-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

Definition

-

Scope of the Study

- Research

- Assumptions

- Limitations

-

Objective

-

3.

-

RESEARCH METHODOLOGY

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

- Primary

- Breakdown of Primary

-

Interviews and Information Gathering Process

-

Respondents

-

Forecasting Modality

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

-

3.7.

-

Data Triangulation

-

Validation

-

MARKET DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

4.4.

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining Power

- Bargaining Power of Buyers

- Threat

- Threat of Substitutes

- Intensity

-

of Suppliers

-

of New Entrants

-

of Rivalry

-

COVID-19 Impact Analysis

- Market Impact

- Regional Impact

- Opportunity and Threat

-

Analysis

-

Analysis

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE

-

Overview

-

Low Density Polyethylene (LDPE)

-

6.3.

-

Linear Low Density Polyethylene (LLDPE)

-

High Density Polyethylene

-

(HDPE)

-

Others

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET,

-

BY APPLICATION

-

Overview

-

Water Supply

-

7.3.

-

Oil And Gas

-

Sewage Systems

-

Agricultural Applications

-

Others

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET, BY

-

END-USER

-

Overview

-

Building and Construction

-

Oil & Gas Industry

-

Municipal

-

Electronics

-

& Telecom

-

Agriculture

-

GLOBAL POLYETHYLENE PIPES

-

FITTINGS MARKET, BY REGION

-

Overview

-

North America

- U.S.

- Canada

-

Europe

- France

- U.K

- Italy

- Spain

- Rest of Europe

-

9.3.1.

-

Germany

-

Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

-

9.4.4.

-

South Korea

-

Rest of the World

- Middle East

- Africa

- Latin America

-

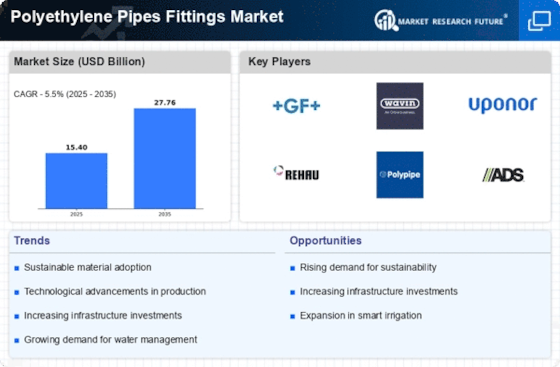

COMPETITIVE LANDSCAPE

-

10.1.

-

Overview

-

Competitive Analysis

-

Market Share Analysis

-

Major Growth Strategy in the Global Polyethylene pipes fittings Market,

-

Competitive Benchmarking

-

Leading Players in Terms

-

of Number of Developments in the Global Polyethylene pipes fittings Market,

-

Key developments and Growth Strategies

- New Type Launch/Application

- Merger & Acquisitions

- Joint

-

Deployment

-

Ventures

-

Major Players Financial Matrix

- Sales

- Major Players R&D Expenditure.

-

& Operating Income, 2022

-

COMPANY PROFILES

-

JM Eagle.

- Financial Overview

- Types

- Key Developments

- SWOT Analysis

- Key Strategies

-

11.1.1.

-

Company Overview

-

Offered

-

Chevron Phillips Chemical Company

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- SWOT

- Key Strategies

-

Analysis

-

Aliaxis

- Financial Overview

- Types

- Key Developments

- SWOT Analysis

- Key Strategies

-

11.3.1.

-

Company Overview

-

Offered

-

WL Plastics

- Company

- Financial Overview

- Types Offered

- Key Developments

- SWOT Analysis

-

Overview

-

11.4.6.

-

Key Strategies

-

Jain Irrigation Systems

- Company

- Financial Overview

- Types Offered

- Key Developments

- SWOT Analysis

-

Overview

-

11.5.6.

-

Key Strategies

-

PIPELIFE INTERNATIONAL

- Company

- Financial Overview

- Types Offered

- Key Developments

- SWOT Analysis

-

Overview

-

11.6.6.

-

Key Strategies

-

Nandi Group

- Company Overview

- Financial Overview

- Types Offered

- SWOT Analysis

- Key Strategies

-

11.7.4.

-

Key Developments

-

Blue Diamond Industries

- Company Overview

- Financial Overview

- Types Offered

- SWOT Analysis

- Key Strategies

-

11.8.4.

-

Key Developments

-

National Pipe & Plastics.

- Company Overview

- Financial Overview

- Types Offered

- SWOT Analysis

- Key Strategies

-

11.9.4.

-

Key Developments

-

Kubota ChemiX

- Company Overview

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.10.2.

-

Financial Overview

-

11.11.

