Africa Receives only 2 Percent of Clean Energy Investment Funds 2024

The clean energy sector sees several kinds of investments to boost the transformation in the energy sector. Globally, organizations are spending well on different countries to provide a base fund for the transition process. Developed and emerging countries like the United States and China are investing in renewable production. In 2024, the International Energy Agency (IEA) declared it would invest USD 3 trillion in the energy market, whereas USD 2 trillion is solely for clean energy upgrades. Hence, IEA will support the clean energy transition by investing USD 2 trillion in 2024. However, the IEA declares that Africa should only spend USD 40 billion to develop a clean energy transition.Global clean energy investment in different countries is set to provide financial support in 2024. International energy agencies claim to provide USD 2 trillion for renewables and distribute it among various nations in 2024. However, surveys show that Africa will receive only 2 percent of the total investment in 2024. IEA's investment in global green energy focuses mainly on electric vehicles, grids, fuels with low carbon emissions, and others. However, IEA targets to spend only USD 40 billion in Africa in 2024 for renewable energy development. Experts claim that Africa contributes about 4 percent of global greenhouse emissions. However, surveys show that USD 110 billion is spent in the African energy market, where investment in fossil fuel is USD 70 billion. Investment in fossil fuels is more than in renewables in Africa for 2024. Experts claim that only 2 percent of total clean energy investment is insufficient to put African countries on the sustainable track.

According to the survey, China will receive an estimated USD 675 billion in funds for the clean energy transition. Europe and the United States followed China with an investment of USD 370 and USD 315 billion, respectively, in 2024. China receives the most funds due to its exponential growth in electric vehicles. Therefore, stable economies like China, the United States, and Europe will receive heavy clean energy investment in 2024.

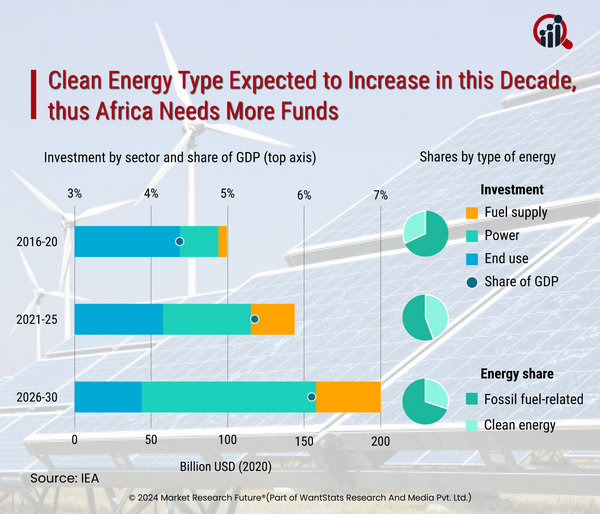

Clean energy is expected to increase in this decade; thus, Africa needs more funds: