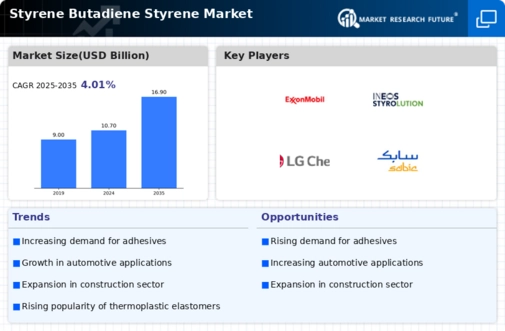

Market Share

Styrene Butadiene Styrene Market Share Analysis

The Styrene Butadiene Styrene (SBS) market, a key player in the global synthetic rubber industry, employs various market share positioning strategies to maintain its competitive edge. One prominent strategy is product differentiation, where SBS manufacturers focus on developing unique features or enhancing product performance. This approach enables them to cater to specific customer needs and preferences, thereby carving out a distinct market niche. By offering specialized grades of SBS tailored for diverse applications, such as automotive tires, adhesives, and asphalt modification, companies can capture a larger share of the market by meeting the varied demands of different industries.

Moreover, pricing strategies play a pivotal role in market share positioning within the SBS sector. Some manufacturers adopt a cost leadership approach, striving to produce SBS at a lower cost than competitors. This allows them to offer competitive prices, attract price-sensitive customers, and gain a larger market share. Conversely, others opt for a premium pricing strategy, emphasizing the superior quality or unique features of their SBS products. This targets customers willing to pay a premium for higher value, helping companies capture a niche segment while potentially increasing profit margins.

In addition to product differentiation and pricing, geographic expansion is another critical aspect of market share positioning in the SBS market. Companies often explore new regions and untapped markets to broaden their customer base and increase sales. By establishing a strong presence in emerging economies with growing industrial sectors, SBS manufacturers can capitalize on rising demand for synthetic rubber. This expansion strategy involves understanding regional preferences, adapting to local regulations, and building strong distribution networks to ensure efficient product availability.

Collaborations and strategic partnerships also play a crucial role in the market positioning of SBS. Collaborating with other industry players, suppliers, or research institutions enables companies to leverage shared resources, knowledge, and technologies. Joint ventures or alliances can lead to the development of innovative SBS products and improved production processes, strengthening a company's competitive position. Moreover, strategic partnerships can facilitate access to new markets and distribution channels, providing a competitive advantage in the ever-evolving global synthetic rubber landscape.

Furthermore, sustainability and environmental considerations increasingly influence market share positioning in the SBS sector. As environmental awareness grows, consumers and industries are seeking eco-friendly alternatives. SBS manufacturers adopting sustainable practices, such as incorporating bio-based raw materials or implementing energy-efficient production processes, can gain a competitive edge. Embracing sustainability not only aligns with societal expectations but also positions companies favorably in the eyes of environmentally conscious customers, potentially expanding their market share.

Leave a Comment