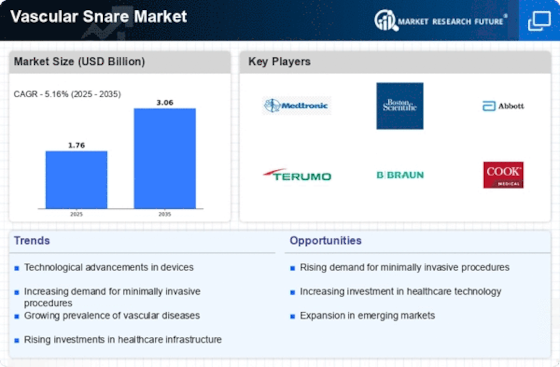

The Vascular Snare Market is characterized by a dynamic competitive landscape, driven by technological advancements and an increasing demand for minimally invasive surgical procedures. Key players such as Medtronic (US), Boston Scientific (US), and Abbott Laboratories (US) are at the forefront, each adopting distinct strategies to enhance their market presence. Medtronic (US) focuses on innovation through the development of advanced vascular snare technologies, while Boston Scientific (US) emphasizes strategic partnerships to expand its product offerings. Abbott Laboratories (US) is leveraging its strong research and development capabilities to introduce novel solutions, thereby shaping a competitive environment that prioritizes technological superiority and operational efficiency.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain resilience. The Vascular Snare Market appears moderately fragmented, with a mix of established players and emerging companies vying for market share. The collective influence of these key players is significant, as they not only drive innovation but also set industry standards that smaller firms must adhere to in order to remain competitive.

In August 2025, Medtronic (US) announced the launch of its latest vascular snare device, which incorporates AI-driven features to enhance procedural accuracy. This strategic move is likely to position Medtronic as a leader in the market, as the integration of AI technology could significantly improve patient outcomes and operational efficiency in surgical settings. The emphasis on AI reflects a broader trend within the industry towards digital transformation, which is becoming increasingly critical in maintaining competitive advantage.

In September 2025, Boston Scientific (US) entered into a partnership with a leading telehealth provider to enhance remote monitoring capabilities for patients undergoing vascular procedures. This collaboration is indicative of a growing trend towards integrating digital health solutions with traditional medical devices, potentially improving patient engagement and post-operative care. Such strategic alliances may not only expand Boston Scientific's market reach but also enhance its product value proposition in an increasingly digital healthcare landscape.

In July 2025, Abbott Laboratories (US) completed the acquisition of a smaller firm specializing in biodegradable vascular snares. This acquisition is strategically significant as it allows Abbott to diversify its product portfolio and cater to the rising demand for sustainable medical solutions. The move aligns with current market trends emphasizing sustainability and could provide Abbott with a competitive edge in attracting environmentally conscious healthcare providers.

As of October 2025, the Vascular Snare Market is witnessing trends that emphasize digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance their market offerings. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technological advancements, and supply chain reliability, as companies strive to meet the growing expectations of healthcare providers and patients alike.