-

FLO-TEK

-

11.11.5.

-

SWOT Analysis

-

Olayan Group

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.12.5.

-

SWOT Analysis

-

Pexmart

- Company Overview

- Financial Overview

- Key Developments

- SWOT Analysis

- Key Strategies

-

11.13.3.

-

Types Offered

-

LESSO

- Company

- Financial Overview

- Types Offered

- Key Developments

- SWOT Analysis

-

Overview

-

11.14.6.

-

Key Strategies

-

Cangzhou Mingzhu

- Company Overview

- Financial Overview

- Types Offered

- SWOT Analysis

- Key Strategies

-

11.15.4.

-

Key Developments

-

Junxing Pipe

- Company Overview

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.16.2.

-

Financial Overview

-

11.17.

-

Ginde Pipe

-

11.17.5.

-

SWOT Analysis

-

Chinaust Group

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.18.5.

-

SWOT Analysis

-

Bosoar Pipe

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.19.5.

-

SWOT Analysis

-

Newchoice Pipe

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

11.20.5.

-

SWOT Analysis

-

Shandong Shenbon

- Company Overview

- Financial Overview

- Types Offered

- Key Developments

- Key Strategies

-

Plastics

-

11.21.5.

-

SWOT Analysis

-

Jinniu Power

- Company Overview

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

- Company Overview

- Financial

- Types Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Industry Science and Technology

-

11.22.2.

-

Financial Overview

-

11.23.

-

Qingdao Yutong Pipeline

-

11.23.2.

-

Financial Overview

-

11.24.

-

HongYue Plastic Group

-

Overview

-

11.25.

-

Especially Nick Tube

-

Overview

-

11.26.

-

ARON New Materials

-

Overview

-

11.27.

-

Zhejiang Weixing

-

Overview

-

12.

-

APPENDIX

-

References

-

Related Reports

-

-

LIST OF TABLES

-

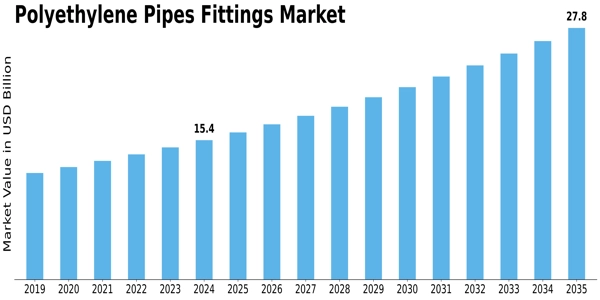

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET,

-

SYNOPSIS, 2025-2034

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET,

-

ESTIMATES & FORECAST, 2025-2034 (USD BILLION)

-

GLOBAL POLYETHYLENE

-

PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

GLOBAL

-

POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD

-

BILLION)

-

NORTH AMERICA POLYETHYLENE PIPES FITTINGS MARKET, BY

-

TYPE, 2025-2034 (USD BILLION)

-

NORTH AMERICA POLYETHYLENE PIPES

-

FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

NORTH

-

AMERICA POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

NORTH AMERICA POLYETHYLENE PIPES FITTINGS MARKET, BY COUNTRY, 2025-2034

-

(USD BILLION)

-

U.S. POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE,

-

U.S. POLYETHYLENE PIPES FITTINGS MARKET,

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

U.S. POLYETHYLENE PIPES

-

FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

CANADA

-

POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

TABLE

-

CANADA POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

CANADA POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034

-

(USD BILLION)

-

EUROPE POLYETHYLENE PIPES FITTINGS MARKET, BY

-

TYPE, 2025-2034 (USD BILLION)

-

EUROPE POLYETHYLENE PIPES FITTINGS

-

MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

EUROPE POLYETHYLENE

-

PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

TABLE 19

-

EUROPE POLYETHYLENE PIPES FITTINGS MARKET, BY COUNTRY, 2025-2034 (USD BILLION)

-

GERMANY POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034

-

(USD BILLION)

-

GERMANY POLYETHYLENE PIPES FITTINGS MARKET, BY

-

APPLICATION, 2025-2034 (USD BILLION)

-

GERMANY POLYETHYLENE PIPES

-

FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

FRANCE

-

POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

TABLE

-

FRANCE POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

FRANCE POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034

-

(USD BILLION)

-

ITALY POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE,

-

ITALY POLYETHYLENE PIPES FITTINGS MARKET,

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

ITALY POLYETHYLENE PIPES

-

FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

SPAIN

-

POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

TABLE

-

SPAIN POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

SPAIN POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034

-

(USD BILLION)

