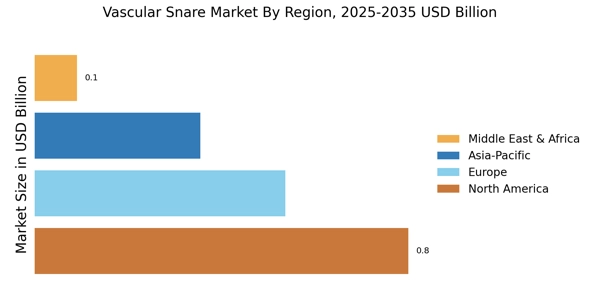

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in various regions is a crucial driver for the Vascular Snare Market. As healthcare facilities grow and modernize, there is an increasing need for advanced medical devices, including vascular snares. This expansion is particularly evident in emerging markets, where investments in healthcare are surging. Market data suggests that healthcare spending in these regions is projected to increase significantly, leading to enhanced access to medical technologies. The Vascular Snare Market is likely to benefit from this trend, as healthcare providers seek to equip their facilities with the latest tools to improve patient care. As infrastructure continues to develop, the demand for vascular snares is expected to rise, further propelling market growth and innovation.

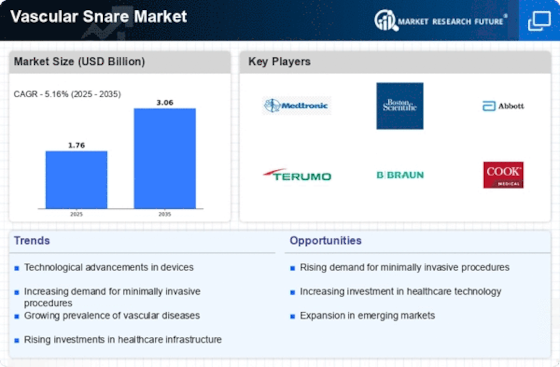

Increasing Prevalence of Vascular Diseases

The rising incidence of vascular diseases, such as peripheral artery disease and varicose veins, is a primary driver for the Vascular Snare Market. As populations age, the prevalence of these conditions is expected to escalate, leading to a higher demand for effective treatment options. According to recent data, vascular diseases affect millions worldwide, necessitating innovative solutions. This trend is likely to propel the market forward, as healthcare providers seek advanced tools to enhance patient outcomes. The Vascular Snare Market is poised to benefit from this growing need, as snare devices are integral in various vascular procedures, offering precision and efficiency. Consequently, the increasing prevalence of vascular diseases is anticipated to significantly influence market dynamics, fostering growth and innovation in the sector.

Technological Innovations in Medical Devices

Technological advancements in medical devices are transforming the Vascular Snare Market. Innovations such as improved materials, enhanced design, and integration of digital technologies are making vascular snares more effective and user-friendly. For instance, the introduction of biodegradable materials and advanced imaging techniques has the potential to enhance the performance of snares during procedures. Market data indicates that the demand for technologically advanced medical devices is on the rise, with a projected growth rate of over 7% annually. This trend suggests that manufacturers who invest in research and development will likely gain a competitive edge. As a result, the Vascular Snare Market is expected to experience substantial growth driven by these technological innovations, ultimately improving patient care and procedural outcomes.

Regulatory Support and Reimbursement Policies

Regulatory support and favorable reimbursement policies are vital drivers for the Vascular Snare Market. Governments and regulatory bodies are increasingly recognizing the importance of vascular health, leading to the establishment of supportive frameworks for medical devices. This includes streamlined approval processes and incentives for manufacturers. Additionally, favorable reimbursement policies for minimally invasive procedures are encouraging healthcare providers to adopt advanced technologies, including vascular snares. Market data indicates that regions with robust reimbursement frameworks experience higher adoption rates of innovative medical devices. As a result, the Vascular Snare Market is likely to thrive in environments where regulatory support and reimbursement policies align, fostering growth and accessibility for patients in need of vascular interventions.

Rising Awareness of Minimally Invasive Techniques

The growing awareness and preference for minimally invasive surgical techniques are significantly impacting the Vascular Snare Market. Patients and healthcare providers increasingly favor procedures that reduce recovery time and minimize surgical trauma. This shift in preference is supported by data indicating that minimally invasive surgeries can lead to shorter hospital stays and lower complication rates. As a result, the demand for vascular snares, which are essential in these procedures, is likely to increase. The Vascular Snare Market stands to benefit from this trend, as the devices are designed to facilitate precise interventions with minimal invasiveness. Consequently, the rising awareness of these techniques is expected to drive market growth, as more healthcare facilities adopt advanced snare technologies to meet patient needs.