Tire Pressure Monitoring System Market Trends

Tire Pressure Monitoring System Market Research Report Information by Technology (Direct TPMS and Indirect TPMS), by Vehicle Type (Passenger Cars, Light Commercial Vehicle, And Heavy Commercial Vehicle), by Sales Channel (OEM and Aftermarket), and By Region (North America, Europe, Asia-Pacific, Middle East & Africa, and South America) –Market Forecast Till 2035

Market Summary

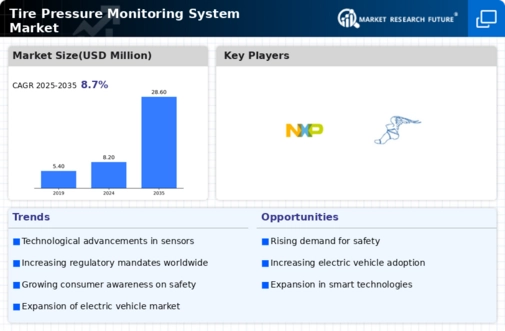

As per Market Research Future Analysis, the Global Tire Pressure Monitoring System (TPMS) Market was valued at USD 8.20 Million in 2024 and is projected to grow from USD 8.20 Billion in 2024 to USD 20.57 Billion by 2035, with a CAGR of 8.7% during the forecast period. The market is driven by the increasing adoption of TPMS in modern vehicles, technological advancements, and rising safety demands. The direct TPMS segment held approximately 85% of the market revenue in 2022, while passenger cars contributed around 68% to the market revenue. The OEM sales channel dominated the market, reflecting the integration of TPMS in new vehicles. Europe leads in market growth due to stringent safety regulations, while the Asia-Pacific region is witnessing rising awareness and demand for TPMS.

Key Market Trends & Highlights

Key trends driving the TPMS market include technological advancements and increasing vehicle safety regulations.

- TPMS market projected to grow from USD 8.2 Billion in 2024 to USD 22.3 Billion by 2032.

- Direct TPMS segment contributed ~85% to market revenue in 2022.

- Passenger cars accounted for ~68% of the TPMS market revenue in 2022.

- OEM sales channel held the majority market share in 2022.

Market Size & Forecast

| 2024 Market Size | USD 8.20 Billion |

| 2035 Market Size | USD 20.57 Billion |

| CAGR | 8.72% |

Major Players

NXP Semiconductors, The Goodyear Tire & Rubber Company, ZF Friedrichshafen AG, Shanghai Baolong Automotive Corporation, Bh Sens Group, Cub Elecparts Inc.

Market Trends

The increasing emphasis on vehicle safety and fuel efficiency appears to drive the adoption of Tire Pressure Monitoring Systems, indicating a shift towards more technologically advanced automotive solutions.

U.S. Department of Transportation

Tire Pressure Monitoring System Market Market Drivers

Market Growth Projections

The Global Tire Pressure Monitoring System Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 8.2 USD Billion in 2024 and further expanding to 28.6 USD Billion by 2035, the industry is on a trajectory of significant development. The compound annual growth rate of 12.04% from 2025 to 2035 suggests a robust market environment, driven by various factors including regulatory changes, technological advancements, and consumer preferences. This growth is indicative of the increasing importance of tire pressure monitoring systems in enhancing vehicle safety and efficiency.

Growth in Automotive Production

The Global Tire Pressure Monitoring System Market Industry is poised for growth due to the increasing production of vehicles globally. As automotive manufacturers ramp up production to meet rising consumer demand, the incorporation of TPMS becomes essential. This trend is particularly evident in emerging markets where vehicle ownership is on the rise. For example, countries in Asia-Pacific are witnessing a surge in automotive production, leading to a higher demand for TPMS. The market is projected to reach 28.6 USD Billion by 2035, reflecting the correlation between vehicle production rates and TPMS adoption.

Technological Advancements in TPMS

Technological advancements are significantly influencing the Global Tire Pressure Monitoring System Market Industry. Innovations such as direct TPMS, which provides real-time tire pressure data, and integration with vehicle infotainment systems enhance user experience and functionality. Furthermore, the development of smartphone applications that allow users to monitor tire pressure remotely is gaining traction. These advancements not only improve the effectiveness of TPMS but also encourage adoption among consumers who value convenience and technology. As these technologies continue to evolve, the market is expected to expand, with projections indicating a market value of 8.2 USD Billion in 2024.

