will increase. China demands a heavy supply of steel to set up a secure metal stock. Chinese auto industry and construction companies are experiencing significant growth in 2024. Therefore, China is heavily funding Zimbabwe to set up a steel plant in 2024. A survey in 2024 reports that Zimbabwe will spend USD 1.5 billion to rebuild its steel plant in 2024. China finances Zimbabwe to revive its iron and steel industry.

Surveys on the steel industry show it is projected to experience positive trends throughout 2024. This is due to the growing demand for steel products in the 2024 economic year. This increase in steel demand is driven by infrastructure growth in different industries, the booming automotive sector, and others. Therefore, Zimbabwe must set up a steel manufacturing plant in 2024. Zimbabwe plans to set up the Mvuma plant as Africa's largest for integrated steelworks. Further, it will enhance the employment facilities in the country. Hence, the steel industry in Zimbabwe will create new employment opportunities to improve the country's financial conditions.

Zimbabwe is a hub house for iron pre and chrome deposits; these two elements are important for steel production. Therefore, China joined hands with Zimbabwe in a strategic move to have a constant supply of resources for steel industries. China is funding Zimbabwe to have a good financial relationship for a stable raw material supply in steel production. Further, this joint venture is expected to result in bilateral cooperation between the two nations. It will result in international ties between the countries for mutual economic benefits. China intends to be on a competitive edge by investing in Zimbabwe's steel industry. China achieves strategic objectives economically by supporting Zimbabwe's steel industry in 2024.