-

U.K POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE,

-

U.K POLYETHYLENE PIPES FITTINGS MARKET,

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

U.K POLYETHYLENE PIPES

-

FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

REST OF

-

EUROPE POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

REST OF EUROPE POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034

-

(USD BILLION)

-

REST OF EUROPE POLYETHYLENE PIPES FITTINGS MARKET,

-

BY END-USER, 2025-2034 (USD BILLION)

-

ASIA PACIFIC POLYETHYLENE

-

PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

ASIA

-

PACIFIC POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

ASIA PACIFIC POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034

-

(USD BILLION)

-

ASIA PACIFIC POLYETHYLENE PIPES FITTINGS MARKET,

-

BY COUNTRY, 2025-2034 (USD BILLION)

-

JAPAN POLYETHYLENE PIPES

-

FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

JAPAN POLYETHYLENE

-

PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

TABLE

-

JAPAN POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

CHINA POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD

-

BILLION)

-

CHINA POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION,

-

CHINA POLYETHYLENE PIPES FITTINGS MARKET,

-

BY END-USER, 2025-2034 (USD BILLION)

-

INDIA POLYETHYLENE PIPES

-

FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

INDIA POLYETHYLENE

-

PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

TABLE

-

INDIA POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

AUSTRALIA POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034

-

(USD BILLION)

-

AUSTRALIA POLYETHYLENE PIPES FITTINGS MARKET,

-

BY APPLICATION, 2025-2034 (USD BILLION)

-

AUSTRALIA POLYETHYLENE

-

PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

TABLE 54

-

SOUTH KOREA POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

SOUTH KOREA POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION,

-

SOUTH KOREA POLYETHYLENE PIPES FITTINGS

-

MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

REST OF ASIA-PACIFIC

-

POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

TABLE

-

REST OF ASIA-PACIFIC POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034

-

(USD BILLION)

-

REST OF ASIA-PACIFIC POLYETHYLENE PIPES FITTINGS

-

MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

REST OF WORLD POLYETHYLENE

-

PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

REST

-

OF WORLD POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

REST OF WORLD POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER,

-

REST OF WORLD POLYETHYLENE PIPES FITTINGS

-

MARKET, BY COUNTRY, 2025-2034 (USD BILLION)

-

MIDDLE EAST POLYETHYLENE

-

PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

MIDDLE

-

EAST POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

MIDDLE EAST POLYETHYLENE PIPES FITTINGS MARKET, BY END-USER, 2025-2034

-

(USD BILLION)

-

AFRICA POLYETHYLENE PIPES FITTINGS MARKET, BY

-

TYPE, 2025-2034 (USD BILLION)

-

AFRICA POLYETHYLENE PIPES FITTINGS

-

MARKET, BY APPLICATION, 2025-2034 (USD BILLION)

-

AFRICA POLYETHYLENE

-

PIPES FITTINGS MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

TABLE 70

-

LATIN AMERICA POLYETHYLENE PIPES FITTINGS MARKET, BY TYPE, 2025-2034 (USD BILLION)

-

LATIN AMERICA POLYETHYLENE PIPES FITTINGS MARKET, BY APPLICATION,

-

LATIN AMERICA POLYETHYLENE PIPES FITTINGS

-

MARKET, BY END-USER, 2025-2034 (USD BILLION)

-

LIST OF FIGURES

-

RESEARCH PROCESS

-

MARKET STRUCTURE FOR THE GLOBAL

-

POLYETHYLENE PIPES FITTINGS MARKET

-

MARKET DYNAMICS FOR THE GLOBAL

-

POLYETHYLENE PIPES FITTINGS MARKET

-

GLOBAL POLYETHYLENE PIPES

-

FITTINGS MARKET, SHARE (%), BY TYPE, 2022

-

GLOBAL POLYETHYLENE

-

PIPES FITTINGS MARKET, SHARE (%), BY APPLICATION, 2022

-

GLOBAL

-

POLYETHYLENE PIPES FITTINGS MARKET, SHARE (%), BY END-USER, 2022

-

FIGURE

-

GLOBAL POLYETHYLENE PIPES FITTINGS MARKET, SHARE (%), BY REGION, 2022

-

NORTH AMERICA: POLYETHYLENE PIPES FITTINGS MARKET, SHARE (%), BY REGION,

-

EUROPE: POLYETHYLENE PIPES FITTINGS MARKET, SHARE (%),

-

BY REGION, 2022

-

ASIA-PACIFIC: POLYETHYLENE PIPES FITTINGS MARKET,

-

SHARE (%), BY REGION, 2022

-

REST OF THE WORLD: POLYETHYLENE

-

PIPES FITTINGS MARKET, SHARE (%), BY REGION, 2022

-

GLOBAL POLYETHYLENE

-

PIPES FITTINGS MARKET: COMPANY SHARE ANALYSIS, 2022 (%)