Rising Awareness of Fuel Efficiency

Growing awareness regarding fuel efficiency is a key driver for the Global Tire Pressure Monitoring System Market Industry. Proper tire inflation is crucial for optimal fuel consumption, as under-inflated tires can lead to increased rolling resistance and, consequently, higher fuel usage. As consumers become more environmentally conscious and seek ways to reduce fuel costs, the demand for TPMS is likely to rise. This trend is further supported by studies indicating that maintaining correct tire pressure can improve fuel efficiency by up to 3.3 percent, making TPMS an attractive solution for both consumers and manufacturers.

Increasing Vehicle Safety Regulations

The Global Tire Pressure Monitoring System Market Industry is experiencing growth due to stringent vehicle safety regulations being implemented worldwide. Governments are mandating the installation of tire pressure monitoring systems in new vehicles to enhance road safety and reduce accidents caused by tire blowouts. For instance, the European Union has established regulations requiring all new passenger cars to be equipped with TPMS. This regulatory push is expected to drive the market significantly, as manufacturers adapt to comply with these standards, thereby increasing the adoption of TPMS in the automotive sector.

Consumer Demand for Enhanced Vehicle Features

Consumer preferences are shifting towards vehicles equipped with advanced safety and convenience features, driving the Global Tire Pressure Monitoring System Market Industry. As consumers increasingly prioritize safety, manufacturers are responding by integrating TPMS into their vehicles. This trend is evident in the growing number of vehicles that come standard with TPMS, as consumers view it as a necessary feature for modern vehicles. The expected compound annual growth rate of 12.04% from 2025 to 2035 indicates a robust market response to this consumer demand, further solidifying the role of TPMS in the automotive landscape.

Market Segment Insights

Tire Pressure Monitoring System Market Technology Segment Insights:

Tire Pressure Monitoring System Type Insights

Based on technology, the Tire Pressure Monitoring System Market is segmented into direct TPMS & indirect TPMS. The direct TPMS segment held the majority share in 2022, contributing around ~85 % to the market revenue. Direct TPMS involves the use of sensors installed inside the tires to constantly measure the air pressure and wirelessly transmit the readings to the vehicle's onboard computer.

These sensors are usually placed on the wheel valve stem or integrated within the wheel and are engineered to withstand tough conditions such as heat, moisture, and vibration. One of the benefits of Direct TPMS is its ability to deliver precise and dependable tire pressure readings. Additionally, it can detect sudden pressure drops, which is crucial in avoiding tire blowouts and other tire-related issues.

Tire Pressure Monitoring System Market Vehicle Type Segment Insights:

Tire Pressure Monitoring System Vehicle Type Insights

Based on vehicle type, the global tire pressure monitoring system is segmented into passenger cars, light commercial vehicles, and heavy commercial vehicles. The passenger cars segment held the majority share in 2022 contributing around ~68% to the market revenue. The passenger car TPMS market is driven by the growing need for safety and fuel efficiency. Underinflated tires can increase the chances of accidents, reduce fuel efficiency, and cause tire wear.

TPMS provides real-time tire pressure information, enabling drivers to take prompt action if the pressure drops below acceptable levels. This helps to prevent accidents and minimize maintenance costs related to tire wear. Moreover, the government regulations mandating the installation of TPMS in new vehicles have also contributed to the growth of the passenger car TPMS mark.

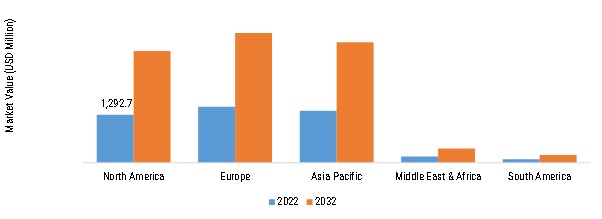

Figure 2: Tire Pressure Monitoring System Market, by Vehicle Type, 2022 & 2032 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Tire Pressure Monitoring System Market Sales Channel Segment Insights:

Tire Pressure Monitoring System Sales Channel Insights

Based on sales channel, the global tire pressure monitoring system is segmented into OEM and Aftermarket. By sales channel, OEM segment holds the majority market share in 2022 contributing majority of the market share. The TPMS systems that are installed by OEMs meet the specific requirements and standards of the automakers and are rigorously tested for accuracy, durability, and reliability.

