Growth in Consumer Goods Sector

The Styrene Butadiene Styrene Market is benefiting from the robust growth in the consumer goods sector. SBS is widely used in the production of various consumer products, including packaging materials, toys, and household items, due to its excellent elasticity and durability. The increasing demand for high-quality consumer goods, coupled with the trend towards lightweight and flexible packaging solutions, is driving the consumption of SBS. Market forecasts indicate that the consumer goods sector will contribute significantly to the overall growth of the Styrene Butadiene Styrene Market, with an expected annual growth rate of around 5% over the next few years. As consumer preferences evolve, the Styrene Butadiene Styrene Market is likely to adapt, ensuring that it meets the diverse needs of this dynamic market.

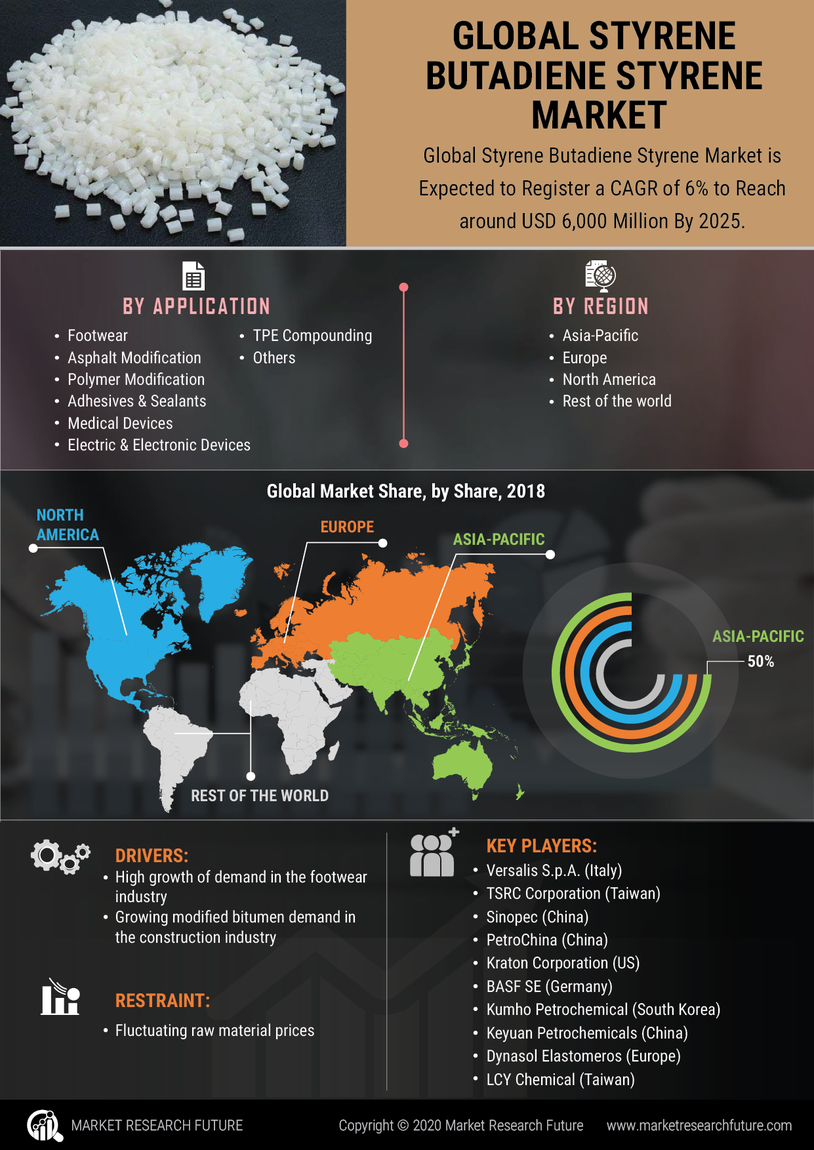

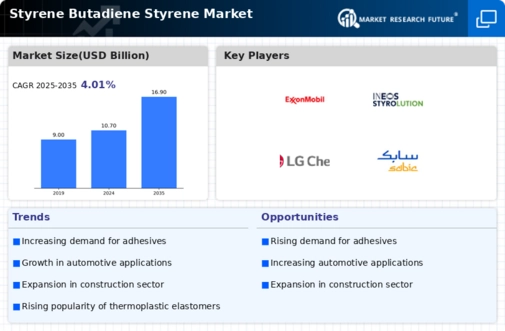

Innovations in Polymer Technology

Innovations in polymer technology are significantly influencing the Styrene Butadiene Styrene Market. Advances in production techniques and formulations have led to the development of high-performance SBS grades that offer enhanced properties such as improved thermal stability and resistance to aging. These innovations are attracting a broader range of applications, particularly in the adhesives and sealants market, where performance is paramount. Market data indicates that the demand for advanced SBS formulations is expected to grow by approximately 6% over the next five years, driven by the need for superior performance in various industrial applications. As manufacturers continue to invest in research and development, the Styrene Butadiene Styrene Market is likely to see a proliferation of innovative products that cater to evolving consumer needs.

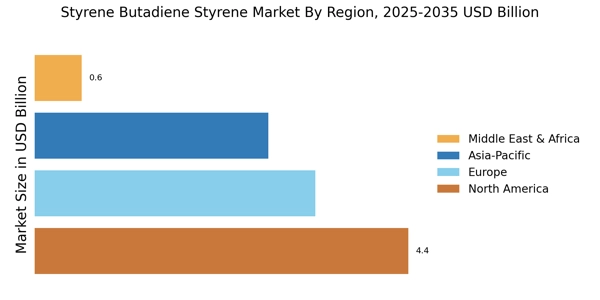

Rising Demand in Automotive Sector

The Styrene Butadiene Styrene Market is experiencing a notable surge in demand from the automotive sector. This increase is primarily driven by the growing need for lightweight and durable materials that enhance fuel efficiency and reduce emissions. Styrene butadiene styrene (SBS) is extensively utilized in manufacturing tires, seals, and gaskets, which are critical components in modern vehicles. According to recent data, the automotive industry accounts for a substantial share of the SBS market, with projections indicating a compound annual growth rate of approximately 5% over the next few years. As automotive manufacturers continue to innovate and prioritize sustainability, the demand for SBS is likely to remain robust, further solidifying its position within the Styrene Butadiene Styrene Market.

Expansion in Construction Applications

The Styrene Butadiene Styrene Market is witnessing significant growth due to its expanding applications in the construction sector. SBS is increasingly favored for its excellent adhesive properties and flexibility, making it ideal for roofing, flooring, and waterproofing materials. The construction industry has seen a resurgence, with investments in infrastructure and residential projects driving the demand for high-performance materials. Recent statistics suggest that the construction sector's consumption of SBS is projected to grow at a rate of 4% annually, reflecting the material's versatility and effectiveness. As urbanization continues to rise, the Styrene Butadiene Styrene Market is poised to benefit from this trend, as builders seek reliable solutions for modern construction challenges.

Increasing Focus on Sustainable Materials

The Styrene Butadiene Styrene Market is increasingly aligning with sustainability trends as manufacturers seek eco-friendly alternatives. The push for sustainable materials is prompting the development of bio-based SBS products, which are derived from renewable resources. This shift is not only responding to consumer demand for greener products but also addressing regulatory pressures aimed at reducing environmental impact. Recent market analyses suggest that the share of sustainable SBS in the overall market could reach 20% by 2030, reflecting a growing commitment to sustainability within the industry. As companies strive to enhance their environmental credentials, the Styrene Butadiene Styrene Market is likely to witness a transformation that prioritizes sustainable practices and products.