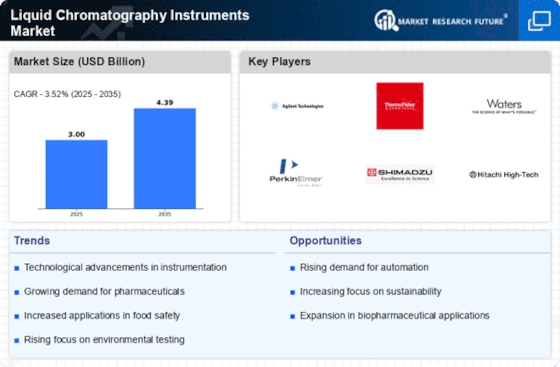

液体クロマトグラフィー機器市場は、技術革新と製薬、環境試験、食品安全などのさまざまな分野における分析ソリューションの需要の高まりによって推進される動的な競争環境が特徴です。アジレント・テクノロジー(米国)、サーモフィッシャーサイエンティフィック(米国)、ウォーターズ・コーポレーション(米国)などの主要企業が最前線に立ち、革新と戦略的パートナーシップを活用して市場での地位を強化しています。アジレント・テクノロジー(米国)は、継続的な革新を通じて製品ポートフォリオの拡大に注力しており、サーモフィッシャーサイエンティフィック(米国)は、高性能液体クロマトグラフィーにおける能力を強化するために戦略的な買収を強調しています。ウォーターズ・コーポレーション(米国)も、顧客エンゲージメントと業務効率を向上させるためにデジタルトランスフォーメーションの取り組みに投資しており、技術的リーダーシップと顧客中心のソリューションを優先する競争環境を形成しています。

ビジネス戦略に関して、企業は製造のローカライズとサプライチェーンの最適化を進め、市場の需要に対する応答性を高めています。液体クロマトグラフィー機器市場の競争構造は中程度に分散しており、いくつかの主要企業が影響を及ぼしています。この分散はニッチプレイヤーが繁栄することを可能にし、一方で大企業は戦略的な動きによって市場シェアを統合し、競争を激化させています。

2025年8月、アジレント・テクノロジー(米国)は、リアルタイムデータ分析のための高度なAI機能を統合した最新の液体クロマトグラフィーシステムの発売を発表しました。この戦略的な動きは、実験室のワークフローの効率を向上させるだけでなく、分析機器における人工知能の統合においてアジレントをリーダーとして位置づけます。AI駆動のソリューションの導入は、業務を効率化する革新的な技術を求める幅広い顧客層を引き付ける可能性があります。

2025年9月、サーモフィッシャーサイエンティフィック(米国)は、分析能力を強化するために主要なクロマトグラフィーソフトウェア会社の買収を完了しました。この買収は戦略的に重要であり、サーモフィッシャーがハードウェアとソフトウェアを組み合わせた包括的なソリューションを提供できるようにし、顧客にシームレスな体験を提供します。高度なソフトウェアソリューションの統合は、サーモフィッシャーの市場における競争力を強化することが期待されています。

2025年7月、ウォーターズ・コーポレーション(米国)は、製造プロセスの環境への影響を減少させることを目的とした持続可能性イニシアチブを開始しました。このイニシアチブは、業界のリーダーが持続可能性を優先する傾向が高まっていることを反映しており、顧客や規制機関にとってますます重要になっています。持続可能な慣行を採用することで、ウォーターズ・コーポレーションはブランドの評判を高めるだけでなく、グローバルな持続可能性目標に沿った形で、環境意識の高い顧客を引き付ける可能性があります。

2025年10月現在、液体クロマトグラフィー機器市場はデジタル化、持続可能性、人工知能の統合といったトレンドを目の当たりにしています。企業は、進化する顧客ニーズに応えるために自らの強みを組み合わせることを求めて、戦略的アライアンスをますます一般的にしています。競争の差別化は、従来の価格競争から革新、技術、サプライチェーンの信頼性に焦点を移す可能性が高く、企業はますます複雑な市場で優れた価値を提供することを目指しています。