Since most new vehicles come equipped with TPMS as standard equipment, the OEM channel is the primary sales channel for TPMS systems. The TPMS systems that are installed by OEMs offer several benefits, including seamless integration with the vehicle's onboard computer, accurate and reliable monitoring, and a long lifespan. The OEM TPMS systems have several advantages over aftermarket systems. Since the OEM TPMS systems are integrated into the vehicle's design, they offer better accuracy and reliability than aftermarket systems.

Get more detailed insights about Tire Pressure Monitoring System Market Research Report-Forecast to 2032

Regional Insights

By Region, the study provides market insights into North America, US, Europe, Asia-Pacific, Middle East & Africa, and South America. Europe, consisting of the Germany, UK, France, Italy, Spain, and rest of Europe, stands at the forefront of technological innovation in Tire Pressure Monitoring System Market.

The European TPMS market is expanding as a result of rising safety regulations implemented by both governments and automotive manufacturers. TPMS is an electronic system that monitors tire pressure and alerts drivers when the pressure falls below a specified level, mitigating the risk of accidents.

The European Union has required TPMS in all new vehicles, leading to an increase in TPMS installations in passenger vehicles, which comprise a significant portion of the European automotive market. TPMS has also been integrated into commercial vehicles, such as trucks and buses, owing to their high mileage and the need for better fuel efficiency. The rising demand for safety features in vehicles is one of the main drivers of the European TPMS market.

Figure 3: Tire Pressure Monitoring System Market Size By Region 2022&2032

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Further, the major countries studied in the market report are the U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, South Korea, South Africa, UAE, Saudi Arabia, Argentina and Brazil.

The North American market for tire pressure monitoring systems (TPMS) is predicted to experience a moderate rate of growth in the forthcoming years, fueled by various factors. These include heightened safety concerns, government regulations mandating the use of TPMS in vehicles, and the increasing prevalence of connected cars. The trend of connected cars is expected to have an even greater impact on the adoption of TPMS, as these systems can be integrated with other vehicle sensors and connected to the internet to enable real-time monitoring.

Furthermore, the adoption of TPMS in the country is expected to be driven by rising safety concerns and the growing trend of connected cars. In summary, the North American TPMS market is projected to grow at a moderate pace in the near future, driven by a combination of government regulations, safety concerns, and the increasing prevalence of connected cars.

The Asia Pacific TPMS market is expected to experience several key trends in the coming years, including rising awareness about the benefits of TPMS among drivers and fleet owners, increasing government regulations mandating the installation of TPMS in new vehicles, growing demand for passenger cars and light commercial vehicles in the region, and technological advancements in TPMS systems, such as the development of wireless TPMS systems.

Japan and South Korea are also expected to be major markets, due to the presence of established automotive industries and high levels of consumer awareness about vehicle safety. Some of the key players operating in the Asia Pacific TPMS market include Continental AG, Denso Corporation, NXP Semiconductors, Robert Bosch GmbH, Schrader International, and ZF Friedrichshafen AG, among others. These players are focusing on product innovation and strategic partnerships to gain a competitive edge in the market.

Key Players and Competitive Insights

With a strong presence across different verticals and geographies, the Tire Pressure Monitoring System Market is highly competitive and dominated by established, pure-play vendors. These vendors have a robust geographic footprint and partner ecosystem to cater to diverse customer segments. The Tire Pressure Monitoring System Market is highly competitive, with many vendors offering similar products and services.

The major players in the market include NXP Semiconductors, The Goodyear Tire & Rubber Company, ZF, Friedrichshafen Ag, Shanghai Baolong Automotive Corporation, Bh Sens Group, Cub Elecparts Inc. and Others. ZF Friedrichshafen AG is focused on leveraging business opportunities in the global market. The company develops innovative products and solutions by investing extensively in R&D to increase its global market share.

Further, the company spent around USD 3,645 million on research & development expenditure which also includes the growth of commercial vehicle segment up to 17% in 2022. It also focuses on strategic contracts, and partnerships with other players in the value chain to offer combined solutions to increase its regional presence.

Key Companies in the Tire Pressure Monitoring System Market market include

Industry Developments

-

In June 2023, The Goodyear Tyre & Rubber Company unveiled racing tyres with the real-time intelligence capability to record tyre pressure and temperature, which will be featured on the Le Mans racing championship on 10th June.