-

JM

-

EAGLE.: FINANCIAL OVERVIEW SNAPSHOT

-

JM EAGLE.: SWOT ANALYSIS

-

CHEVRON PHILLIPS CHEMICAL COMPANY: FINANCIAL OVERVIEW SNAPSHOT

-

CHEVRON PHILLIPS CHEMICAL COMPANY: SWOT ANALYSIS

-

FIGURE

-

ALIAXIS: FINANCIAL OVERVIEW SNAPSHOT

-

ALIAXIS: SWOT ANALYSIS

-

WL PLASTICS: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE 20

-

WL PLASTICS: SWOT ANALYSIS

-

JAIN IRRIGATION SYSTEMS.: FINANCIAL

-

OVERVIEW SNAPSHOT

-

JAIN IRRIGATION SYSTEMS.: SWOT ANALYSIS

-

PIPELIFE INTERNATIONAL: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE

-

PIPELIFE INTERNATIONAL: SWOT ANALYSIS

-

NANDI GROUP: FINANCIAL

-

OVERVIEW SNAPSHOT

-

NANDI GROUP: SWOT ANALYSIS

-

FIGURE

-

BLUE DIAMOND INDUSTRIES: FINANCIAL OVERVIEW SNAPSHOT

-

BLUE

-

DIAMOND INDUSTRIES: SWOT ANALYSIS

-

NATIONAL PIPE & PLASTICS.:

-

FINANCIAL OVERVIEW SNAPSHOT

-

NATIONAL PIPE & PLASTICS.:

-

SWOT ANALYSIS

-

KUBOTA CHEMIX: FINANCIAL OVERVIEW SNAPSHOT

-

KUBOTA CHEMIX: SWOT ANALYSIS

-

FLO-TEK: FINANCIAL

-

OVERVIEW SNAPSHOT

-

FLO-TEK: SWOT ANALYSIS

-

FIGURE

-

OLAYAN GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

OLAYAN GROUP:

-

SWOT ANALYSIS

-

PEXMART: FINANCIAL OVERVIEW SNAPSHOT

-

PEXMART: SWOT ANALYSIS

-

LESSO: FINANCIAL OVERVIEW

-

SNAPSHOT

-

LESSO: SWOT ANALYSIS

-

CANGZHOU

-

MINGZHU: FINANCIAL OVERVIEW SNAPSHOT

-

CANGZHOU MINGZHU: SWOT

-

ANALYSIS

-

JUNXING PIPE: FINANCIAL OVERVIEW SNAPSHOT

-

JUNXING PIPE: SWOT ANALYSIS

-

GINDE PIPE: FINANCIAL

-

OVERVIEW SNAPSHOT

-

GINDE PIPE: SWOT ANALYSIS

-

FIGURE

-

CHINAUST GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

CHINAUST GROUP:

-

SWOT ANALYSIS

-

BOSOAR PIPE: FINANCIAL OVERVIEW SNAPSHOT

-

BOSOAR PIPE: SWOT ANALYSIS

-

NEWCHOICE PIPE: FINANCIAL

-

OVERVIEW SNAPSHOT

-

NEWCHOICE PIPE: SWOT ANALYSIS

-

FIGURE

-

SHANDONG SHENBON PLASTICS: FINANCIAL OVERVIEW SNAPSHOT

-

SHANDONG

-

SHENBON PLASTICS: SWOT ANALYSIS

-

JINNIU POWER INDUSTRY SCIENCE

-

AND TECHNOLOGY: FINANCIAL OVERVIEW SNAPSHOT

-

JINNIU POWER INDUSTRY

-

SCIENCE AND TECHNOLOGY: SWOT ANALYSIS

-

QINGDAO YUTONG PIPELINE:

-

FINANCIAL OVERVIEW SNAPSHOT

-

QINGDAO YUTONG PIPELINE: SWOT ANALYSIS

-

HONGYUE PLASTIC GROUP: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE

-

HONGYUE PLASTIC GROUP: SWOT ANALYSIS

-

ESPECIALLY NICK TUBE:

-

FINANCIAL OVERVIEW SNAPSHOT

-

ESPECIALLY NICK TUBE: SWOT ANALYSIS

-

ARON NEW MATERIALS: FINANCIAL OVERVIEW SNAPSHOT

-

FIGURE

-

ARON NEW MATERIALS: SWOT ANALYSIS

-

ZHEJIANG WEIXING : FINANCIAL

-

OVERVIEW SNAPSHOT

-

ZHEJIANG WEIXING : SWOT ANALYSIS

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Leave a Comment