Market Trends

Key Emerging Trends in the Styrene Butadiene Styrene Market

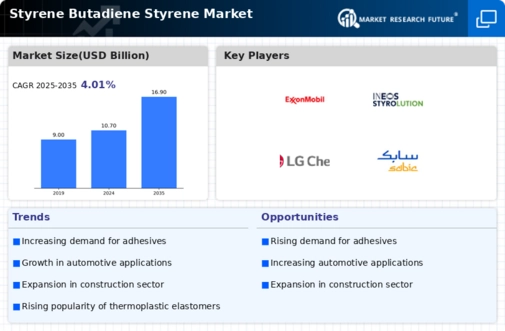

The Styrene Butadiene Styrene (SBS) market has been experiencing dynamic trends in recent times, shaping the industry landscape and influencing key stakeholders. One prominent trend is the growing demand for SBS in the automotive sector, particularly in tire manufacturing. As the automotive industry continues to expand globally, the need for high-performance and durable tires has surged, propelling the demand for SBS as a crucial component in tire formulations. This trend is driven by SBS's exceptional properties, such as improved abrasion resistance, flexibility, and enhanced grip, making it an ideal material for tire tread compounds.

Another significant market trend is the increasing focus on sustainable and eco-friendly solutions. Environmental concerns and regulatory pressures have prompted industries to adopt more sustainable practices, and the SBS market is no exception. Manufacturers are increasingly exploring bio-based and recycled sources for styrene and butadiene, aiming to reduce the environmental impact of SBS production. This shift towards sustainability not only addresses ecological concerns but also aligns with the growing consumer preference for eco-friendly products, influencing purchasing decisions across various industries.

Furthermore, the construction industry has emerged as a key driver for the SBS market. The versatile nature of SBS makes it a valuable component in the production of bitumen-modified materials used in roofing and waterproofing applications. The construction sector's steady growth, coupled with the need for durable and weather-resistant materials, has contributed to the rising demand for SBS in these applications. As urbanization and infrastructure development continue globally, the construction industry is expected to remain a major consumer of SBS in the foreseeable future.

The market trend of regional expansion is also noteworthy in the SBS industry. Manufacturers are strategically expanding their production capacities and distribution networks to tap into emerging markets and meet the growing demand for SBS. Developing economies, in particular, are witnessing increased infrastructure development and industrialization, driving the need for SBS in various applications. Market players are establishing collaborations and partnerships to strengthen their presence in these regions, aligning their strategies with the evolving global economic landscape.

Moreover, technological advancements play a pivotal role in shaping the market trends of SBS. Ongoing research and development efforts focus on enhancing the performance characteristics of SBS, exploring novel applications, and improving production processes. Innovation in polymer modification techniques and the development of advanced formulations contribute to the evolution of SBS products, meeting the diverse needs of end-users across industries.

Leave a Comment