-

In June 2022, Samsara's Inc has collaborated with General Motors for optimizing cloud-based fleet management. Samsara's platform is installed on the vehicle dashboard which will provide vehicle insight such as fleet vehicle location, fuel usage and levels, speed as well as tire pressure along with additional operations data on the platforms.

Future Outlook

Tire Pressure Monitoring System Market Future Outlook

The Tire Pressure Monitoring System Market is projected to grow at a 8.72% CAGR from 2025 to 2035, driven by increasing vehicle safety regulations, technological advancements, and rising consumer awareness.

New opportunities lie in:

- Develop advanced TPMS integrating AI for predictive maintenance solutions.

- Expand into emerging markets with tailored, cost-effective TPMS solutions.

- Leverage partnerships with automotive manufacturers for OEM integration of TPMS.

By 2035, the Tire Pressure Monitoring System Market is expected to be robust, reflecting substantial growth and innovation.

Market Segmentation

Tire Pressure Monitoring System Regional Outlook

- US

- Canada

Tire Pressure Monitoring System Technology Outlook

- Direct TPMS

- Indirect TPMS

Tire Pressure Monitoring System Vehicle Type Outlook

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Tire Pressure Monitoring System Sales Channel Outlook

- OEM

- Aftermarket

Report Scope

| Attribute/Metric | Details |

| Market Size 2024 | USD 8.2 Billion |

| Market Size 2035 | 20.57 (Value (USD Million)) |

| Compound Annual Growth Rate (CAGR) | 8.72% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019- 2022 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Technology, Vehicle Type, Sales Channel and Region |

| Geographies Covered | Europe, North America, Asia-Pacific, Middle East & Africa, and South America |

| Countries Covered | The U.S, Germany, Canada, U.K., Italy, France, Spain, Japan, China, India, South Korea, South Africa, UAE, Saudi Arabia, Argentina Brazil, and others. |

| Key Companies Profiled | NXP Semiconductors, The Goodyear Tire & Rubber Company, ZF, Friedrichshafen Ag, Shanghai Baolong Automotive Corporation, Bh Sens Group, Cub Elecparts Inc. and Others. |

| Key Market Opportunities | · Increasing Sales of Luxury Cars |

| Key Market Dynamics | · Rising Adoption of Tire Pressure Monitoring Systems (TPMS) In Vehicles · Growing Demand for The Safety of A Vehicle |

| Market Size 2025 | 8.92 (Value (USD Million)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the Tire Pressure Monitoring System Market?

The Tire Pressure Monitoring System Market size is expected to be valued at USD 4,445.5 Million in 2022.

What is the growth rate of the Tire Pressure Monitoring System Market?

The global market is projected to grow at a CAGR of 8.7% during the forecast period, 2024-2032.

Which region held the largest market share in the Tire Pressure Monitoring System Market?

Europe has the largest share of the global market.

Who are the key players in the Tire Pressure Monitoring System Market?

The key players in the market are NXP Semiconductors, The Goodyear Tire & Rubber Company, ZF, Friedrichshafen Ag, Shanghai Baolong Automotive Corporation, Bh Sens Group, Cub Elecparts Inc. and Others.

Which Technology led the Tire Pressure Monitoring System Market?

The direct TPMS category dominated the market in 2022.

