Market Share

Solid State Battery Market Share Analysis

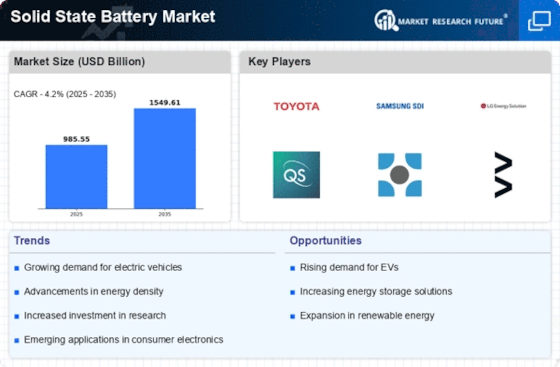

To get a significant part of the powerful energy stockpiling market, solid state battery organizations should carry out piece of the pie situating systems that encourage development, give an upper hand, and secure an essential piece of the market. Mechanical separation is a chief methodology, by which enhancements in energy thickness, wellbeing credits, and assembling systems arise as urgent distinctive elements, laying out associations as leaders in the arrangement of reliable and high-performing strong state batteries. In the solid-state battery industry, vital partnerships speed up the periods of improvement, testing, and commercialization. Auto makers, innovation suppliers, and examination foundations are framing associations with enterprises to propel jolt and electric vehicle innovation. Associations are decisively framing partnerships with auto producers to acquire contracts for solid state batteries used in electric vehicles. This situating lays out the organizations as dependable partners in the continuous course of jolt. Associations that apportion assets towards innovative work focus on clever arrangements, specialized snags, and development to lay down a good foundation for themselves as leaders in the strong state battery area and to separate themselves from rivals. Geographic expansion is a fundamental methodology for partnerships to accomplish a bigger portion of the overall industry on the worldwide stage by working with the satisfaction of differed market requests, exploring complex administrative conditions, and improving stock chains. The essential position of a brand is of foremost significance in the solid-state battery industry, as it effectively improves mechanical ability, draw in clients, and brace industry coalitions — all of which add to the development of piece of the pie. Laying out an expense administrative role is of vital significance in the strong state battery industry, as it successfully mitigates creation costs and upgrades economies of scale, consequently situating firms as suitable and financially savvy choices. Administrative consistence and certificate assume a crucial part in laying out the market position of solid-state batteries, supporting their validity, wellbeing, and constancy, and giving organizations an upper hand. In the strong state battery industry, it is basic to carry out client driven techniques to accomplish separation, energize positive verbal, secure repeating business, and grow piece of the pie. Mechanical separation, vital associations, arrangement with the auto area, interest in innovative work, geographic broadening, brand situating, cost administration, administrative consistence, and client driven drives are parts of the strong state battery industry's piece of the pie situating techniques.

Leave a Comment