複合材料市場 概要

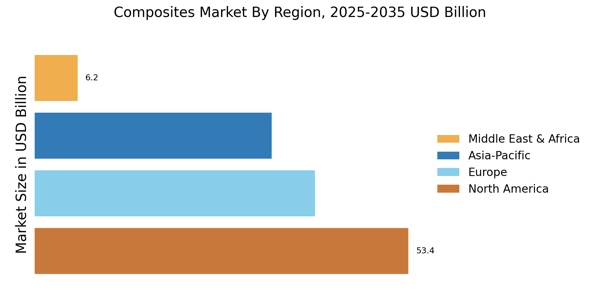

MRFRの分析によると、2024年の複合材料市場規模は133.55億米ドルと推定されています。複合材料産業は、2025年に145.07億米ドルから2035年には331.95億米ドルに成長すると予測されており、2025年から2035年の予測期間中に8.63の年平均成長率(CAGR)を示すとされています。

主要な市場動向とハイライト

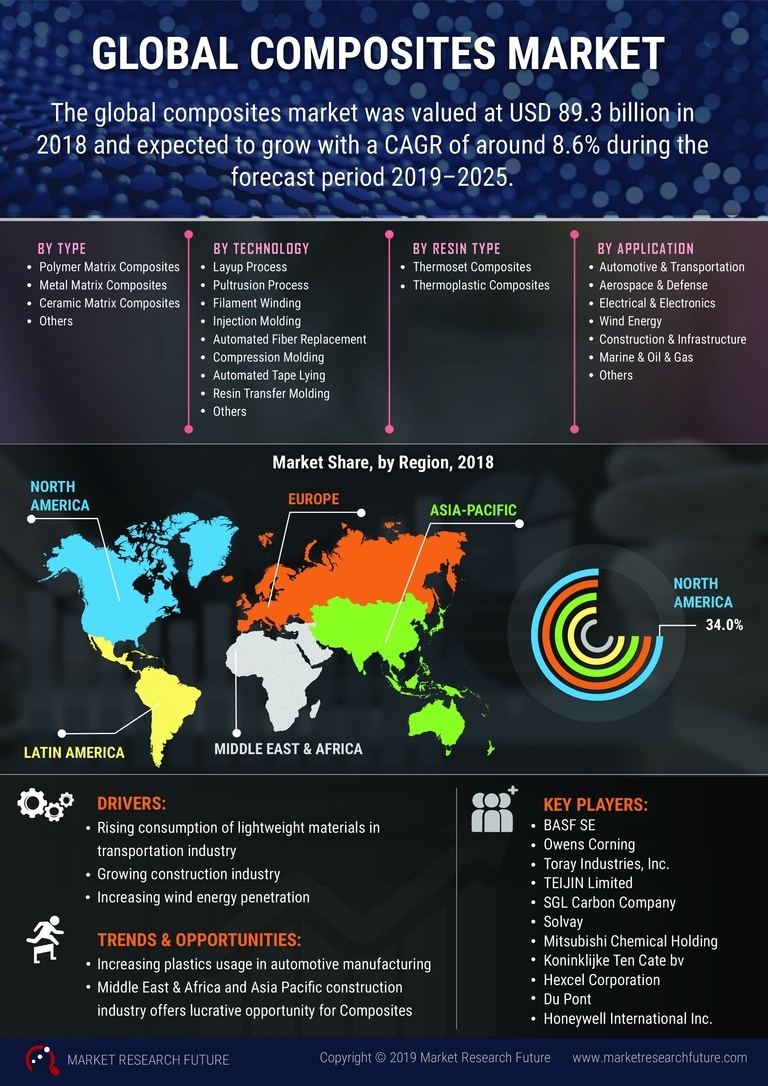

複合材料市場は、持続可能性と技術の進歩によって堅調な成長が期待されています。

- "北米は複合材料の最大市場であり、航空宇宙および自動車部門の強い需要に支えられています。

- アジア太平洋地域は、産業化の進展とインフラ開発の増加により、最も成長が早い地域として浮上しています。

- ガラス繊維複合材料が市場を支配しており、炭素繊維複合材料はその軽量特性により急速に成長しています。

- 主要な市場の推進要因には、再生可能エネルギーへの関心の高まりと、特に自動車用途における製造技術の進展が含まれます。"

市場規模と予測

| 2024 Market Size | 133.55 (USD十億) |

| 2035 Market Size | 331.95 (米ドル十億) |

| CAGR (2025 - 2035) | 8.63% |

主要なプレーヤー

ヘクセル社(米国)、東レ株式会社(日本)、テイジン株式会社(日本)、SGLカーボンSE(ドイツ)、三菱ケミカル株式会社(日本)、ソルベイSA(ベルギー)、オーウェンズ・コーニング(米国)、BASF SE(ドイツ)、3M社(米国)、デュポン・デ・ヌモール社(米国)

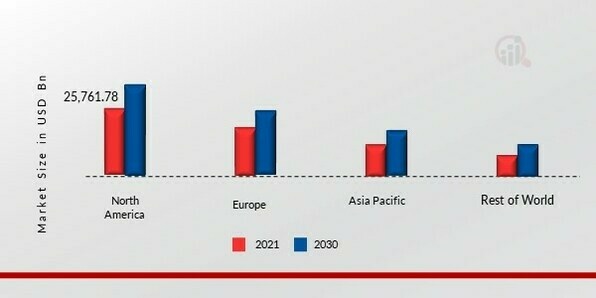

出典:二次研究、一次研究、市場調査未来データベースおよびアナリストレビュー。ヨーロッパの複合材料市場は、EUが2030年の新車CO2排出量目標を2021年レベルの50%削減に引き上げる提案を行ったため、2番目に大きな市場シェアを占めています。自動車メーカーは、電気自動車のアプリケーションシナリオに基づいて、温度変化への耐性、振動耐性、異なる温度での運用信頼性、耐久性など、さまざまな要件を課しています。さらに、ドイツの複合材料市場は最大の市場シェアを保持し、欧州地域で最も成長の早い市場でした。北米の複合材料市場は2022年から2030年にかけて7.46%のCAGRで成長すると予測されています。これは、自動車および輸送産業の成長によるものです。さらに、アメリカの複合材料市場は最大の市場シェアを保持し、地域で最も成長の早い市場でした。

出典:二次研究、一次研究、市場調査未来データベースおよびアナリストレビュー。ヨーロッパの複合材料市場は、EUが2030年の新車CO2排出量目標を2021年レベルの50%削減に引き上げる提案を行ったため、2番目に大きな市場シェアを占めています。自動車メーカーは、電気自動車のアプリケーションシナリオに基づいて、温度変化への耐性、振動耐性、異なる温度での運用信頼性、耐久性など、さまざまな要件を課しています。さらに、ドイツの複合材料市場は最大の市場シェアを保持し、欧州地域で最も成長の早い市場でした。北米の複合材料市場は2022年から2030年にかけて7.46%のCAGRで成長すると予測されています。これは、自動車および輸送産業の成長によるものです。さらに、アメリカの複合材料市場は最大の市場シェアを保持し、地域で最も成長の早い市場でした。