-

Table of Contents

-

Executive Summary 19

- GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY 21

- GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE 22

- GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL 23

-

Market Introduction 24

- DEFINITION 24

- Scope of the Study 24

- RESEARCH OBJECTIVE 24

- MARKET STRUCTURE 25

-

Research Methodology 26

- RESEARCH PROCESS 26

- PRIMARY RESEARCH 27

- SECONDARY RESEARCH 28

- MARKET SIZE ESTIMATION 29

- FORECAST MODEL 30

- LIST OF ASSUMPTIONS 31

-

MARKET DYNAMICS 32

- INTRODUCTION 32

-

DRIVERS 33

- RISING ADOPTION OF TIRE PRESSURE MONITORING SYSTEMS (TPMS) IN VEHICLES 33

- GROWING DEMAND FOR THE SAFETY OF A VEHICLE 33

- DRIVER IMPACT ANALYSIS 34

-

RESTRAINT 34

- HIGH COST AND COMPLEXITY OF THE TPMS 34

- RESTRAINT IMPACT ANALYSIS 35

-

OPPORTUNITY 35

- INCREASING SALES OF LUXURY CARS 35

-

COVID-19 IMPACT ON THE AUTOMOTIVE INDUSTRY 35

- IMPACT ON THE GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET 36

- IMPACT ON MARKET DEMAND 37

- IMPACT ON PRICING 37

-

MARKET FACTOR ANALYSIS 38

-

PORTER’S FIVE FORCES MODEL 38

- THREAT OF NEW ENTRANTS 39

- BARGAINING POWER OF SUPPLIERS 39

- THREAT OF SUBSTITUTES 39

- BARGAINING POWER OF BUYERS 39

- INTENSITY OF RIVALRY 40

-

SUPPLY CHAIN ANALYSIS 40

- DESIGN & DEVELOPMENT 41

- RAW MATERIAL/COMPONENT SUPPLY 41

- MANUFACTURE 41

- DISTRIBUTION/SUPPLY 41

- END USER 41

-

PORTER’S FIVE FORCES MODEL 38

-

VEHICLE ANALYSIS 42

- EV CHARGING PILES (DC, AC) 42

- ADAS CALIBRATION 42

- FOUR WHEEL ALLIGNMENT 43

- BATTERY TEST 43

- TIRE PATTERN DETECTION/MONITORING 43

- COMMERCIAL VEHICLE REGULATION MANAGEMENT 44

-

GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY 45

- OVERVIEW 45

- DIRECT TPMS 46

- INDIRECT TPMS 46

-

GLOBAL TIRE PRESSURE MONITORING SYSTEM, BY VEHICLE TYPE 47

- OVERVIEW 47

- PASSENGER CARS 48

- LIGHT COMMERCIAL VEHICLE 48

- HEAVY COMMERCIAL VEHICLE 48

-

GLOBAL TIRE PRESSURE MONITORING SYSTEM, BY SALES CHANNEL 50

- OVERVIEW 50

- OEM 51

- AFTERMARKET 51

-

GLOBAL TIRE PRESSURE MONITORING SYSTEM, BY REGION 52

-

OVERVIEW 52

- GLOBAL TIRE PRESSURE MONITORING SYSTEM, BY REGION, 2018–2032 53

-

NORTH AMERICA 54

- NORTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY COUNTRY, 2018–2032 54

- NORTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2018–2032 55

- NORTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2032 55

- NORTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL, 2018–2032 55

- US 56

- CANADA 57

- MEXICO 58

-

EUROPE 59

- EUROPE: TIRE PRESSURE MONITORING SYSTEM MARKET, BY COUNTRY, 2018–2032 59

- EUROPE: TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2018–2032 60

- EUROPE: TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2032 60

- EUROPE: TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL, 2018–2032 60

- UK 61

- GERMANY 62

- FRANCE 63

- ITALY 64

- SPAIN 65

- REST OF EUROPE 66

-

ASIA-PACIFIC 67

- ASIA-PACIFIC: TIRE PRESSURE MONITORING SYSTEM MARKET, BY COUNTRY, 2018–2032 68

- ASIA-PACIFIC: TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2018–2032 68

- ASIA-PACIFIC: TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2032 68

- ASIA-PACIFIC: TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL, 2018–2032 69

- CHINA 69

- INDIA 70

- JAPAN 71

- SOUTH KOREA 72

- REST OF ASIA-PACIFIC 73

-

MIDDLE EAST & AFRICA 75

- MIDDLE EAST & AFRICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY COUNTRY, 2018–2032 75

- MIDDLE EAST & AFRICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2018–2032 76

- MIDDLE EAST & AFRICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2032 76

- MIDDLE EAST & AFRICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL, 2018–2032 76

- UAE 77

- SAUDI ARABIA 78

- SOUTH AFRICA 79

- REST OF MEA 80

-

SOUTH AMERICA 81

- SOUTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY COUNTRY, 2018–2032 81

- SOUTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY TECHNOLOGY, 2018–2032 82

- SOUTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY VEHICLE TYPE, 2018–2032 82

- SOUTH AMERICA: TIRE PRESSURE MONITORING SYSTEM MARKET, BY SALES CHANNEL, 2018–2032 82

- BRAZIL 83

- ARGENTINA 84

- REST OF SOUTH AMERICA 85

-

OVERVIEW 52

-

Competitive Landscape 86

- COMPETITIVE OVERVIEW 86

- COMPETITIVE DASHBOARD 87

- MARKET SHARE ANALYSIS 88

-

KEY DEVELOPMENTS IN THE GLOBAL TIRE PRESSURE MONITORING SYSTEM MARKET 88

- KEY DEVELOPMENTS: CONTRACTS & AGREEMENTS 88

- KEY DEVELOPMENTS: PARTNERSHIPS & COLLABORATIONS 89

- KEY DEVELOPMENTS: PRODUCT DEVELOPMENTS/LAUNCHES 89

- COMPETITION BENCHMARKING 91

-

COMPANY PROFILE 92

-

NXP SEMICONDUCTORS 92

- COMPANY OVERVIEW 92

- FINANCIAL OVERVIEW 93

- PRODUCTS OFFERED 93

- KEY DEVELOPMENTS 94

- SWOT ANALYSIS 94

- KEY STRATEGIES 94

-

THE GOODYEAR TIRE & RUBBER COMPANY 95

- COMPANY OVERVIEW 95

- FINANCIAL OVERVIEW 96

- PRODUCTS OFFERED 97

- KEY DEVELOPMENTS 97

- SWOT ANALYSIS 99

- KEY STRATEGIES 99

-

ZF FRIEDRICHSHAFEN AG 100

- COMPANY OVERVIEW 100

- FINANCIAL OVERVIEW 101

- PRODUCTS OFFERED 101

- KEY DEVELOPMENTS 102

- SWOT ANALYSIS 102

- KEY STRATEGIES 102

-

SHANGHAI BAOLONG AUTOMOTIVE CORPORATION 103

- COMPANY OVERVIEW 103

- FINANCIAL OVERVIEW 104

- PRODUCTS OFFERED 104

- KEY DEVELOPMENTS 105

- SWOT ANALYSIS 105

- KEY STRATEGIES 105

-

BH SENS GROUP 106

- COMPANY OVERVIEW 106

- FINANCIAL OVERVIEW 106

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 106

- KEY DEVELOPMENTS 107

- SWOT ANALYSIS 107

- KEY STRATEGIES 107

-

CUB ELECPARTS INC 108

- COMPANY OVERVIEW 108

- FINANCIAL OVERVIEW 109

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 109

- KEY DEVELOPMENTS 110

- SWOT ANALYSIS 110

- KEY STRATEGIES 110

-

INTELLIGENT TECHNOLOGY CORP, LTD. (AUTEL) 111

- COMPANY OVERVIEW 111

- FINANCIAL OVERVIEW 111

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 112

- KEY DEVELOPMENTS 113

- SWOT ANALYSIS 113

- KEY STRATEGIES 114

-

INFINEON TECHNOLOGIES AG 115

- COMPANY OVERVIEW 115

- FINANCIAL OVERVIEW 115

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 116

- KEY DEVELOPMENTS 116

- SWOT ANALYSIS 117

- KEY STRATEGIES 117

-

HAMATON LTD (HAMATON AUTOMOTIVE TECHNOLOGY CO. LTD) 118

- COMPANY OVERVIEW 118

- FINANCIAL OVERVIEW 118

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 119

- KEY DEVELOPMENTS 119

- SWOT ANALYSIS 120

- KEY STRATEGIES 120

-

BENDIX COMMERCIAL VEHICLE SYSTEMS LLC (KNORR-BREMSE AG) 121

- COMPANY OVERVIEW 121

- FINANCIAL OVERVIEW 122

- PRODUCTS/SERVICES/SOLUTIONS OFFERED 122

- KEY DEVELOPMENTS 123

- SWOT ANALYSIS 124

- KEY STRATEGIES 124

-

VALOR EUROPE GMBH 125

- COMPANY OVERVIEW 125

- FINANCIAL OVERVIEW 125

- PRODUCTS OFFERED 125

- KEY DEVELOPMENTS 125

- SWOT ANALYSIS 126

- KEY STRATEGIES 126

-

VALEO 127

- COMPANY OVERVIEW 127

- FINANCIAL OVERVIEW 128

- PRODUCTS OFFERED 128

-

NXP SEMICONDUCTORS 92

-

Tire Pressure Monitoring System Market Segmentation

Market Segmentation Overview

- Detailed segmentation data will be available in the full report

- Comprehensive analysis by multiple parameters

- Regional and country-level breakdowns

- Market size forecasts by segment

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment